Etoro review and test for new investors – Is it a scam or not?

Table of Contents

Review: | Regulation: | Min. deposit: | Assets: | Special: |

|---|---|---|---|---|

(5 / 5) (5 / 5) | CySEC, FCA, ASIC | $ 50 | 3,000+ | Copy-trading |

Etoro is one of the world’s famous brands when it comes to online trading but is eToro a good and professional broker or not? – Find out the truth on this page. With more than nine years of experience in financial trading, we have tested the provider for contracts for difference (CFDs), forex, commodities, and stocks. Read about the trading conditions and the offer for traders. Does it really make sense to invest money with this broker? – Inform yourself transparently through our review.

**Please note that instruments restrictions may apply according to region

Risk warning:

eToro is a multi-asset platform that offers equity and cryptocurrency investments as well as CFD asset trading.

CFDs are complex financial instruments. Because of the leverage effect, they carry a high risk of losing money quickly. 60 – 89% of private investor accounts lose money when trading CFDs with this provider.

Please be aware of the risks of CFD trading in advance, as high losses cannot be ruled out.

(Risk warning: eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.)

What is Etoro? – The broker presented

Etoro has been one of the leading trading platforms in the field of contract for difference, social, and copy trading since 2007. Overall you can invest in more than 2,000 different assets and markets. Since 2017, the range has also been expanded to include new stock assets like Tesla or Coinbase. The Etoro brand is backed by an innovative company that wants to clearly differentiate itself from other providers by inventing the best trading platform.

The broker is internationally active and has many branches accordingly. In Europe, the head office is located in Cyprus, and there is another office in Great Britain. Since 2007, the company has had a complete history with many innovations and functions that improve trading for the trader.

Etoro is not just an ordinary broker but offers many other opportunities to invest in the financial markets. As a trader, you can, for example, copy other traders or become a signal by yourself. Investing in larger CopyPortfolios is also possible on their platform. Thanks to the good company data and offers for traders, Etoro makes a good first impression on me.

Facts about the company:

⭐ Rating: | 5 / 5 |

🏛 Founded: | 2007 |

💻 Trading platforms: | Etoro Web Trader |

💰 Minimum deposit: | $10 |

💱 Account currencies: | USD |

💸 Withdrawal limit: | Minimum amount is $30 |

📉 Minimum trade amount: | $50 |

⌨️ Demo account: | Yes |

🕌 Islamic account: | Yes |

📊 Assets: | Stocks, Indices, Commodities, Currencies, ETFs |

💳 Payment methods: | Etoro money, Credit- Debit Cards, bank transfers, Skrill, Neteller, Paypal, Klarna |

🧮 Fees: | From 1.0 pip spread, variable fees depending on assets |

📞 Support: | Via live chat, support ticket, or help center |

🌎 Languages: | 18 Languages |

(Risk warning: eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.)

Is Etoro regulated? – Regulations and safety of customer funds

The regulation of a CFD Broker and the security of client funds is the most important point in online trading, which should be checked before you sign up. Brokers domiciled in the EU are only allowed to offer certain financial products with official regulation. Regulation or licensing is subject to strict criteria and conditions. If a broker violates the rules, there is a risk of immediate loss of the license. Fraud against the trader is, therefore, almost 100% impossible with European-regulated brokers.

Etoro is regulated and licensed several times. The CFD Broker has regulations in Europe (CySEC and FCA), Australia (ASIC), and the USA (FinCEN). These regulations radiate high trustworthiness to us. Also, the customer money of the traders is well protected. The broker must guarantee separate storage between customer money and company money. European Tier 1 banks are used for this purpose. There is also deposit protection in the unlikely event of corporate insolvency of up to € 20,000 (EU).

Facts about the regulation:

- Multi-regulated online broker

- Etoro (Europe) Ltd., a Financial Services Company authorized and regulated by the Cyprus Securities Exchange Commission (CySEC) under license # 109/10

- Etoro (UK) Ltd, a Financial Services Company authorized and regulated by the Financial Conduct Authority (FCA) under the license FRN 583263

- Etoro (AUS) Capital Pty Ltd. is authorized by the Australian Securities and Investments Commission (ASIC) under Australian Financial Services License 491139.

- FinCEN (USA)

What are the pros and cons of Etoro?

Etoro is one of the world’s leading social investment networks with an ambition to revolutionize the way people invest. Their strong belief in simplicity, innovation, and quality is a main factor for their success, with millions of active users around the world and offices worldwide. Like any other platform, Etoro isn’t for everybody, but to help you make an informed decision, we tested the platform and give you an overview of our pros and cons below.

Pros of Etoro | Cons of Etoro |

✔ One of the leading social trading platforms worldwide | ✘ A withdrawal fee of $5 per withdrawal |

✔ Certified by the most-reputable regulators | ✘ Customer support via live chat only available with a verified live account |

✔ Account insurance for up to $1,000,000 included | |

✔ 0% commissions on Stocks & ETFs | |

✔ Very transparent fee structure | |

✔ Free demo account with $100,000 in virtual funds | |

✔ Excellent rating on Trustpilot with more than 19,000 reviews |

Is Etoro a user-friendly trading platform?

Etoro is one of the most popular trading platforms, with millions of users around the world. They specifically aim at newer traders with their copy-trading option and the easy-to-understand platform, for example.

Criteria | Rating |

General Website Design and Setup | ★★★★★ The platform works flawlessly, is secure, and has a great clarity |

Sign-up Process | ★★★★★ Sign-up process is extremely fast and easy, and even the demo account gives you access to helpful tools. |

Usability of trading area | ★★★★ Trading area with the Etoro is made very easy |

Usability of mobile app | ★★★★★ The app is a very popular alternative with millions of users and gives you all the similar tools you have in the web trader |

(Risk warning: eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.)

Review of the conditions for Etoro traders

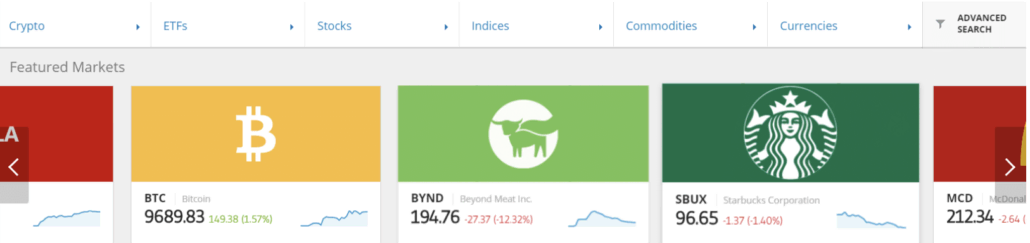

With Etoro, you can trade over 2,000 different assets. These include currencies (forex), commodities, metals, stocks, and ETFs. The assets can be traded either by difference contracts (CFD) or as real value (real stocks). Maximum leverage up to 1:30 (CySEC) in the EU is available for the CFDs, which can enable a higher profit or loss. It is important to know that there is negative balance protection. So you cannot lose more than your deposit at Etoro.

The spreads (trading fees – the difference between purchase and sale price) are very acceptable on Etoro. Especially in the indices area, the provider is far ahead when it comes to low fees. Currencies (Forex) can be traded from variable 1.0 pips spread. With levered positions, holding fees overnight can result, which are clearly communicated to the trader.

If you are looking for a broker with a large offer, then you have come to the right place. Another plus point is the social and copy trading function. Talk to other traders in the newsfeed, for example, and exchange your analysis. Other traders can also be copied for free. Find a trader who has been making profits for some time and convert his trader 1 to 1. Various portfolios are also available for investment at Etoro. It contains a special selection of assets, which are divided according to risk level.

See the sample spreads of Etoro:

Asset: | Spread from: |

|---|---|

EUR/USD | 1.0 pips |

USD/JPY | 1.0 pips |

GBP/USD | 2.0 pips |

EUR/JPY | 2.0 pips |

Oil | 0.05 points |

Gold | 45 pips |

S&P500 | 75 pips |

DowJones | 600 pips |

Conclusion of the conditions for traders:

- More than 2,000 assets and markets

- Currencies, commodities, metals, stocks, ETFs

- Competitive variable spreads

- Leverage up to 1:30 (CySEC) for European traders

- A minimum deposit of $ 200

- Negative balance protection

- CFDs and real assets

(Risk warning: eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.)

Test of the Etoro platform – What you should know

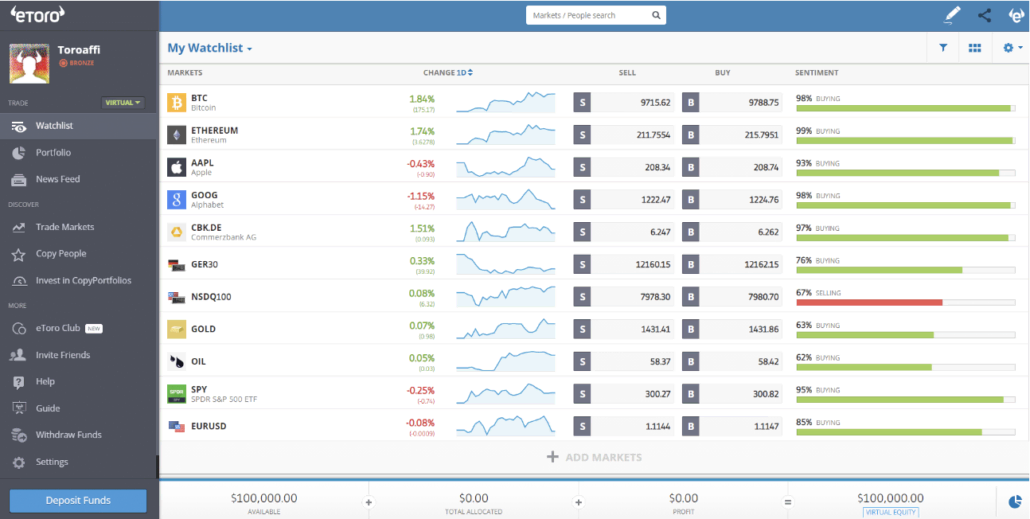

In contrast to other providers, Etoro can shine with many different special functions. What we particularly noticed is that the trading platform is very user-friendly and easy to use. As a beginner, you get along very well here. Also, tools for professional trading and analysis are available.

In the main menu of the trading platform, you have transparent access to all functions. The functionality is really overwhelming, and the trading platform is also available for all devices. In the left menu, you can operate the account and make settings. A detailed overview of your investments and portfolio is very transparent and allows optimal management. In the following points, we will introduce you to the functions of Etoro.

Facts about the trading platform:

- Available for any device (Mobile app and desktop)

- One account for real money and virtual trading

- Userfriendly and easy to use

- Professional charting solutions

- Contact other traders and see what they are doing

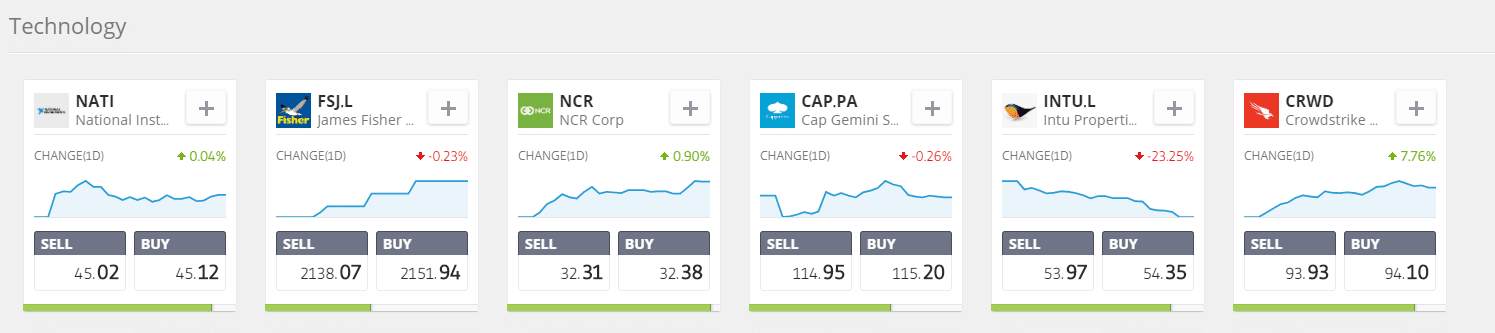

Choose any market for investing with Etoro

The selection of a market or asset is relatively simple. Using the search bar, you can, for example, search for a specific market. Under “Markets,” there are different categories to which the markets are assigned. This facilitates the selection enormously. Etoro provides important information directly in this market selection. You can view the last performance and current prices. In addition, the investment decisions of other traders are displayed.

A Watchlist is a powerful tool for every trader, and not every broker offers this feature. Here you can select markets that you find interesting and where you may want to invest later.

(Risk warning: eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.)

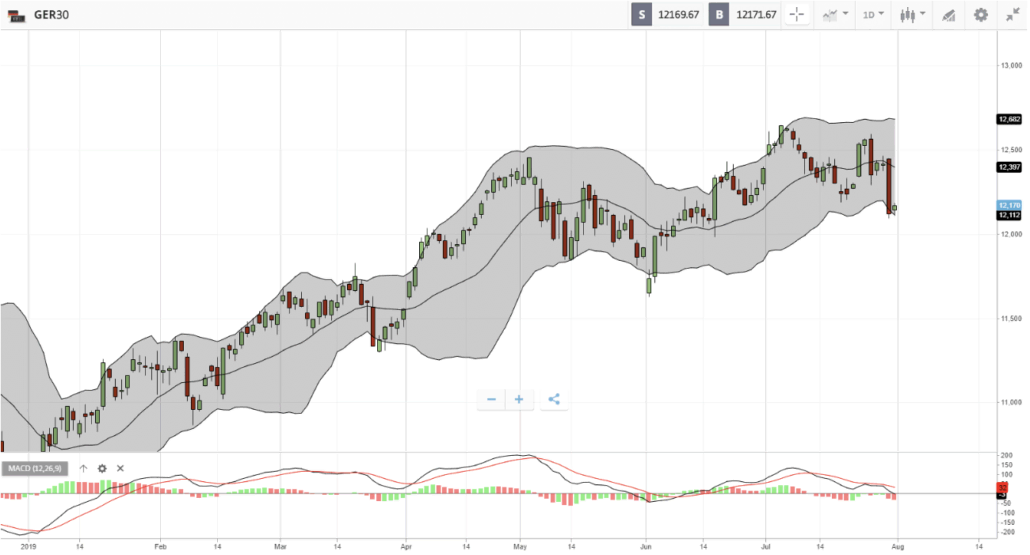

Professional analysis and charting are available

Etoro offers a wide range of analysis tools for trading. Especially the market characteristics stand out (already mentioned above). As a trader, you can get a quick overview. Professional charts are offered for charting. You can take a close look at every market.

No matter if indicators, technical drawing tools, or fundamental data of an asset, Etoro offers you the necessary functions. Use over five different chart displays and more than 50 indicators.

Facts about charting and analysis:

- Free indicators

- Free drawing tools

- Personally customizable charts

- Get a detailed asset overview

- Fundamental data and analysis feed

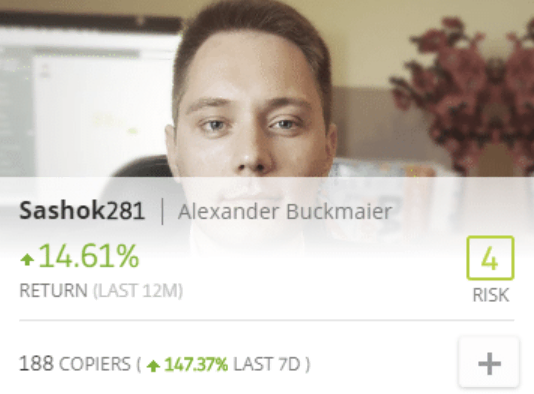

Review of the social and copy trading by Etoro

On the trading platform, you can copy other traders and trade their placed investments automatically. eToro is the world’s leading social trading platform. View the statistics of professional traders and analyze the risk. You can also follow several traders at the same time and thus differentiate your portfolio. The risk is controlled by you, and you choose what you want to invest in.

A copy of a successful trader should be carefully considered and analyzed. My tip is this: spread risk over several traders. As a client, you also have the option of having yourself copied. So you can build up a second lucrative income besides trading. For more information, you can read my full review of the eToro copy and social trading.

The advantages of copy trading:

- Friendly for beginners

- Learn from experienced traders

- See the transparent performance of a trader

- eToro shows you the risk

- Become a popular investor by yourself

- Decide by yourself how much you want to invest

(Risk warning: eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.)

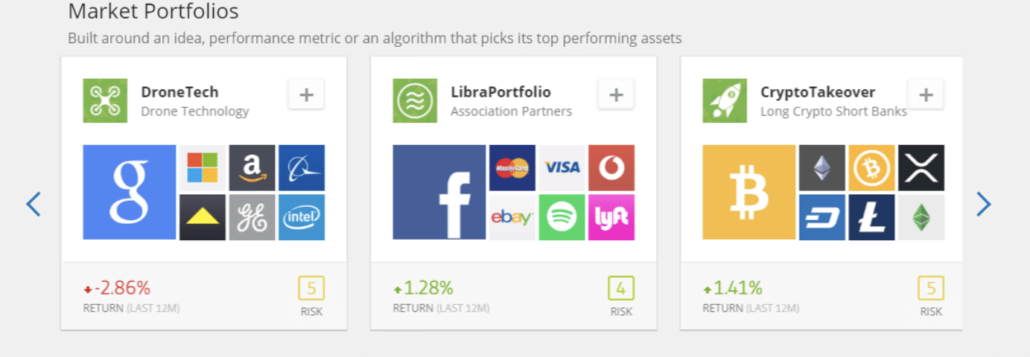

Market portfolios for diversification of investment

The CopyPortfolios are friendly for anyone who wants to build a diversified portfolio. Similar to an ETF, a copy portfolio contains several different assets that together form an “Asset.” So if you invest in a CopyPortfolio, the investment is spread over a large number of investments at the same time.

What’s particularly great about eToro is that the risk is displayed automatically. You can also see the composition and performance of the CopyPortfolio in the past.

The advantages of market portfolios:

- Friendly for a diverse portfolio

- Spread the risk through different assets

- See the latest performance

- Start investing a small amount of money in different assets

Real stocks and ETFs without transaction fees (0% commission)

Etoro is a progressive Forex Broker and CFD Broker that is constantly expanding its offering. In addition to pure CFDs (difference contracts), traders can now also invest in real stocks and ETFs. Worldwide stock exchanges are offered here. Trade Australian, German, American, and other countries with just a few clicks. For example, over 500 NYSE shares are available. Another investment advantage is that there are no trading fees. The only difference is the market spread.

The market spread can be viewed transparently on the trading platform and is only a few cents high on average. Those who do not wish to specialize in individual stocks can choose an ETF for their investment. An ETF comprises a certain area of equities (similar to CopyPortfolios). Thus, with a small amount of capital, it is possible to participate in the increase in value and the dividends of many shares simultaneously.

Etoro does not charge a commission or additional fees for trading stocks.

The advantages of the Etoro stockbroker:

- Invest in worldwide stocks with only one click

- ETFs are available

- Trade as a leveraged position or not

- Dividends in real-time

- Comprehensive information about the markets

- Trade stocks with 0% commission

Additional fees apply.

(Risk warning: eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.)

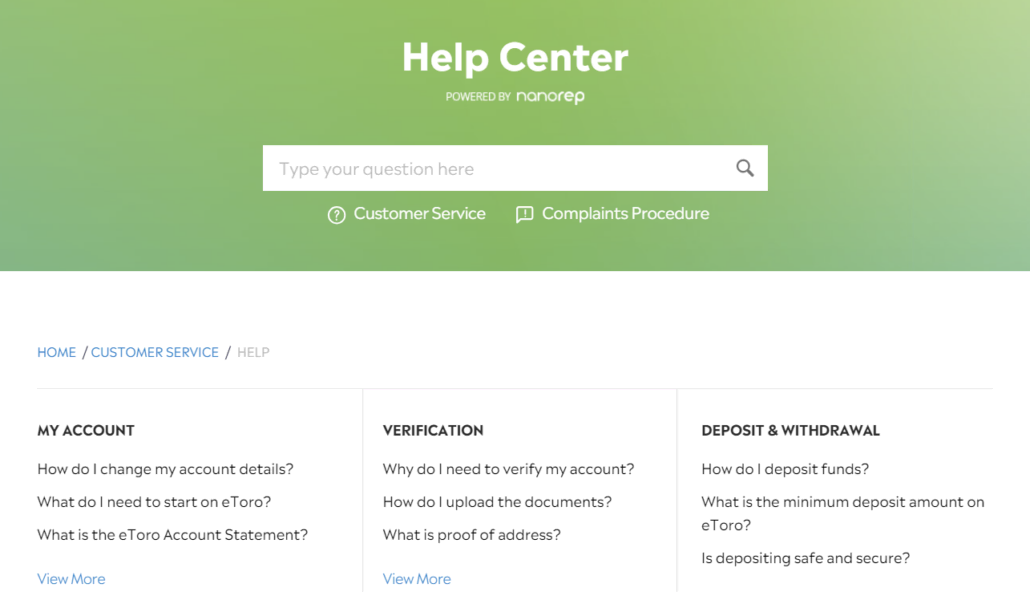

Which type of support and service is provided by Etoro?

Etoro offers support for every interested party and customer. For beginners who do not yet have an eToro account, there is only email and ticket support, which is supplemented with a large FAQ. For merchants with an account, there is an additional email service and chat service. Each merchant is assigned an account manager. He will probably contact you after opening the account.

If you have any questions about the trading platform, you can be helped very quickly. The account managers are trained to teach the trader all the functions of the trading platform. From my experience, this staff is professionally trained and has the necessary expertise to help you trade successfully.

In summary, the support at eToro is well structured and gives you the opportunity to get help as fast as possible. We did not find anything negative about it. It works fast and professionally.

Facts about the support:

- Support 24/5

- Chat, email, and ticket support

- Account manager

- Well-trained support employees

- Support in different languages (English, India, Russian, German, Thai, and more)

How to deposit and withdraw with eToro? – Fees and duration

All customer funds are securely protected at Etoro. A variety of options are available for your transactions (including PayPal). The minimum deposit is $200 (depending on your location), and the minimum payout is $30. Here is an overview of the accepted payment methods:

For each withdrawal, Etoro charges a fee of 5 USD, which gives a small deduction from my overall rating. But the payouts are always processed in the promised time. In the past, there were delays because the CFD Broker was overloaded by the stock exchange hype. Nowadays, you can expect the processing of your withdrawal request within the timeframes below:

Withdrawal Method | Processing time |

eToro Money | Instant withdrawal |

Credit- debit card | Up to 10 business days |

Bank transfer | Up to 10 business days |

PayPal | Up to 2 business days |

Neteller | Up to 2 business days |

Skrill | Up to 2 business days |

Trustly | Up to 2 business days |

iDEAL | Up to 2 business days |

Facts about the deposit and withdrawal:

- Minimum deposit $200 (depending on your location)

- The minimum withdrawal is $ 30

- Withdrawal fee $5

- Regulated deposit and withdrawal

- Payment methods: PayPal, Credit Card, Skrill, Neteller, Bank wire, and more

As experienced traders, we checked this broker completely. You can read more here about our withdrawal proof.

Does Etoro offer negative balance protection?

Is it possible for your Available balance to fall below zero? This could happen if you invest all of your available balance in open positions and overnight fees or trading losses are incurred. Most of the time, the account equity remains positive.

On rare occasions, market conditions may cause your equity to fall. In certain instances, eToro will issue a margin call, which means we will close all of your open trades. They will then absorb the loss and reset your Equity to zero as part of their Negative Balance Protection policy. This means you can never lose more money than you put into your eToro account.

How does Etoro make money from you?

Etoro will make revenue from you strictly from the ask/bit difference on their trading pairs, as well as fees like small withdrawal fees and inactivity fees. Unlike other traders, the broker doesn’t charge markup, ticketing, or account management fees. You will find a transparent and more detailed overview of the fees and commissions on Etoro here.

(Risk warning: eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.)

What are the best alternatives for Etoro?

Etoro is very popular for new traders and comes with many advantages also some disadvantages. Our most important goal is to give you all information you need, so you can make your own informed decision. If you feel like Etoro isn’t the perfect match for you, take a look at our favorite Etoro alternatives below.

Capital.com

Since 2016, Capital.com has operated as a well-known and trustworthy online trading platform. The broker, which has its global headquarters in London and operations in more than 50 nations, has quickly built a reputation for offering its customers an intuitive interface and cutting-edge capabilities. Over 3,000 markets, including those for shares, commodities, and currencies, are accessible through Capital.com. In addition, clients benefit from a high level of security and trust because of the broker’s regulation by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC).

RoboForex

On our list of the top Tickmill substitutes, RoboForex is next in line. You can trade a wide range of assets with this broker, and their key selling point is the cheap minimum deposit requirement of just $10. Your money is also very safe because the broker has an official license from the IFSC Belize. Additionally, a sizable business group with its main European offices owns the broker. Finally, Roboforex allows you a lot of versatility by providing a variety of account kinds to pick from.

XTB

One of the most well-known broker systems in the industry right now is XTB. Since its 2006 founding in Poland, XTB has experienced rapid expansion. You can trade more than 3,000 different assets with this broker, which are divided into six asset categories. But don’t just take our word for it; XTB has received numerous honors from its clients and is renowned for providing exceptional customer support. For instance, every customer has access to a learning center with a ton of resources and specialized 1 to 1 support for every client.

Review conclusion: Is Etoro a scam or not? – We think it is a reliable investment platform

As we showed you in this review, Etoro is one of the largest brands in online trading. The offers of this broker are quite large and innovative. You can start trading in any market with a regulated and safe company. Also, the fees are very low for investments. Compared to other online brokers, Etoro is number one at the moment.

There are a lot of different functions that are not offered by other brokers. For example, the copy trading section is unique. Beginners and advanced traders should be very satisfied with handling the platform. Overall, for us, Etoro is the best investment platform for any trader. If you search for a good provider, you should sign up directly.

The advantages of Etoro:

- A regulated and safe company

- Huge range of markets and assets

- Innovative and user-friendly platform

- Social and copy trading

- Free demo account

- A low minimum deposit of $200 (depending on your location)

- Competitive spreads and commissions

- Professional support

eToro is not without reason a popular investment platform. They offer you all the tools you need to trade successfully.

Trusted Broker Reviews

(Risk warning: eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.)

Risk warning:

CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to

leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete

years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down.

Your capital is at risk.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the

accuracy or completeness of the content of this publication, which has been prepared by our partner

utilizing publicly available non-entity specific information about eToro.

FAQ – The most asked questions about Etoro :

What regulations does Etoro CFD broker put in place?

Etoro is a trusted CFD broker platform that has earned multiple regulations to ensure the maximum safety of online traders and investors. For European countries, it has put two regulations- FCA and CySEC. On the other hand, Etoro follows ASIC regulatory policies for Australia, and it has implemented FinCEN regulations for the USA market.

What assets can a trader trade on the Etoro brokerage platform?

Etoro is a versatile brokerage platform where traders are allowed to trade in over 2000 assets. Initially, it began with stocks and forex currencies. But later, it added several other assets like ETFs, commodities, and metals. Recently, Etoro has included stocks like Tesla or Coinbase.

What is the asset spread range allowed on Etoro?

Spread is the differential between an asset’s ask (buying) and bid (selling) prices at a specific moment. Etoro has a versatile asset spread range, with the minimum valuation being one pip for EUR/USD and USD/JPY and the highest being 600 pips for DowJones.

What makes Etoro best for copy trading?

One of the best forms of trading that one can perform on Etoro is copy trading. This user-friendly brokerage platform allows copy traders to see the open positions of other individuals with 100% transparency. In addition, it also displays the risks in a particular copy trade, ensuring one can invest in the right open trade.

See other articles about online brokers:

Last Updated on January 3, 2024 by Andre Witzel