How to learn Binary Options trading – The best tutorial for beginners

Table of Contents

Disclaimer: This material is not intended for viewers from EEA countries. Binary options are not promoted or sold to retail EEA traders

Trading Binary Options is not very complicated and hinges on a single question:

Will a given asset rise above or drop below a specified price at a specified time?

If it does, you make a substantial profit. If it doesn’t, however, you lose your entire investment. It’s a zero-sum game, since you will either earn someone’s investment or lose yours to someone – and it works this way for every investor involved.

Binary Options are some of the most straightforward financial instruments one can trade – but don’t be mistaken; making a profit with it is not as easy as it may seem.

But how do Binary Options work? Are they legal? Are there ways you can get scammed? More importantly, how does one trade Binary Options? What strategies can you apply? And which brokers can you trust? We’ll answer all of these questions and more in this comprehensive guide.

What are Binary Options?

Binary Options are derivatives that you can trade on any market. What makes them appealing is their simplicity. The investor knows precisely how much they could make (or lose) before making the trade. You typically make a profit of 70%-95% estimating the right price. If you invest $100 in a commodity and predict the direction of the price right, you will make between $170 and $195. Of course, if you’re estimation is incorrect, you will lose the $100.

Call Option

You are making a forecast that the price will be higher after the expiry time.

Put Option

You are making a forecast that the price will be higher after the expiry time.

The simplicity of trading Binary Options makes risk management a lot easier, making it appealing to many traders. There is no complicated math involved at all, and it is for this reason binary options are often called “all or nothing” trades.

Trading Binary Options can be a lot easier than other kinds of trading. There are fewer factors to consider, and you can sometimes make profits simply by following the news closely. One can trade Binary Options on commodities like crude oil and stocks such as Tesla and Amazon. But that’s not all; there is a vast range of derivatives you can choose from. You could trade foreign exchange rate options and even cryptocurrencies. Exchange-traded Binary Options are becoming increasingly popular as well. The trade can be as short as 60 seconds, enabling traders to make hundreds of trades per day across markets globally.

Notice:

You can trade Binary Options in any timeframe and market.

Broker: | Review: | Advantages: | Account: |

|---|---|---|---|

1. Quotex  | + Accepts international clients + Crypto payments + Bonuses + High payout 95%+ + Best platform | Live-account from $ 10 (Trading includes risk) | |

2. IQ Option  | + Easy platform + Best support + Highest yield + Multiple payment options | Live-account from $ 10 (Trading includes risk) | |

3. Pocket Option  | + Accepts any clients + Bonus program + Social Trading + Accepts international clients | Live-account from $ 50(Trading includes risk) |

Learn the history of Binary Options

Learning about the origins of Binary Options trading can often be helpful if you’ve never traded them before. Binary Options are by no means a new concept – they have been around for decades. What’s interesting about the options is that initially, only large institutions like banks and the tremendously wealthy had to access to these options. But that changed quite recently.

In 2008, the US Securities and Exchange Commission formally enabled traders to trade Binary Options through exchanges. It didn’t take long for the easy-to-understand derivative to gain popularity, and as the internet flourished, more and more traders of all skill levels set about trading Binary Options.

Types of Binary Options explained

While the concept of trading binary options can be boiled down to predicting whether the price will be higher or lower at a specified time, there is more to it than just that. Here are the four prevalent types of binary options you need to know about:

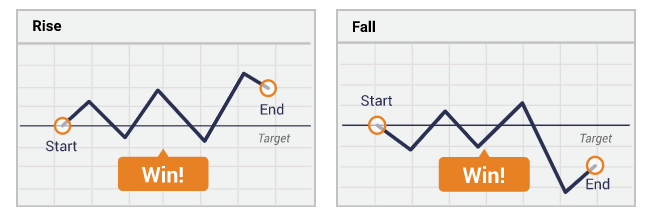

Up/Down (or High/Low):

It’s the most straightforward kind of binary options trade. You must bet whether the price will be higher or lower than the asset or commodity’s current price when the trade expires.

Ladder:

Think of ladders trades as up/down trades, but instead of using the current price, ladder trades use pre-determined levels that are staggered up or down. These trades demand that the price move up or down substantially, resulting in higher risk. However, the reward is just as gratifying since the returns on a successful trade often exceed 100%. The one thing you must remember about ladder trades is that both sides of the trade (up and down) are not always available.

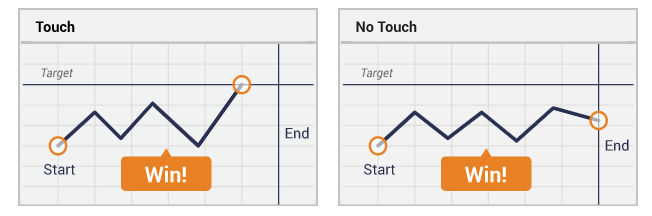

Touch/No Touch:

In these trades, levels are set either higher or lower than the current price. If the price ‘touches’ the levels before expiry, you will be paid out the profits.

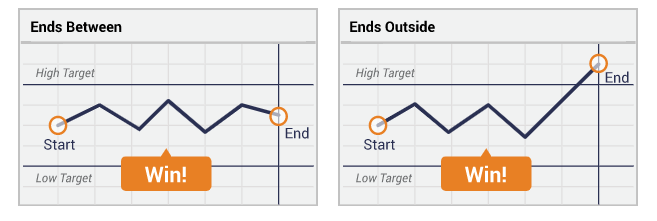

In/Out (Range/Boundary) Trade:

In/Out trades are unique. A ‘high’ and ‘low’ boundary is set, and you must estimate whether the trade will expire within or outside of these boundaries.

(Risk warning: Trading involves risks)

Expiry times and how they work

The point at which the trade will end is known as the expiry time. It is at this point in time you will know whether you’ve won or lost the trade.

Expiry times can be as short as 30 seconds or as long as a year.

However, most traders prefer a minute-long expiry time since it enables them to make a large number of trades in a day.

The legality: Are Binary Options legal?

Binary Options are perfectly legal to trade in most regions; however, they have somewhat of a negative reputation amongst traders. The prevailing scams make traders skeptical of investing in binary options. However, most companies operate fairly, and as long as you pick a company with a good reputation, you have nothing to worry about.

European Binary Options Brokers are only allowed to accept professional traders in Europe as clients. However, in regions like the USA, India, and Australia, trading binary options is legal for private traders.

Binary Options scams (And how to spot one)

The pervasiveness of deceitful companies has tarnished the reputation of binary options. The risk of being scammed is high, especially for a newcomer.

To spot scams in a market flooded with them:

- Don’t fall for the promise of ‘instant money’

- Don’t believe brokers that could call you

- Celebrity endorsement doesn’t mean much – the company may still scam you

- There is no such thing as trading binary options for free. Steer clear of companies making such claims

- Legitimate companies rarely give deposit bonuses, if ever. You’re better off avoiding doing business with a broker that offers you a deposit bonus

Don’t trust anybody who promises guaranteed profits.

(Risk warning: Trading involves risks)

Advantages and disadvantages of trading Binary Options

Why trade Binary Options when CFDs exist?

You may ask yourself why one would trade binary options when CFDs exist. While the two derivatives are similar in some ways, there are some critical differences between them. When trading Binary Options, you will either lose the money you put up or gain a pre-determined amount. The risk is fixed, and even if the price sinks to zero, you won’t lose more than what you put up for the trade.

But then again, if the price skyrockets, you don’t stand to gain any more than stipulated. In contrast, CFDs have virtually unlimited risk. If the asset’s price moves significantly, your trade can grow considerably – for better or worse. CFDs don’t suit everybody’s trading style, since not everybody has a high-risk tolerance.

In the same way, Binary Options don’t suit everybody’s trading style, either. Weighing out the pros and cons of Binary Options trading is the best way to figure out if it’s right for you considering your capital and risk tolerance.

Advantages (pros)

- Fixed risk: Regardless of what you trade – gold, stocks, or cryptocurrencies – your risk is minimized. This is because, with binary options, you don’t have to worry about as many parameters as you have to with other derivatives.

- Decent profit potential: Most brokerages pay over 70% on a single trade, with some offering payouts of 90%. The attractive profit potential coupled with the simplicity of the trade makes Binary Options worth looking at.

- Trade control: You know how much you stand to lose before you enter the trade, so you have more control over the trade right from the start. In contrast, if you trade in stocks, there is no telling whether your trade will make the entry price.

- Versatility: With binary options, you’re not constrained to a single market. You have the opportunity to trade currencies, indices, bonds, and virtually every other instrument in every market globally.

- Accessibility: You are not limited to trading at specific times. Since you can trade Binary Options in any market globally, you can log in at any time from any device and get to making profits. If you want to, you can also trade on the weekends.

- Simplicity: This is perhaps the biggest advantage of trading Binary Options. You only need to bet on whether the price will go up or down – it’s the most straightforward of trades there are. There is no need for you to worry about when the trade ends or set up stop-losses to limit your losses.

Disadvantages (cons)

- Reduced payouts for sure-banker trades: If the odds of your trade succeeding are very high, the payout will be a lot lower than you’d expect. Companies only pay big percentages if the expiry date is set at least for a few days from the trade. Also, trades are unpredictable on such a timeline.

- Higher chance of loss: With other derivatives, you can control the risk/reward ratio to get the edge that makes you profits. However, the odds of Binary Options tip the risk/reward ratio in favor of losing trades.

- Lack of quality trading tools: Many Binary Options brokers do not offer technical analysis features and charts to users. While experienced traders can source these tools elsewhere, most new traders have nothing to work with.

- Mitigated trade corrections: If you trade in a commodities or forex market, and a repeat analysis reveals that a trade you made was a mistake, you can close the trade and open another one, minimizing your losses. Such trade corrections are mitigated when you trade Binary Options on an exchange.

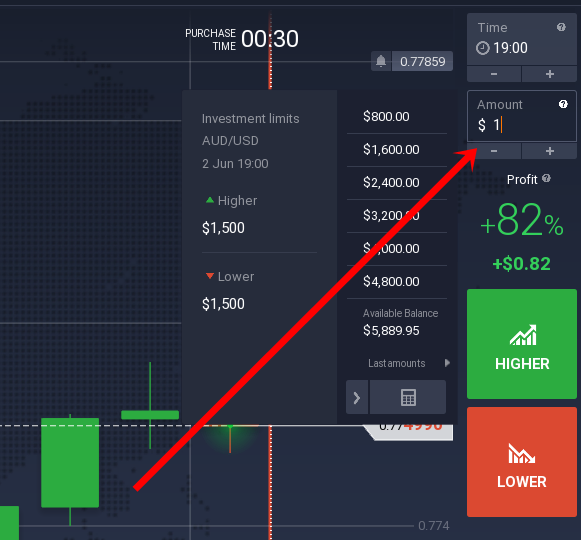

- Limitations on risk management: Brokers set higher minimum trading amounts, and there is no such thing as trading in mini- and micro-lots with binary options. In a forex market, you may be able to make several trades with $200 by trading in micro-lots. However, if a binary broker sets a minimum trade value of $50, you may lose the entire amount in just four trades.

(Risk warning: Trading involves risks)

Risks of trading Binary Options

You may find trading Binary Options appealing for several reasons, but delving into trading them without learning about the risks involved isn’t a good idea. Here’s a list of the downsides of trading binary options:

- The odds are against you: For every 70% in profit, the corresponding trade would result in an 85% loss. Doing the math further, you will need a win percentage of 55% just to break even.

- Easy to lose capital: Most Binary Options brokers set trading floors, and to participate, a trader must invest at least the minimum amount. You cannot trade in mini- or micro-lots, so you risk losing most or all of your capital in a few trades.

- Lack of well-equipped trading tools: Unlike other brokers, Binary Options brokers do not offer advanced charting or technical analysis tools. Thankfully, some brokers are catching on and now provide analysis tools. There are also several online services that enable charting for Binary Options traders.

- Reduced payouts: If the likelihood of your trade succeeding is high, you will not get the 80%-90% payout you would expect. Brokers only pay out high percentages when the expiry time is at least a few days from the trade date.

How to trade Binary Options?

Now that you understand what binary options are and know the advantages and risks, you can begin trading binary options. Here are the steps involved:

Step 1: Find the right broker

Finding the right broker to work with is one of the most critical steps in the process of trading binary options. Here are some factors you must consider before signing up for any broker:

Broker: | Review: | Advantages: | Account: |

|---|---|---|---|

1. Quotex  | + Accepts international clients + Crypto payments + Bonuses + High payout 95%+ + Best platform | Live-account from $ 10 (Trading includes risk) | |

2. IQ Option  | + Easy platform + Best support + Highest yield + Multiple payment options | Live-account from $ 10 (Trading includes risk) | |

3. Pocket Option  | + Accepts any clients + Bonus program + Social Trading + Accepts international clients | Live-account from $ 50(Trading includes risk) |

Fees

Trading Binary Options can be quick and easy, and the commissions you pay your broker will rack up quickly. To maximize your profits, you must work with a broker with a competitive fee structure. It’s also vital to remember that different asset classes have different fees.

Minimum deposit

While some Binary Options brokers have no minimum deposit, most do not allow traders to operate without a minimum balance of $50 or $100. Investigating the minimum deposit criteria of the broker you’re interested in working with is an excellent idea, especially if you’re strapped for cash.

Regulation

Ensuring that the appropriate authority regulates your broker is the best way to protect yourself from scams. All the brokers recommended below are regulated and safe. A popular regulator is the CySEC or the Financial Commission.

Assets offered

Asset lists are always available on the broker’s website. Looking through the list and checking whether the asset you want to trade is available is a good idea before signing up with the broker. A handful of brokers specialize in certain assets. If you’re set on trading just stocks or crude oil, finding a broker that specializes in your asset of choice is worth the effort.

These brokers boast relevant news feeds and other tools to help increase your chances of making a profit.

Platform

The platform is the gateway to the market, and you will be using it every time you want to trade. You are no longer limited to only a single platform – there are several excellent platforms out there that offer a range of charts, patterns, and other tools you need to make a smart trade.

We’ve reviewed the ease of use of our recommended brokers in the section below.

Reliability

Downtime and technical issues can cost you a lot of money, especially if you’re an intraday trader. If you trade a lot, ensure that the broker you work with offers 24/7 support. Top brokers offer support via both phone and live chat.

Apps

Several brokers now also offer mobile apps to enable their customers to trade on the go. However, the quality and features of these apps can vary greatly.

If you’re the kind of trader that likes to trade on the move, check that the broker you’re interested in working with has an easy-to-use app with all the features you need.

(Risk warning: Trading involves risks)

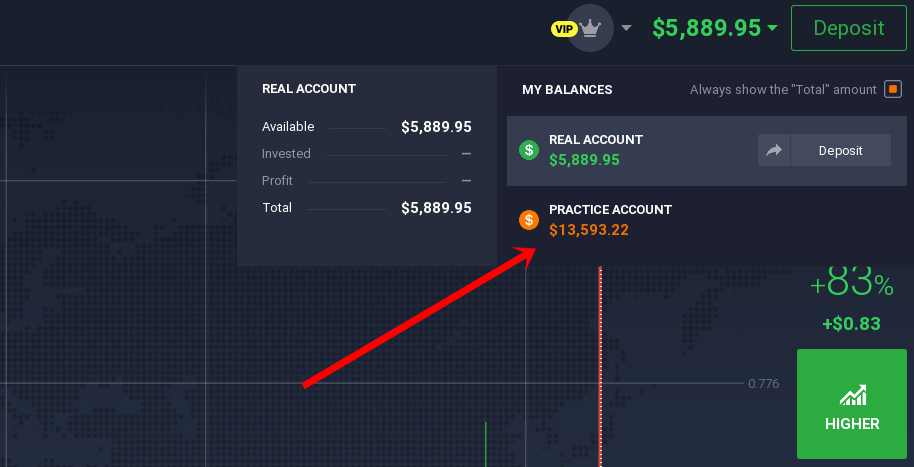

Demo accounts for Binary Options

If you’ve never traded binary options, using a demo account to get a feel for things is the right way to go.

Demo accounts come funded with simulated money, and you are enabled to invest this money into real assets and options and test out strategies.

These accounts can be the perfect launchpad for a new trader since you can make all the mistakes you want before putting real capital on the line.

But here’s the best part – most companies that offer demo accounts don’t require you to deposit any funds to use the account. You can hold onto the initial funds you intended to invest while you gain some experience with trading.

Add-ons and extra features

Demo accounts technically count as an extra feature, but they’re not the only extra feature brokers offer. Many brokers offer courses and lessons on trading to attract traders, and some also have free trading trial plans.

The brokers that are geared to cater to more experienced traders offer trading bonuses and strategy reviews.

(Risk warning: Trading involves risks)

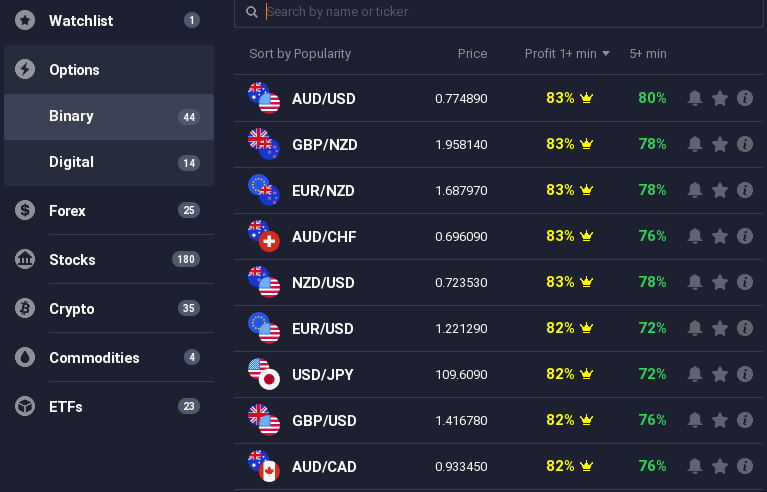

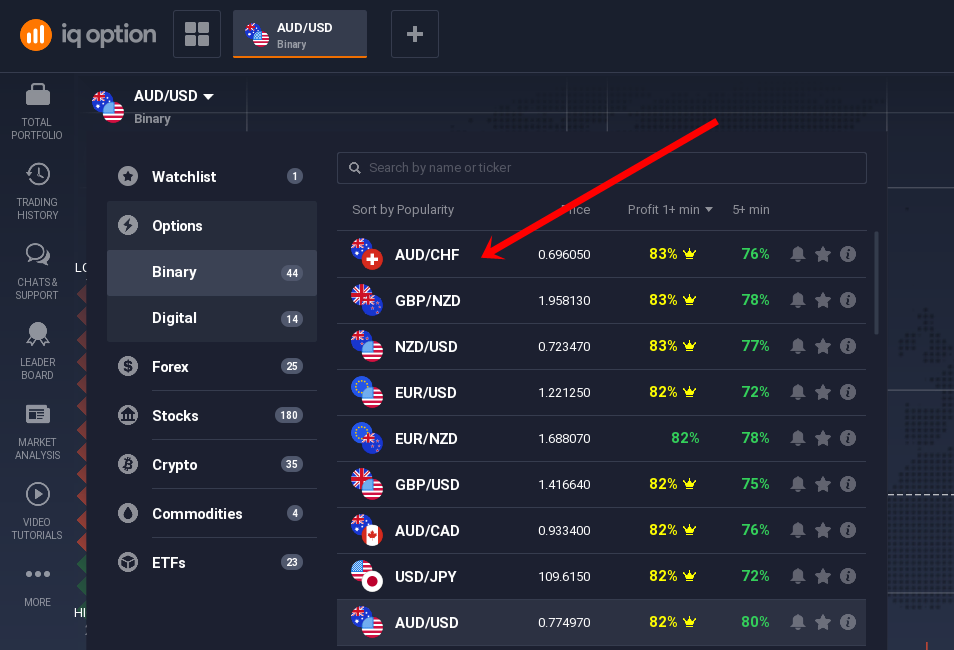

Step 2: Pick an Instrument

After you’ve signed up with the broker you want to work with, your next step is to select the instrument you want to trade binaries in.

You can trade binaries in virtually any market, including forex and indices. But it’s always best to opt for the market you understand well.

If you want to trade in the forex market, you will be happy to learn that most brokers allow you to trade major forex pairs such as EUR/USD, USD/JPY, and GBP/USD. You could also bet on whether the price of gold, silver, or oil will go up or down.

However, if you want to trade binary options in stocks, you must note that brokers do not make every stock on the market available to trade. The typical broker will give you between 25 to 100 stocks to choose between, and brokers make more stocks available depending on demand.

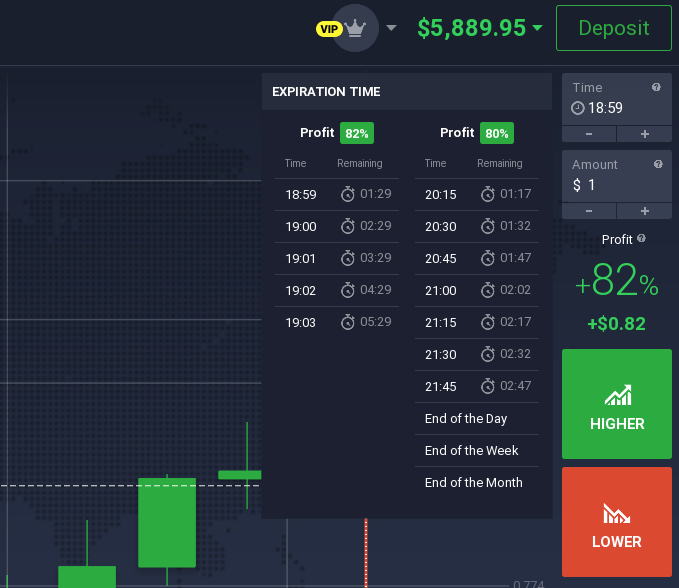

Step 3: Set the expiry time

Setting the expiry time is one of the most critical steps – you must balance your trading volume depending on the price movement. Never be impulsive. While betting more may mean winning more in the heat of the moment, it is better to make fewer, more accurate trades.

There are three categories of expiry times:

- Short Term/Turbo: Any expiry time under five minutes.

- Normal: Expiry times ranging from five minutes to the end of the day. “End of Day” expiries work according to the local market for the respective asset.

- Long term: Expiry times that span beyond the end of the day are classified under long-term expiries. The longest expiry time is 12 months.

If you have an intraday trader’s mindset, 30-second, one-minute, and end-of-day expiry times will suit your trading style best.

(Risk warning: Trading involves risks)

Step 4: Decide on the trade size

The size of your investments directly indicates how much profit you make. The bigger your investment is, the higher the possible profit in it. That being said, you must remember that the entirety of your investment is at risk. Having an effective money management system will ensure that you make sufficient trades and profits without running out of capital.

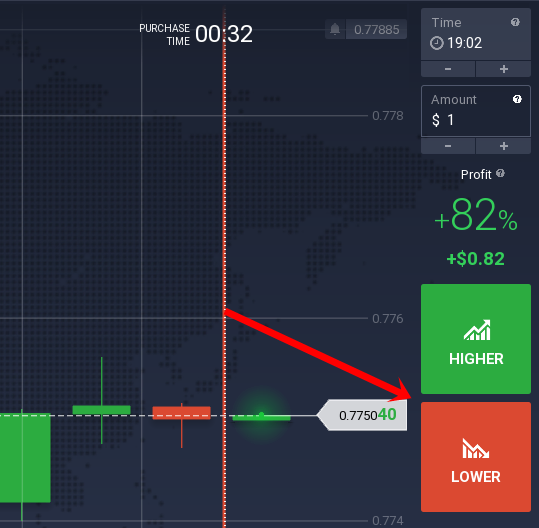

Step 5: Select an option

Think carefully about where you want to bet your money, and make sure you give heavy consideration to the factors that may jeopardize your investment. The end goal is to choose the option with the highest probability of yielding profits.

Don’t always go for the ladder trade option. While the returns are higher, the risk is also higher. While larger profits may seem appealing, your aim must always be to make safer bets. After doing your due diligence, you can go ahead and confirm your trade. All that’s left for you to do is sit back and wait for the trade to play out.

The best Binary Options brokers/platforms

The broker’s platform is where you will spend most of your time trading since it is your gateway to your market of choice.

There’s no such thing as the “best” platform since every trader has different preferences. You may prefer a simple layout to a feature-rich one, but another trader may not share your preferences. That being said, different platforms have different qualities. Some are easier to use, while others offer more features. One trend we’ve noticed is that the brokers offering both CFDs and binary options boast a strikingly more feature-rich platform.

To make picking a broker easier for you, we’ve shortlisted brokers with the best platforms and pricing:

Broker: | Review: | Advantages: | Account: |

|---|---|---|---|

1. Quotex  | + Accepts international clients + Crypto payments + Bonuses + High payout 95%+ + Best platform | Live-account from $ 10 (Trading includes risk) | |

2. IQ Option  | + Easy platform + Best support + Highest yield + Multiple payment options | Live-account from $ 10 (Trading includes risk) | |

3. Pocket Option  | + Accepts any clients + Bonus program + Social Trading + Accepts international clients | Live-account from $ 50(Trading includes risk) |

1. Quotex.io

Quotex.io is one of the newest trading brokers in the industry. Operating since 2020, it’s one of the most trustworthy brokers on this list.

While the platform is exceptionally user-friendly, it is available for traders in every country in the world. The company enables you to trade 24/7, even on the weekends, without any hassle. With 100+ tradable markets, it allows you to trade binary options on virtually any asset. Its compatibility with a mobile app is a massive plus for beginners and experts alike. Another feature traders will appreciate is the availability of practice accounts. Every trader gets a virtual credit of $10,000 (which can be replenished on demand).

Quotex.io boasts a fast execution engine, and a lower minimum deposit of $10, making it more accessible to beginners looking to dabble. The company is licensed in the Seychelles, Victoria, Mahe.

It’s no surprise that Quotex has won numerous awards in its years in the industry, and it’s undoubtedly one of the best trading platforms for beginners looking to trade binary options. It offers high profits, fast deposits and withdrawals, and a professional platform.

(Risk warning: Your capital is at risk)

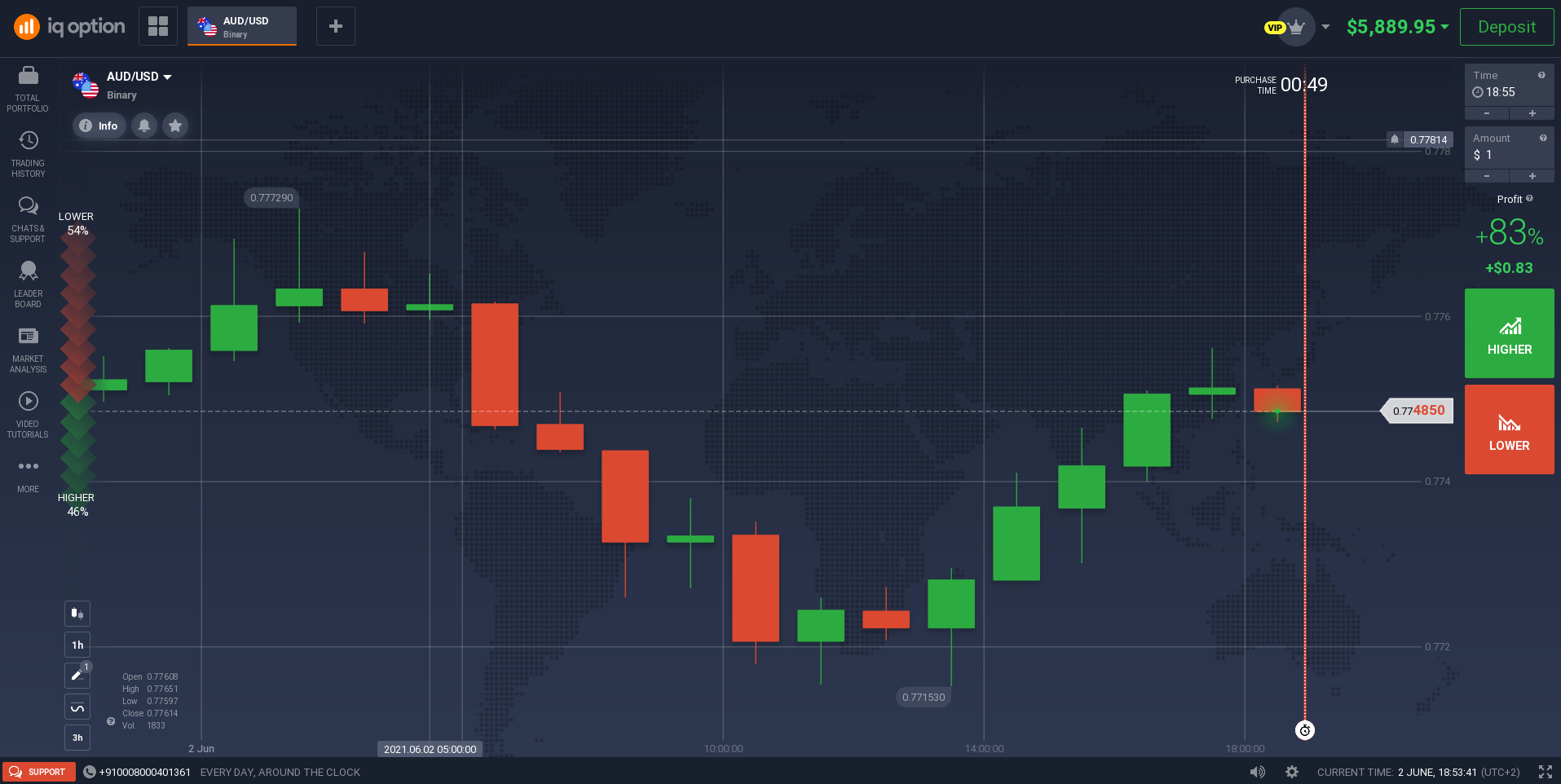

2. IQ Option

If you’re looking for a platform with an intuitive interface rich with features, IQ Option may be the perfect broker for you. The company was founded in 2013 and has since grown its userbase to over 48 million traders globally. IQ Option facilitates over a million trades a day.

The company offers everything from CFDs to commodities and cryptocurrencies and gives you access to forex pairs. In total, IQ Option offers traders access to about 250 financial instruments, making it one of the most versatile brokers in the industry. The platform is loaded with tools that enable effective fundamental and technical analysis. The news section will help you stay in the loop about market developments.

Its large trading community acts as a channel for you to share your ideas and learn from other traders. It’s the perfect learning environment for a novice trader. New users can make demo accounts and practice trading strategies while getting acquainted with the platform’s features. IQ Option’s platform works flawlessly on Windows and macOS, and the web and phone apps enable you to trade when you’re on the move.

You can get in touch with the friendly customer support team 24/7 via the live chat function, which is one of its best features. You can sign up in a matter of minutes and make your deposit using your credit card, Alipay, MoneyGram, or a handful of other payment methods. The minimum deposit amount is $10, and the minimum trade amount is $1.

If you’re confused about where you should start your trading binary options, IQ Option is the right place to start.

(Risk warning: Your capital can be at risk)

3. Pocket Option

While Pocket Option was founded only recently, it’s already garnered a user base of over 10 million in its four years in the market. The broker caters to traders in over 95 countries and enables them to trade well over 100 assets.

With its easy-to-use platform, you can trade indices, stocks, commodities, crypto, and forex pairs. Like IQ Option, Pocket Option also offers demo accounts to users, an invaluable tool for new traders. Withdrawing and depositing funds is easy, but the minimum deposit amount is $50. On the upside, the company offers several safe payment methods and also sometimes gives traders cashback.

You can use Pocket Option on your desktop, laptop, or phone, and you can also access its platform using a web browser.

One of the best things about the company is its comprehensive education section. If you’re a newcomer, the guides and tutorials will teach you a lot about the ins and outs of binary options trading.

But perhaps the most impressive quality of Pocket Option is that it is regulated by the International Financial Market Relations Regulation Center. All the trades you make on the platform are safe, and you can trade binaries using Pocket Option whether you’re in the US or Europe.

(Risk warning: Your capital can be at risk)

Successful trading tips for Binary Options beginners

With a lot of experience comes a lot of knowledge, but learning from other trader’s mistakes is the better route to take. The three big tips we can give you about trading Binary Options are:

- Educate yourself and never stop learning.

- Keep a trading journal.

- Understand the psychology behind trading.

Educating Yourself

Immerse yourself in a good book or tutorial about trading – you always want to go to bed knowing more than you knew yesterday. Markets change, and to change with them, you must arm yourself with knowledge.

Some resources you can use to learn more include:

- Books: There are thousands of great books you can learn a lot from available on the market. There are hundreds of books that can teach you about trading binary options, but even if you read a handful of the best books, you’ll be miles ahead of the average trader. One of the best things about learning from books is that you can learn at your own pace. CALL or PUT: How I profit using Binary Options by Dennis Preston is currently one of the best-rated books for learning binary options trading.

- Courses, video tutorials, and seminars: YouTube is a treasure trove of video tutorials that can teach you a lot about binary options. It’s not hard to find videos that teach you trading strategies on the platform. You can also take a course on platforms like Udemy and Skillshare or attend seminars and webinars and take advice from expert traders. Seminars are an excellent source of learning about market developments, which is why many experienced traders continually attend them.

- Guides: There’s an abundance of trading guides on the internet, which give you a step-by-step breakdown of strategies and trading tricks. Many of them are free to download, and you can read them on your desktop, mobile phone, or tablet. Trading Binary Options: Strategies and Tactics by Abe Cofnas is one of the dozens of PDFs you can learn from for free.

- Blogs and email newsletters: Reading blogs and subscribing to email newsletters is an excellent way of staying in the loop about market developments.

- Forums & chat rooms: If you believe you learn more by doing, joining a forum or chat room and following along with what other, more experienced traders are doing can be a great catalyst to your success. On forums and chat rooms, you can ask for recommendations, learn new trading tactics, and brainstorm ideas to make them better.

Keeping a trading journal

Regular journals help you reflect, and that’s precisely what the goal is with a trading journal. It’s a well-kept secret experts rarely talk about.

Keeping a trading journal can be extremely helpful since you will be able to analyze why a trade didn’t work out or why it did later. A simple way to maintain a trading journal is to write down the date and price of every trade you make. Investing a few seconds in keeping a record of your trades will immensely improve your trading strategy. You don’t have to use a book to do this. You can use a spreadsheet or any other software of your choice. Even the best traders make mistakes, but they never miss out on the opportunity of understanding what went wrong. Besides, having a trading journal can come in handy when filing tax returns.

Understanding the psychology behind trading

Success in binary options trading doesn’t come from just having the right strategy. It comes from holding your ground when you are afraid that the trade will work against your favor.

Experiencing losses is part and parcel of trading, and you must accept that you cannot avoid losses. Even if you feel fear, you must stick to your strategy – if you begin acting inconsistently, your profits will decrease.

(Risk warning: Trading involves risks)

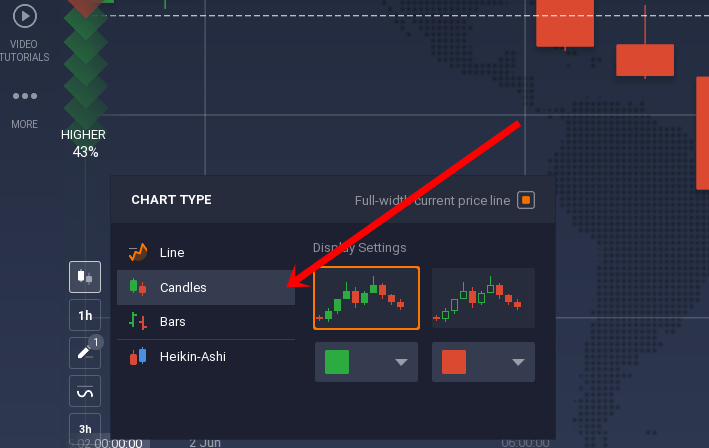

Finding charting tools

Charts are the cornerstone of technical analysis, and without them, you won’t be able to gauge and make sense of trades. If you don’t know what you’re getting into, you’re essentially gambling.

Notice:

Most brokers offer to use professional charts. But using external resources can also help you with the analysis.

The two chart sources

The chart source that most new traders are familiar with is online charts. While these are easier to access, they typically don’t have many tools and aren’t as interactive as downloadable charts. It is for these reasons, we cannot recommend using online charts for trading Binary Options. Downloadable charts are chart sources, which, as the name suggests, must be downloaded onto your computer. These typically come as a part of forex trading platforms, but many are also available to download as standalone software.

These charts come loaded with tools that enhance the results of technical analysis. Downloadable charts are often free, but some require paid plug-ins to work, and others only work if you pay for them.

Charting Sources Recommendations

1. MetaTrader 4

MetaTrader 4 is renowned as the best free tool to access charting information and interactive charts. Almost every broker works with the platform; however, you must strive to work with a broker that offers a more comprehensive asset base.

Ideally, the broker you’re working with should have more than 40 currency pairs, at least eight major stock indices, stocks, and also spot metals. FXCM, Forex.com, and FxPro are some of the many MetaTrader platforms you can use for your charts. MetaTrader 4 is free to use and supports plug-ins that help with the signal generation, which is another big plus.

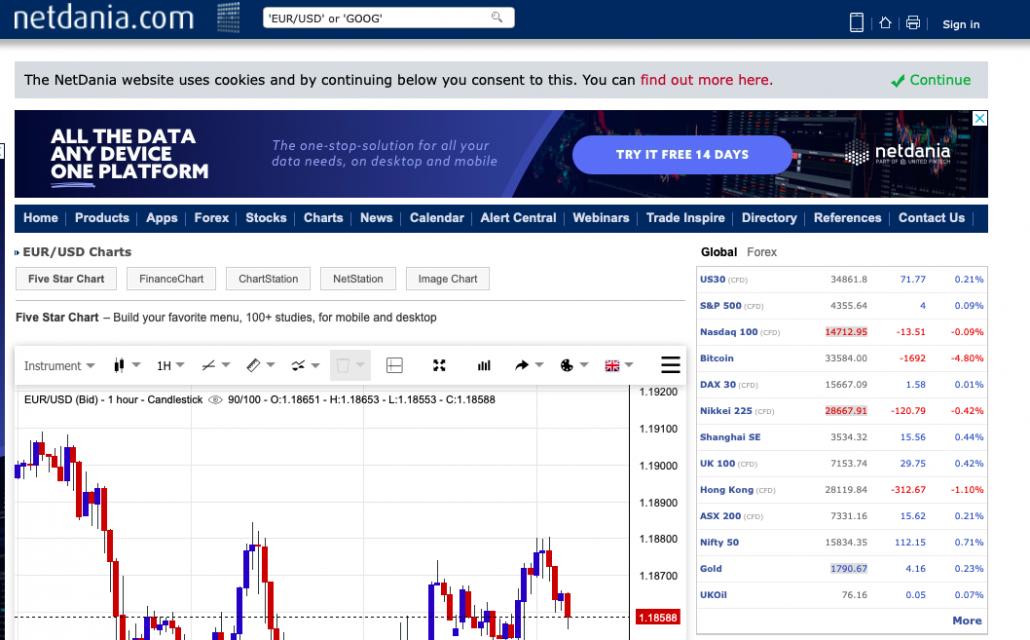

2. NetDania

If you prefer using a web-based charting tool and don’t care much about chart interactivity, using NetDania’s free charts is an excellent idea.

The real-time charting program works for markets worldwide and also the forex market.

(Risk warning: Trading involves risks)

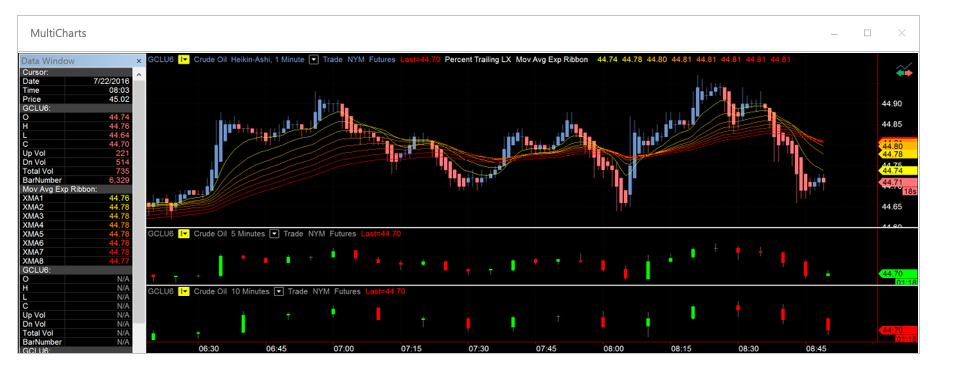

3. MultiCharts

It is a paid downloadable software that gives you access to forex charts on over two dozen currency pairs. While there is also a web-based version of the software available, we recommend using the downloaded version.

You can try the tool out for a limited time by signing up for the free trial and check out its many unique features, such as the ODM chart trading feature. It enables you to make a trade at the exact price you want to.

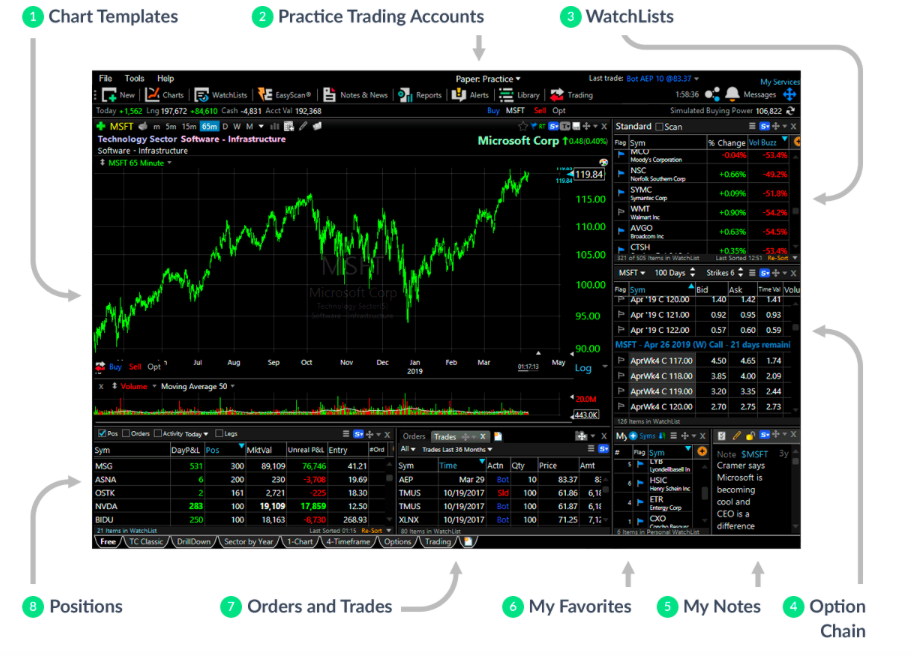

4. Free Stock Charts

If you haven’t traded stocks before, Free Stock Charts is the right software to use. It gives you access to all US stocks and options, offers dozens of indicators, and gives access to delayed streaming data.

You can make option chains and also practice trading by making paper accounts. The software recently became a part of the award-winning TC2000 software, and it works on all computers and phones. You can also use the tool’s web version since it makes no compromises in terms of features.

It is important to note that the software is free to try, but you will need to pay to use it in the long run.

(Risk warning: Trading involves risks)

Learn Binary Options trading strategies

As a beginner, it is imperative that you learn as much as possible about what you’re getting into, which in this case, are options. Here’s an hour-long lecture from Professor Shiller, Sterling Professor of Economics at Yale.

The video is less a lecture and more a crash course on options. After you complete watching it, you can go ahead and strategize how you want to go about trading your binary options.

Why build a strategy?

The first and most important reason why a trader must always have a strategy is that it prevents emotion from getting in the way of trading decisions. You may think ambition is a good thing, but it’s not. When trading, ambition, greed, and fear are equally destructive and almost always lead to errors.

Your strategy will keep your emotions in check and help you focus on the data and the math. Besides, strategies help you repeat profitable decisions. If you understand how and why a binary option you traded made your money, you can repeat the strategy to make more money. But it’s important to remember that the effectiveness of strategies differs from market to market. A strategy that worked on a range trade on gold may backfire for a ladder option in the forex market. Also, read our full article about Binary Options trading strategies.

Making your own strategy isn’t complicated – the process can be broken down into two steps.

Step 1: Develop a signal

The signal tells you whether your asset’s price will go up or down, enabling you to make a prediction and subsequently make profits. You can make a signal in two ways: either by following the news or by conducting technical analysis.

Creating a signal with news

Developing a signal with the news is straightforward. All you have to do is look for company announcements and go through financial reports. You can also look at global news and correlate it to your trade, since world events often impact entire markets. The smallest of announcements can cause a plummet or surge in price, so staying in the loop is critical. You want to trade your binary options as soon as you can – ideally before the rest of the market catches on. To do that, you will need to have your TV on in the background and tune into relevant news sources on the internet.

Some of the best news sources for traders include:

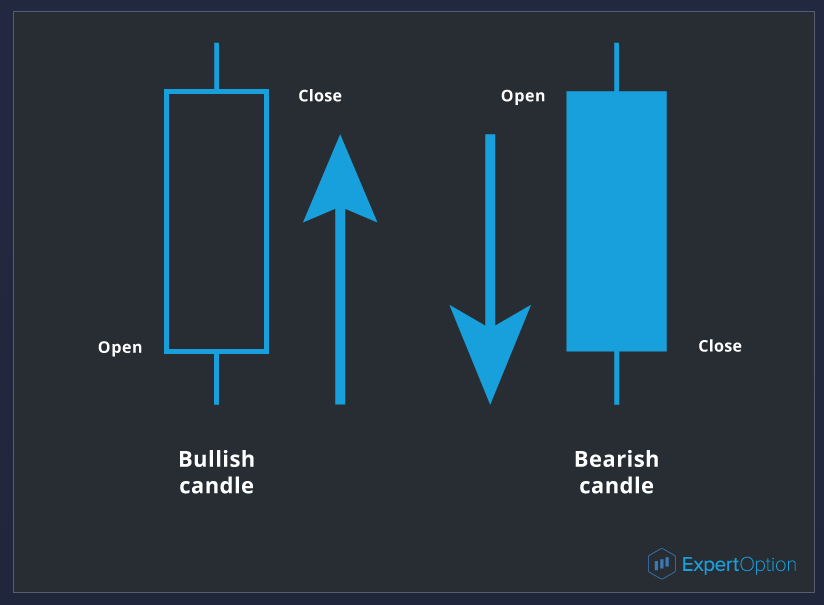

After you pick your charting source from our list above, you can begin identifying patterns in the charts. More often than not, you will be able to predict price movements accurately. A good trader relies on the pearl of wisdom that is, “history repeats itself.”

Learning how to read candlesticks and line charts will further deepen your understanding of patterns, enabling you to make more profits with your findings. Building indicators is the next move in this progression. These will tell you what type of binary option you should trade and when. If you’re a beginner, make sure that the broker you sign up with offers these technical tools since they will come in handy as you gain more knowledge and experience.

While binary trading is not easy, it is easier than other trading methods since it gives you the flexibility of using several tools and indicators to predict price trends.

Some strategies you can incorporate into your trading are:

- Price action

- MACD indicators

- Babypips

- Support and resistance levels

- Mirrors

- Stochastic oscillators

(Risk warning: Trading involves risks)

Step 2: Decide how much to trade

You want to go low and slow in the beginning. Trade the same amount on every trade, regardless of what market you’re trading on until you find your footing.

Here are three strategies you can apply according to how confident you’re feeling with your abilities:

1. The Martingale Strategy

In this strategy, you must trade a larger amount after a loss to recover your loss quickly. Let’s say you’ve set your mind to making $100 trades. If a trade fails, and you lose money, you must put up $200 on the next trade. If the new trade works out in your favor, you’ll make your money back and then some.

However, the strategy isn’t without its faults. If you’re on a losing streak, you will lose a lot of capital in a very short period. The martingale strategy isn’t for beginners and should only be used if you have a reliable system of making trade decisions in place.

2. The Percentage Strategy

If the idea of never losing more than you can afford appeals to you (as it should), the percentage strategy is one you will benefit from. This strategy is popular among all traders, not just binary options traders, and for good reason. Let’s say you have $10,000 in your account. You must determine how much of your capital you’re willing to risk. Most traders are willing to risk 1%-2%, but you can risk up to 5% if your risk tolerance is high.

In this scenario, if you decide that you’re willing to risk 5%, put up $500 on each trade. It’s an excellent strategy for newcomers since you don’t have to worry about losing big.

3. The Straddle Strategy

Employing the straddle strategy is an excellent way to make money in a volatile market. You can use it just before a company is about to make an announcement. Let’s say the value of the instrument has risen, and you’re anticipating it to decrease. Once the descent in price begins, you must place a call expecting that the price will bounce back. You can also do this when an ascent has begun and bet that the price will come back down.

Note:

The strategy works best for short-term traders and can be used by traders of all experience levels.

Automating your trades

After you’ve perfected your strategy and are making profits from it consistently, consider automating it. Automation bots use algorithms that rely on signals to make trades.

The upside of using bots is that they can make trades a lot faster than you can, increasing the potential profits you make. Also, bots can trade on all markets. As you become a better trader, it becomes worth taking the time to find a broker that allows auto-trading. Several brokers will enable you to build programs without much hassle.

While bots are faster, you will still need to stick around and supervise. If the bot makes mistakes or there is an unforeseen change in the market, you will need to correct it.

(Risk warning: Trading involves risks)

Other considerations

You must remember that some strategies only work for specific expiry times. A five-minute binary options strategy won’t give you great results in a 15-minute binary options trade, and vice versa. If you’ve set your mind on trading with a fixed expiry time, using strategies tailored for the expiry time is the right way to go.

The key to making a profit with trading is to find a strategy that suits your trading style. Consider what instrument you want to trade carefully, and have a money management system in place before you begin trading. Use charts and patterns to develop indicators, and remember to leverage news announcements for making profits. If you’ve never traded before, get used to the process with a practice account and only put up capital when you’re confident in your abilities.

Are Binary Options regulated? – Region-wise regulations

Binary options are niche derivatives, but they’re quickly gaining popularity globally.

Regulatory bodies in different regions hold different stances with respect to binary options, and it is essential to learn whether trading binary options is allowed where you live before getting into trading them.

USA

While trading Binary Options is allowed in the USA, only a handful of brokers are licensed to enable binary options trading. Thankfully, both firms boast competitive pricing and provide a wide range of assets you can trade binaries on.

UK

You can only trade binary options in the United Kingdom if you have a UK Gambling Commission license. You must do your due diligence when picking a broker to sign up with. We recommend that you opt for a broker regulated by the FCA.

Some brokers are registered with the FCA but are not regulated by it. Have a keen eye for the details when looking for a broker to sign up with. Earlier, the MiFID II guidelines were set to be implemented in the UK, which would enforce stricter rules regarding binary options trading. However, after Brexit, the UK is no longer under pressure for reclassifying binaries as financial instruments.

Europe

The European Securities and Markets Authority banned the sale and marketing of binary options in 2020. However, traders in Europe can still trade binary options in two ways: via an unregulated firm and via a firm regulated outside of Europe. Trading with unregulated firms is highly risky, and we advise you to steer clear of firms that are not regulated, since most are scams.

The average trader’s best option is to sign up with a firm regulated by ASIC, a respected regulator in Australia. Since the ban only applies to retail investors in Europe, you are exempt from the ban if you’re a registered professional trader.

If you meet the following criteria, you can get registered as a professional trader:

- Own assets worth €500,000 or more

- Make ten or more trades worth at least €150 every quarter

- Have two years of experience working at a financial firm

European traders can choose a broker outside Europe to trade Binary Options as private traders and investors.

Rest of the world

There are regulatory bodies in every country with unique sets of regulations in place regarding trading binary options.

Australian traders must abide by the rules set forth by the Australian Securities and Investments Commission (ASIC). The Cyprus Securities and Exchange Commission (CySec) regulates brokers in Cyprus and Israel. In the same way, the Dubai International Financial Centre (DIFC) regulates binary options in the UAE.

If you want your money to be safe, it is best to sign up with brokers regulated by the respective authority in your location. It’s not difficult to find unregulated brokers, but most are not trustworthy. We recommend steering clear of unregulated brokers.

Region-wise tax laws

The tax laws pertaining to binary options differ from region to region. In the UK, trading binary options is considered gambling, and this distinction comes with some unexpected benefits. The HMRC does not charge traders tax on the profits they make by trading binary options. That being said, if you trade binary options full-time, you may need to pay income tax.

In contrast, in Japan, all the profits from binary options trading are subject to taxation. Learning your tax laws before you begin trading binary options is the right way to go.

In conclusion: Trading binary options opens up great opportunities on the market

While trading binary options was reserved only for the elite and wealthy in earlier times, today all traders can trade binary options on the global markets. By choosing binary options as different instruments like CFDs, different investment strategies can be pulled off with binary options.

Moreover, with a suitable broker by their side like IQ Options, traders can trade Binary Options under the best conditions. Good regulation is always a prerequisite. For trading, however, you should also make sure that the selection is large enough and that appropriate charting tools from trading platforms such as MetaTrader are available for trading.

(Risk warning: Trading involves risks)

FAQ – The most asked questions about binary options:

Are Binary Options legal?

In most countries, trading binary options is legal. However, traders in Europe cannot legally trade binaries unless they’re classed as professionals.

Can I trade Binary Options on the weekend?

Yes, you can trade binary options on the weekend since forex markets in other parts of the world remain open because of the time difference.

If you don’t wish to trade in forex markets, you can trade on synthetic markets. However, only a handful of brokers offer access to these virtual markets, and since there is no underlying market for these options, most traders don’t trade on them.

Can I trade Binary Options in Europe?

European regulator ESMA has withdrawn the option to trade Binary Options. You can still trade this financial product by signing up with brokers not regulated by Europe. Alternatively, you can trade on synthetic markets that work exactly like Binary Options, just called Digital Options or Turbo Options for example.

Professional traders are exempt from the ban, which means they can trade Binary Options in Europe.

Can I trade Binary Options on cryptocurrencies?

Leading Binary Options brokers allow you to trade binary options on cryptocurrencies. However, you will need to create a cryptocurrency wallet to trade binaries on Bitcoin, Ethereum, Litecoin, and the like.

Do Binary Options work on MetaTrader 4?

Binary options brokers do not directly integrate with MetaTrader, which is one of the disadvantages of trading binary options. However, you can perform technical analysis on MetaTrader 4 separately and place trades on your platform of choice.

How do you always win in binary options?

Before making a decision, you may check winning numbers and do a complete due diligence investigation. You may use the Kelly criteria for this. Beware of brokers who claim they will trade for you. They’re trying to convince you to up your investment so they can lead you into a losing trade. Binary options brokers make money only if you lose.

How do binary traders make money?

The most popular approach for binary traders to profit is through pricing binary options. Other methods involve traders’ trading actions. Typically, pricing structures for binary options brokers are obtained from their market makers.

Which binary options brokers are regulated?

Regulated brokers are those who have been certified by common financial authorities such as the Cyprus Securities and Exchange Commission (CySEC), the Isle of Man Gambling Supervision Commission (GSC), the Malta Gaming Authority (MGA), the United States Securities and Exchange Commission (SEC), and others.

Why are binary options banned?

Binary options are prone to fraud in their application and are thus prohibited as a form of gambling in many jurisdictions. However, due to their high demand, a few nations with multiple laws continue to use them.

General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. You should never invest money that you cannot afford to lose

Last Updated on February 25, 2023 by Andre Witzel

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5) (4.7 / 5)

(4.7 / 5)