What is day trading? – Basic tutorial

Table of Contents

Day Trading definition:

Day trading is the term used to describe trading on a daily basis during stock exchange opening hours. All positions must be closed before the end of the day at the close of the market. In contrast to long-term investors, small price fluctuations are usually used to make a profit. Day trading can be carried out on any asset and market.

Characteristics of a day trader:

- Daily stock exchange trading with fixed working hours

- Trading and making profits from small movements in the market

- Fast reactions to news and political decisions

- Opens positions with higher capital and leverage

Day trading basics – how does it work?

Many people want to get rich as day traders, but how does it work, and what is “day trading”? – As traders with over 9 years of experience, we explain how day trading works and which basics beginners or advanced traders should consider. You will get an overview of this special trading method on the stock exchange and sustainable tips & tricks.

Daytraders trade the markets 5 days a week (Exception: Cryptocurrencies like Bitcoin or Ethereum are traded 24/7). Special focus is put on the opening hours of the stock exchange because most traders are active there and the trading volume is very high. Day trading can be considered a normal job but without a fixed income if you do it as a private person. One has fixed working hours and consistently carries out trading on a daily basis. Professional day traders in banks or institutions got a fixed income and get a bonus for making profits with trading.

Some traders prefer to trade for only a few seconds and others for several hours. Day trading is adaptable to the wishes of the trader. The trader is always dependent on the market situation. If there is no movement you can not make a successful trade. High volatility (movement) of the market is the friend of a daytrader.

Day trading can be compared with a normal job, but here you are paid by the market according to your own performance. Profits are realized by a price formation of the markets.

Popular markets for day traders:

- Forex (currencies)

- Commodities (oil, wheat, and more)

- Metals (gold, silver, and more)

- Stocks

- ETFs (exchange-traded funds)

- Government bonds

- Cryptocurrencies

Assets with high trading volume and volatility are popular. Especially economic news is interesting for daytraders to make a quick profit. Daytraders trade exclusively derivatives or large positions with shares. Derivatives are leveraged trading positions with an underlying asset (market). Various financial products can be used for this. These are in most cases either CFDs (contracts for difference) or futures (futures contracts). CFDs are the most popular because CFDs can be traded with a very small initial capital and give quick access to all markets.

Popular financial products for day traders:

- Different types of derivates

- CFDs (contracts for difference)

- Options

- Futures

- Leveraged trading products

How much money do you need for Day Trading?

How much money do you need for day trading? This is a very popular question and most beginners are asking it. From our experience, day trading can be started with a very small amount of money. It is depending on the financial product you are trading. For example, CFDs or some Digital Options are offered to trade with less than $1 investment. For other products like “Futures”, you will need the minimum margin of $500 for one contract (we recommend using more than $20,000 to trade futures because it is a highly leveraged product). Also, some stocks can be traded at prices like $5 or less.

All in all, it is depending on the financial product you want to trade and invest in. The most important thing is to try out day trading, the financial product, and the markets. This is possible to do with a free trading demo account which is offered by most online brokers.

Note

CFDs (contracts for difference) are the best way to start fay trading with small amounts of money.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 78.1% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

Advantages and disadvantages of Day Trading

Why should you start with day trading? – Like any other trading style, there are advantages and disadvantages. In general, many traders are fascinated by exchanging their own job for stock exchange trading. Simply spending your working hours in front of the computer and earning money is tempting.

The advantages are also to realize a profit quickly. While longer investments give away a few percent a month, a daytrader makes his daily percentages. In addition, he saves swap costs (financing costs, interest) for leveraged derivatives that accrue overnight. In general, however, there are higher trading fees because the trading frequency in day trading can be very high.

In the following table we have listed the advantages and disadvantages for you:

Advantages: | Disadvatages: |

|---|---|

Fast profits are possible | Higher trading volume means higher trading fees as well |

No trading fees overnight (swap, interest payment) | You will need a very fast reaction and high brain capacity |

It is not always necessary to sit many hours in front of the computer because goals can be reached very quickly. | Trading against very fast algorithms and professional traders |

Which are the best markets for day trading?

Which markets should one trade in day trading? – Many beginners ask themselves this question. From our trading experience and the knowledge of professional day traders, one should rely on liquid markets. Not every market is accordingly liquid (little trading volume) and is traded a lot. It is even harder to predict the market movement in illiquid markets because there is less order flow.

For a trader in the short term, it is essential to get a correct execution in the market. The most frequently traded markets are suitable for this, as supply and demand are very high.

Note:

Using liquid markets gives a day trader better execution and analytic possibilities of the order flow.

The best markets for day trading:

- Liquid shares of big companies

- Forex (currency pairs, but only majors)

- Government bonds

- Indices (S&P500 for example)

- Metals (Gold)

- Liquid ETFs

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

How to start day trading?

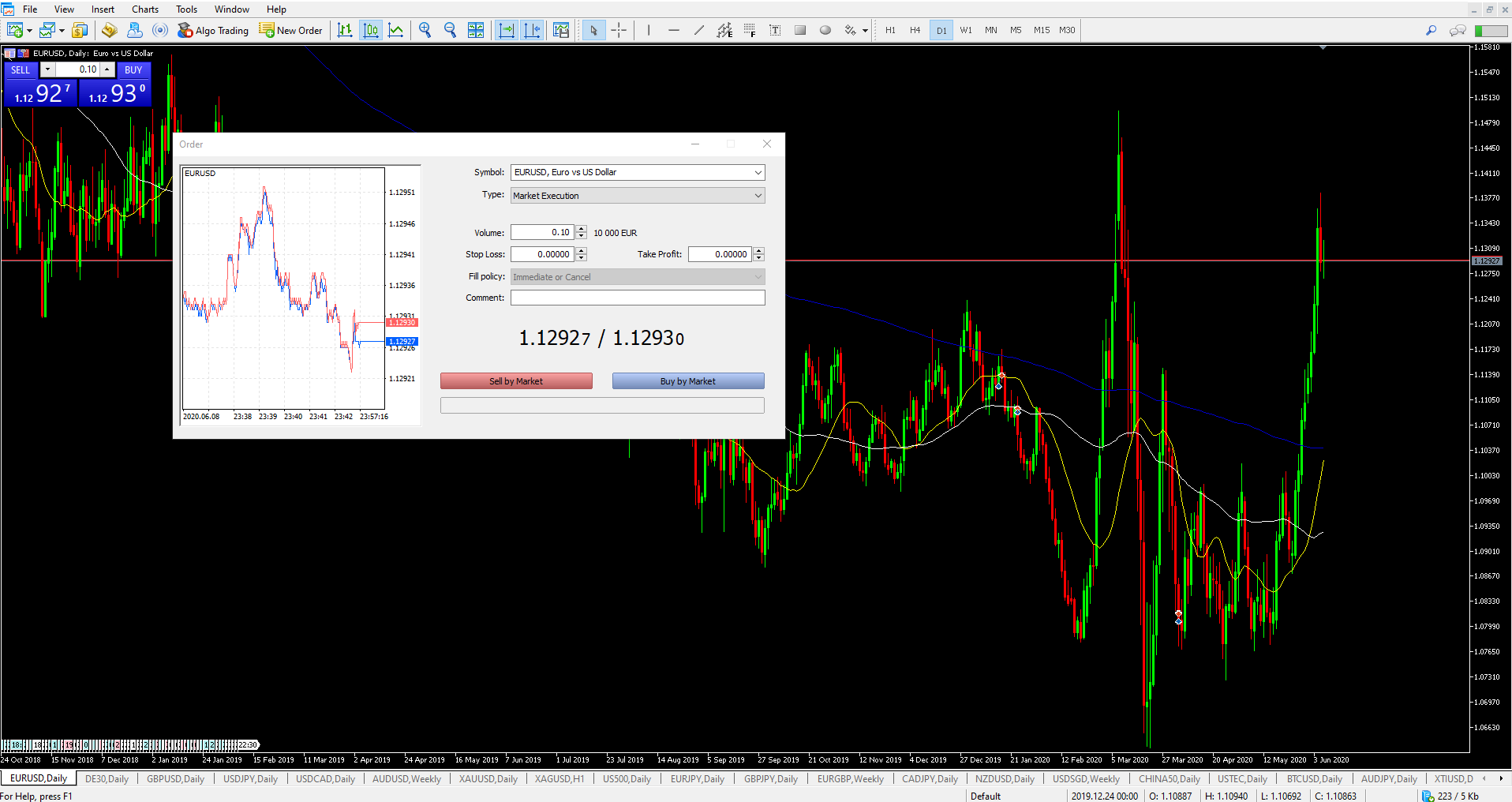

How to start with day trading? – Thanks to electronic trading and the internet it has become very easy to start day trading. All you need is suitable software and a broker. You can often use the software for any device (computer, smartphone, tablet). It offers you many analysis possibilities to make the right decisions in the markets.

Beginners can create a free demo account. This is an account with virtual credit and it simulates real money trading. You trade without risk. It is perfect for learning and testing trading. In many cases, the broker simultaneously offers one or more suitable trading platforms in addition to access to the markets. Thanks to the strong competition on the Internet, these are professionally programmed and offer everything you need for day trading.

What do you need for day trading:

- Brokerage account

- Trading Software

- Money or use the virtual demo account

It is very important to have a fast internet connection. Sometimes milliseconds decide on a win or loss. The broker must also play along with this. Some providers, unfortunately, offer a too slow order execution. Therefore, before the real money deposit, the broker should be tested extensively.

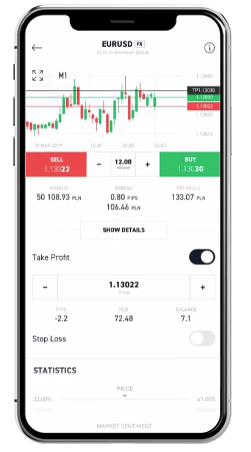

Mobile day trading is available

Should you ever have to leave your desk and have an open trading position, you can check your trading account via a mobile app. Nowadays, the programs for the smartphone offer you 90% of the same functions as the trading software on the computer.

You only need one access to the account at a time and can manage it with any device. You can also react immediately to news or political decisions. Day trading is universal and the software can be adapted to the trader.

Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

Day trading broker: Where should you start investing?

It is important to choose a trusted provider. For beginner and advanced traders, it is usually difficult to find a suitable online broker, thanks to the very large offer. Often there are confusing advertising promises, which also have a negative effect on your trading. The basic rule is that the more advertising the broker does, the higher his fees will be.

Criteria to find a reliable online brokerage account:

- The official regulation of a finance authority

- Professional trading software

- Fast execution for trades

- Support in different languages

- Low trading fees

- No hidden fees

- Huge variety of markets and financial products (not always necessary)

So choose a suitable online provider to practice day trading. The following table gives you an overview of recommended brokers. They have been compared by us with other providers and tested with real money. With more than 9 years of experience, we present you with the top 3.

Test yourself a free demo account:

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com  | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 78.1% of retail CFD accounts lose money) | |

2. RoboForex  | # High leverage up to 1:2000 # Free bonus # ECN accounts # MT4/MT5 # Crypto deposit/withdrawal | Live account from $ 10 (Risk warning: Your capital can be at risk) | |

3. Vantage Markets  | # High leverage up to 1:500 # High liquidity # No requotes # MT4/MT5 # Spreads from 0.0 pips | Live account from $ 200 (Risk warning: Your capital can be at risk) |

How risky is Day Trading? – Your own risk

Day trading can be quite dangerous if you trade the wrong way. Although the obligation to make additional contributions to CFD Trading has been abolished, there is still the possibility of losing 100% of your deposited capital. Therefore choose a reasonable position size. Especially many beginners take too high a risk because you overstretch the account.

You should definitely secure your positions with an automatic loss limit (stop loss). This tool automatically closes the position at a certain price or loss. The risk can always be limited by the trader. In the end, it is still the trader himself who determines the risk. It is up to him what amount he wants to invest in the markets.

Basic rule: The higher the risk, the higher the possible profit. Work out a strategy and set yourself fixed goals for trading. Good risk management can help a lot in this respect. Professional traders risk 1 – 2% of the total capital per position. With a good profit ratio, a high profit is possible every day.

Our 3 best tips for doing day trading:

From our experience, many traders fail at the basics. These should definitely be understood. It is best to write your own set of rules in order not to be destroyed by the market.

1. Market opening hours

Times are very important in day trading because here the volume is determined. Every market has its own characteristics. Especially at the opening and closing of the exchange, there is a high trading volume. Know your market and the trading hours. Often it is also the case that there is hardly any movement around midday.

2. Do not trade at the news

News influence the market very strongly in day trading. Especially in the small-time units, you will feel big movements. Use the economic calendar for this. There the daily news and their influence on the markets are published. The broker offers this in most cases or the page “Investing.com”.

3. Market correlations

Another factor is correlations in the market. In the case of currencies, for example, you can see very clearly that the USD is the driving force. Commodities also have a dependency on other markets. A correlation between different markets is very important for a day trader and his analysis. So unexpected movements can be predicted.

Conclusion: Day trading is a special trading method

Daytrading is definitely a possibility to enter the markets professionally. However, one should not take this topic on the light shoulder. It can take several years before one trades profitably. We can tell you that it does not work without your own efforts.

You may still have the best method for the markets in front of you, but you have to practice it permanently and find out how the market behaves at certain points. You can make money with the simplest things on the market. However, there is more to trading than just a correct strategy.

Our best tips for beginners:

- Risk management: Without proper risk management you will lose money very quickly. In a trade, only a small part of your account balance should be risked.

- Psychology: Many newcomers feel fear or greed. This has no place in the market at all. The market is not interested in what you feel. Trade according to strict rules.

- Trading Strategy: Any method can work if used in the right context. Trading requires many hours of practice.

90% of traders lose capital in the market and this is not without reason. Most traders go to the stock market with too high expectations. From my experience, one should start very small in the stock market first and then increase his investment or capital over time.

Day trading needs like any other trading method deep trading knowledge. It can be used to make fast profits or losses.

Trusted Broker Reviews

Professional traders since 2013Trade more than 3,000+ markets from 0.0 pips spread without commissions and professional platforms:

(Risk warning: 78.1% of retail CFD accounts lose money)

See other articles about day trading:

Last Updated on January 27, 2023 by Arkady Müller

(5 / 5)

(5 / 5)