How to trade Forex with Binary Options

Table of Contents

There are many opportunities in the Forex market for individuals as well as banks and large funds, and binary options on forex is one of them. From trading futures contracts to measuring prices using binary options, traders can access the foreign exchange market without owning the currency itself. Binary Options are another way to play the Forex market (Forex market) for traders.

If you use financial instruments like binary options to speculate on the foreign exchange market, you can make predictions on various currency pairs. Since there is no underlying asset, the cost is low and the opportunities are high. Binary options offer fixed risk, so you know your biggest gains and losses before you trade. You can find a great relationship between risk and reward in contracts.

Although it is a relatively expensive method of trading Forex compared to random Forex operated by growing brokers, the biggest advantage of binary options forex trading is the fact that the maximum potential loss is limited and known in advance.

How to engage in forex binary option trading: Step by step tips

Follow the steps below to get started in binary options trading:

1. Select a web-based Binary Forex Broker

To do Binary Options currency trading, you need to have a forex trading account with a broker. Before joining, you can research several forex brokers online. Minimum deposit, minimum trade value, payout ratio, and amount of forex pairs accessible for trading are all aspects to take into consideration when using web-based binary options forex services.

Choose the right broker for trading Binary Options on Forex:

Broker: | Review: | Advantages: | Account: |

|---|---|---|---|

1. Quotex  | + Accepts international clients + Crypto payments + Bonuses + High payout 95%+ + Best platform | Live-account from $ 10 (Trading includes risk) | |

2. IQ Option  | + Easy platform + Best support + Highest yield + Multiple payment options | Live-account from $ 10 (Trading includes risk) | |

3. Pocket Option  | + Accepts any clients + Bonus program + Social Trading + Accepts international clients | Live-account from $ 50(Trading includes risk) |

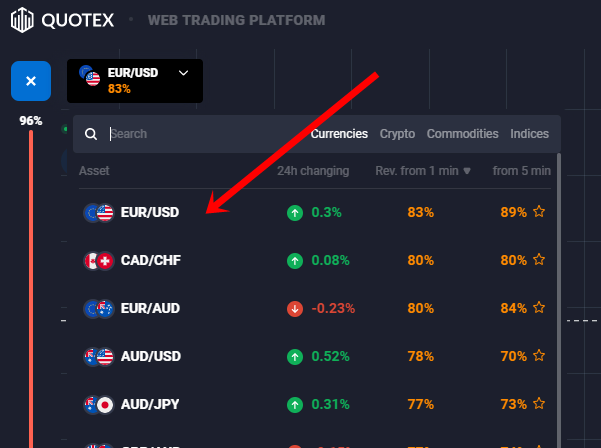

2: Pick a currency pair to trade.

Most web-based binary forex brokers offer a selection of roughly 40 currency pairs. EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CHF, USD/CAD, and NZD/USD are all frequently available currency pairs traded on the forex market. The popularity of a nation’s currency does not imply that it is lucrative. An informed investment based on research and statistics will help you limit the risk of the binary options you buy.

3: Binary Options selection

An online forex trading platform allows you to choose the type of binary option you want to buy. Depending on your preference, the percentage of binary options fees will change accordingly. The best-selling binary options are:

- High or Low: You can predict whether the price will be above or below the strike price of the currency pair. For example, if the EUR/USD exchange rate is 1.1134, you can buy the highest price or call 1.1139. Similarly, you can buy a lower option or set the option to 1.1131.

You can forecast if the price of a currency pair would be within or over its strike price by using a range or boundary. You can buy a break option if the GBP/USD price is 1.2452 and you anticipate it to hit 1.240. Likewise, if you estimate the margin call to hit 1,259, you can purchase.

- With a single press of a button, you may forecast the price of a silver pair. If the AUD/USD exchange rate is 0.6147, you can purchase speed dials up to 0.6150.

- No Touch: You can forecast pricing that Silver Pairs won’t be able to match. If the AUD/USD rate is 0.6147, you can purchase a different option at 0.6140.

- 60 Seconds: In less than a minute, you can anticipate the rise or fall of a currency pair. You can purchase a buy option if the USD/CAD price is 1.3997 and you predict it to reach 1.3999 for the next 60 seconds.

You can purchase a buy option if the USD/CAD price is 1.3997 and you predict it to reach 1.3999 for the next 60 seconds.

You can buy a call or enter into a contract after you’ve decided on the type of binary option you want to use for FX trading. Buy a buy option if you believe a silver pair to grow in value. Buy a put option if you expect a currency pair to devalue. This does not apply to binary options with a single touch or no touch.

(Risk warning: Trading involves risks)

5: Enter an expiration date

You must specify the duration of your forex trading binary options. Binary Options Forex contract times can range from 30 seconds to 1 day or 1 week. Many traders use intraday binary options to make money quickly. Be careful when walking with your feet. You can burn as fast as binary options.

6: Profit from it

Unlike forex regular forex trading, binary options contracts have a defined interest rate and a fixed charge. Both buyers and sellers of binary options contracts must make a deposit. As a result, as soon as the exchange rate hits its redemption price, it can benefit.

There is no actual market for currency trading, hence, you must first open an account with an online currency broker in order to trade currency pairings. Because global economic and political news has a significant impact on forex trading, you should make use of all of the analytical tools available through online brokers with registered accounts.

Based on important factors such as price, trading fees, speed, ease of use, and rules, we suggest trading binary options with any of the following brokers: Quotex, IQ Option, and Pocket Option.

Binary Options overview:

There are two options for binary options. It is calculated as a predetermined value (usually $100) or $0. Estimating this value depends on whether the underlying asset price is above or below the ‘strike price at the end of the period.

Binary Options currency trading can be used to reflect the outcome of a variety of scenarios. Will the S&P 500 rise above a certain level tomorrow or next week? Are unemployment claims higher than market expectations this week? Or will the euro or yen collapse against the US dollar today?

For example, suppose gold is currently trading at $1195 per troy ounce and will trade above $1200 later that day. Suppose, at the end of the day, you can buy a binary option when trading gold above $1200, and that option is trading at $57 (bet) / $60 (bid). Buy an alternative for $60. If gold closes above $1200 as expected, the payout is $100. This means your total profit (excluding fees) is $40 or 66.7%. On the other hand, if gold closes below $1200, you will lose $60, resulting in a 100% loss.

How Binary Options works for buyers and sellers

For binary options buyers, value is the price at which the option is traded. For binary options providers, the value is 100, and the difference between the option price and 100.

From a buyer’s point of view, the price of a binary alternative can be thought of as the probability of a successful trade. The higher the binary option price, the higher the implied probability that the asset price will be higher than the strike price. From the seller’s point of view, the probability is 100 minus the option price.

All binary options contracts are completely parallel. This means that both parties (buyer and seller) of a particular contract must invest capital in terms of the transaction. So, if the contract trades at 35, the buyer pays $35 and the seller pays $65 ($100-$35). This is the highest risk for buyers and sellers and equals $100 anyway.

So, in this case, the risk-reward ratio of the buyer and seller can be formulated as:

Buyer

- Maximum risk = $35.

- Maximum Fee = $65 ($100-35).

Seller

- Maximum risk = $65.

- Maximum wage = $35 ($100-65).

(Risk warning: Trading involves risks)

Binary money market example for forex: Nadex

Forex binary options are available on exchanges like Nadex and offer the most popular pairs like USD-CAD, EUR-USD, and USD-JPY, as well as other high-volume currency pairs.

North American Derivatives Exchange, or Nadex, was founded in 2004 and is a Chicago-based financial exchange specializing in short-term binary options and spreads. The company is a subsidiary of London-based IG Group (LON: IGG) and is regulated by the Commodity Futures Trading Commission (CFTC). Binary options are legal and can be traded in the US, but only on CFTC regulated exchanges like Nadex (you can also trade binary options through the Chicago Board Options Exchange).

Nadex Binary Options are offered in crossover expiry dates ranging from daily and weekly. The minimum bet size on Nadex Spot Forex Binary Options is 0.25, so the bet value is $0.25. Forex intraday binary options offered by Nadex expire every 5 minutes every hour, while each day expires at a specific time. Weekly binary options close at 15:00 Friday.

For most Forex contracts, Nadex calculates the expiry date by averaging the 10 most recent trades on the foreign exchange market, subtracting the three highest and lowest prices, and then taking the arithmetic average of the remaining four prices. For high activity situations, it takes all average prices collected during the last 10 seconds of a trade, lowering the top and bottom 30%, and averaging the rest.

Examples of Binary Options in Forex

Let’s see how to trade Forex using binary options using the EUR-USD currency pair. We have a weekly alternative that ends at 15:00. Friday or 4 days later (or Monday). Assume the current exchange rate is 1 Euro = 1.2440 USD.

Consider the following scenario:

1. I think the euro is unlikely to weaken by Friday and should remain above 1.2425.

EUR/USD Binary Options > 1.2425 is quoted at 49.00/55.00. Buy 10 contracts for a total of $550 (excluding fees). at 3 pm. On Friday, the euro was trading at $1.2450. Binary options count as 100 and payout $1000. Your total profit (excluding fees) is $450 or about 82%. However, if the euro closes below 1.2425, you lose your entire $550 investment at 100% loss.

2. The euro is moving in the bearish direction and I think it could move lower (eg $1.2375).

Binary Options EUR/USD > 1.2375 are listed at 60.00/66.00. You will sell this option as it is bearish against the euro. Therefore, the initial selling value of each binary options contract is $40 ($100-60). Let’s say you sell 10 contracts and earn a total of $400. Let’s say the euro is trading at 1.2400 on Friday at 3pm.

You will lose all of your $400 or 100% of your investment because the euro last traded above $1.2375. What if the euro closes below 1.2375 as expected? In this case, the contract will be $100 and you will receive a total of $1000 for 10 contracts in the form of $600 or 150%.

Additional basic strategies

You don’t have to wait for the contract to close to make a profit in a binary options contract.

For example, suppose the euro is trading at 1.2455 in the spot market through Thursday, but if the US economic data released on Friday is very positive, you are concerned about a potential devaluation of the currency. In this case, the binary options contract (EUR / USD > 1.2425) was priced at 49.00 / 55.00 at the time of purchase and is now 75/80. So you can sell 10 option contracts you bought for $55 for $75 each and get a total return of $200 (or 36%).

Low-risk/low-reward combination trading is also possible.

Consider the USD/JPY binary option as an example. Let’s say you think the yen’s volatility, which is trading at 118.50 per dollar, could increase significantly and could trade above 119.75 or fall below 117.25 by Friday. So, you buy 10 binary options contracts (USD / JPY > 119.75, trades 29.50 / 35.50) and sells 10 binary options contracts (USD / JPY > 117.25, trades at 66, 50 / 72.00). So you pay $35.50 to buy USD/JPY contract > 119.75 and you pay $33.50 (i.e. $100 – $66.50) to sell USD/JPY contract > 117.25. Total cost is $690 ($355 + $335).

Three possible scenarios occur at the end of the alternative on Friday at 15:00:

1. The yen is trading above 119.75. In this scenario, contract USD/JPY > 119.75 holds $100 and contract USD/JPY > 117.25 has no value. The total payout is $1000 and the profit is $310 (or about 45%).

2. The yen is trading below 117.25. In this scenario, contract USD/JPY > 117.25 holds $100 and contract USD/JPY > 119.75 has no value. The total payout is $1000 and the profit is $310 (or about 45%).

3. The yen is trading between 117.25 and 119.75. In this scenario, both contracts are worthless and you lose both your $690 investment.

(Risk warning: Trading involves risks)

Frequently asked questions for Binary Forex Trading:

What are Binary Options?

Binary options are financial instruments that offer a fixed payout when the underlying market exceeds the strike price. Determines whether the market will exceed a certain price at any given time. Trading binary options is like asking a simple question. Will the market exceed this price at this point? If you believe yes, you buy; if you believe no, you sell. Nadex binary options allow traders to predict the outcome of underlying market movements.

How do Binary Options work?

A binary options contract consists of three key components:

• The underlying market. This is the market you want to trade-in.

• Operating price. The strike price plays a key role in the binary options decision process. In order to trade, you must decide whether the underlying market is above or below the strike price.

• Expiration date and time. Binary options can be traded for up to 1 week, with durations of 5 minutes or longer.

Are Binary Options legal?

Yes, binary options can be traded with US-regulated providers. Trading binary options in the US is not only legal but also regulated, has low capital requirements, and is available to retailers. Ensure that exchanges that trade under the CFTC rules have legal oversight to protect them from unfair market practices. Also, make sure the exchange is located in the US and trades with your own account.

Is Binary Options Trading Risky?

Perhaps! Here are a few steps you should follow to trade binary options more safely:

• Trade only on CFTC regulated exchanges.

• Do not contact anyone who claims to be a broker or who may exchange your account on your behalf.

• Trade for your own account.

Trade Binary Options on Free Managed Exchanges! The best way to trade with confidence is to train on our $10,000 Virtual Binary Options demo account.

How do binary traders make money?

Binary traders can make money by accurately predicting whether the market will exceed a certain price at any given time. After the expiry date, you either earn a predetermined income or lose the money you paid to start trading. Binary options are traded at prices between $0 and $100. Each contract shows the maximum you can gain and the maximum you can lose. If the trade is successful, you will receive a $100 payment, so your profit is $100 without any money paid to start the trade. If the transaction fails, payment cannot be received. This means that you have lost your capital because your risk is limited, but you have lost nothing else.

What is the difference between Options and Binary Options?

Binary options are, after all, short-term, limited-risk contracts with two possible outcomes. In other words, you either earn a predetermined profit or lose the money you paid to open a trade. Fees are registered on both sides of the redemption price. An option, also known as a vanilla option, has a holding that depends on the strike price of the option on the one hand and the difference between the price of the underlying asset and the strike price and a fixed price on the other hand. Binary Options on forex are complex, difficult to price, and have the potential to produce undue profits or losses.

What is the minimum deposit to trade binary options?

The minimum deposit to open a living account on Nadex is $250, with an additional minimum deposit of $100 thereafter. Binary trading prices on Nadex range from $0 to $100 excluding currency fees. The cost of securing a trade is always equal to the highest risk and should be considered when placing an order. Not ready to open a live account? You can practice binary options trading for free with a binary options demo account.

Conclusion: Binary forex trading is simple

Although binary options are a useful tool as part of a comprehensive forex trading strategy, they have limited upside potential even when asset prices rise sharply and have some disadvantages as binary options are derivatives with a limited lifespan (expiration).

However, binary options have a number of advantages that make them particularly useful in the volatile Forex world. First, it has a limited risk (even if asset prices rise sharply), requires relatively low collateral, and can be used in volatile and volatile markets. These advantages make binary options worth paying attention to for experienced forex traders.

One of the simplest ways to build wealth is to trade binary options on the currency market.

Binary options help us predict how a currency pair’s price will change over a given period. You can engage in a demand option for the EUR/USD pair, for instance, you can predict the Euro (EUR) to strengthen against the Dollar (USD) in the following minute. If you are correct, the binary options contract will be terminated at 100 USD, and you will receive your money back with a gain of 100 USD.

The principles of good yields and high-risk returns are embodied in Forex binary options. This is a good investment plan for aggressive traders who want to make money quickly in the Foreign exchange market.

(Risk warning: Trading involves risks)

See our other articles about Binary Options trading:

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.7 / 5)

(4.7 / 5)