FBS Broker account types – Which one is the best?

Table of Contents

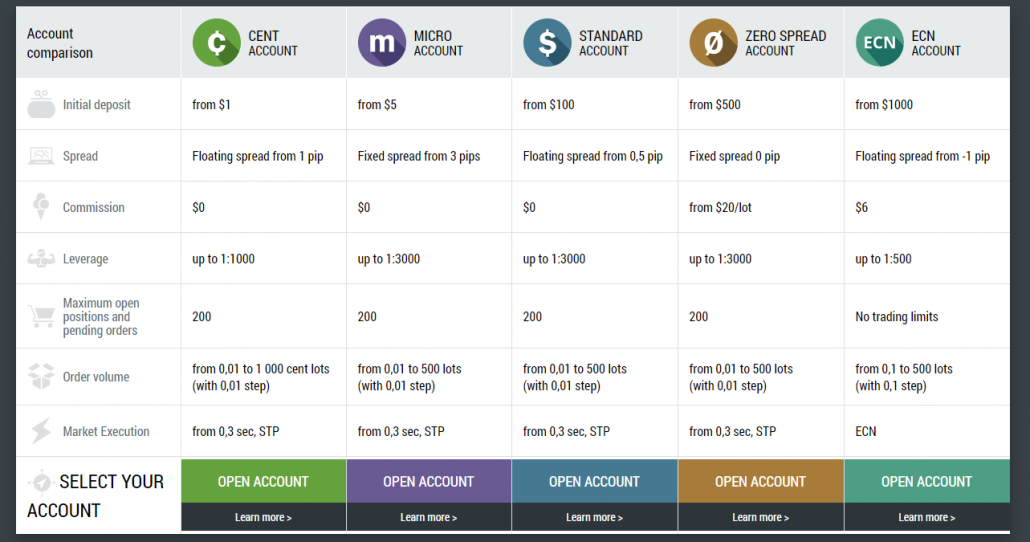

FBS Broker account types are surely commendable. We must note and commend the fact that FBS features an interesting and feature-rich array of accounts that traders can go for. The account you go for will be determined by several factors including the minimum deposit you can put up. Those accounts are outlined below alongside their features.

In this article, we will compare the features of different trading accounts. Which one is the best trading account for you? – Find out in the following sections.

The FBS Broker offers the following account types:

- Cent account

- Micro account

- Standard account

- Zero Spread account

- ECN account

(Risk warning: Your capital can be at risk)

Cent Account

The FBS cent account is available for international users. Similar to the FBS European Cent Account, a very minimal deposit of $1 is required. This account also features a floating spread from 1 pip and it is commission-free.

Trading through this account is done using the STP method, and it is a great way to get started in learning to trade with FBS. The Cent account offers you to trade with smaller positions. If you deposit $ 10 in your Cent account you will get a value of 1,000 in your account. The position sizes are x100 smaller. So you can open positions with very small amounts of capital.

- Minimum deposit is $ 1

- STP execution

- Floating spreads from 1 pip in forex

- No commissions

- Leverage up to 1:1000

- Smaller position sizes x100.

- Best for trading with small amounts of money

Micro Account

An FBS Micro account is available to FBS international traders. This account is something of a meeting between the FBS Cent account and a Standard account. The FBS minimum deposit is $5 here, and a fixed spread starting from 3 pips is implemented. This account also provides for a maximum FBS leverage of 1:3000 and commission-free trading with the STP processing method being used.

- Minimum deposit $ 5

- STP execution

- Fixed spread from 3 pips

- No commissions

- Leverage up to 1:3000

- Best for news trading with high volatility

Standard Account

The FBS Standard Account which is made available to international traders features a $100 minimum deposit. This account has spreads that are floating and which start from 0.5 pips. The STP processing method is also used here, and you can avail of commission-free trading as the standard and an impressive maximum FBS leverage of up to 1:3000.

- Minimum deposit $ 100

- STP execution

- Floating spread from 0.5 pips

- No commission

- Leverage up to 1:3000

- Average trading account

(Risk warning: Your capital can be at risk)

Zero Spread Account

The FBS Zero Account provides for a great fixed spread from 0 pip to the FBS traders who are based outside Europe. This also comes along with extensive leverage of up to 1:3000. The STP processing method is used to make sure of the best possible trade, and a commission of $20 per lot is charged. However, to have access, the FBS minimum deposit for opening a Zero Account is $500.

- Minimum deposit $ 500

- STP execution

- Fixed Spreads from 0.0 pips

- Commission from $20/1 lot trade

- Leverage up to 1:3000

- Best for news trading

ECN Account

An FBS ECN Account is also available. This requires a $1000 minimum deposit and holders can benefit from the leverage of up to 1:500. The FBS ECN Account commission is $6 and the spreads start from -1 pip. This account type offers just forex currency pairs trading. There are other special accounts made available to traders, including:

- Minimum deposit $ 1000

- ECN execution

- Floating spread from -1 pip

- $ 6 commission per 1 lot trade

- Leverage up to 1:500

- Overall the best trading account and the cheapest

Islamic Account

As with the FBS EU-based traders, international traders can also benefit from the availability of an FBS Islamic Account. This is available with every account type offered and the only exceptions in terms of market availability are that exotic forex trading and CFDs are unavailable.

(Risk warning: Your capital can be at risk)

The best FBS trading account

Overall, we can say the ECN account is the best trading account which is offered by FBS. You will pay fewer fees and get a better execution for your traders. The disadvantage is that you will need $ 1,000 for the deposit. So you should think about it how much money you will invest.

For news trading, you should use a fixed spread account or zero spread account because the spreads can be very high with a floating spread account when you trade the news and there is high volatility. So in the end the account type is depending on your trading strategy.

FBS secondary accounts

FBS secondary accounts are limited if you are a European trader based under CySEC. The options here do not really extend beyond the standard and micro-accounts mentioned. As you can see from the categories above though, you have lots of choices if you are using the International side of FBS. You will also be able to open a Copy Trading account if you wish. You can use this account to either copy trades or provide your own signals.

FBS Copytrading is available through standard and micro-accounts of international IFSC-based traders only.

How to Open an FBS Account

The process of opening an account at FBS is simple.

- Visit the website fbs.com.

- Click the “Open an account” button in the top right corner of the website. You’ll need to go through the registration procedure and get a personal area.

You can register via a social network or enter the data required for account registration manually. Firstly, you will need to choose an account type. FBS offers a variety of account types as you can see above.

If you are a newbie, you should choose Cent or Micro account to trade with smaller amounts of money as you get to know the market. If you already have Forex trading experience, you might want to choose a Standard, Zero Spread, or unlimited account.

To find out more about the account types, check the “Trading” section of the FBS website.

- Next, you have to set the currency of your account and fill in your full name, email, and mobile number.

Have a look at FBS Customer Agreement. Make sure that you read through it carefully so that you are not surprised by some things in the future.

When you read all the information, click that you accept the customer agreement and then press the “Open an account” button.

- Your registration is finished. The system has generated for you a temporary password. We strongly recommend you change it and create your own password.

Type in the new password and press “Save password.” You will see your account information. Make sure you carefully save your passwords and keep them in a safe place.

Note that you will need to enter your account number, trading password, and trading server to MetaTrader 4 to start trading.

- Check your email. There will be a registration email. Follow the link in this letter in order to confirm your email address and complete the registration.

To be able to withdraw money from your account, you need to verify your profile, as you will see below. Now that you have a personal area at FBS, you will be able to open more trading accounts anytime you like.

(Risk warning: Your capital can be at risk)

Account Verification

FBS verification is another required step in the process of trading with your FBS live account. This can be completed online as long as you have a few basic documents to hand. These include proof of your identity document and also proof of your residence. Typical documents that work well include a driver’s license, national identity card, voter’s card, international passport, and others.

Account Currency

FBS account currency is available as Euro only for those based in Europe. If you are using the international FBS, however, you will have the option of a USD base currency. Other currencies can be used but they will have to be converted into USD or EUR depending on your location. Any conversion fee which you incur will depend on your payment method.

Minimum Deposit

The FBS minimum deposit varies depending on your location. For those based in Europe, this means it is either €10 or €100. If you are using the international FBS regulation, the minimum deposit can be anywhere between $1 and $1000 depending on account type – as we see above.

Account Funding

As mentioned, your FBS account funding from Europe can be completed in Euro currency only. If you are holding an international account, you can fund with any but this will be converted to USD or EUR and you may be charged a fee depending on your payment method.

Deposit Method

For FBS deposits from Europe, these are typically fee-free. They are also usually instant when we consider the time it takes to deposit. The exception is bank transfers which may charge a small fee and take 3-4 days for processing. International account deposits are also usually fee-free. Some wallets and processors do charge a fee, although every FBS deposit method offered here can be instant in nature.

Withdrawal Method

FBS withdrawal methods within Europe are typically fee-free. These are usually also processed on the same business day. Bank transfers may apply some fees and usually take 48 hours to process. If you are holding an international FBS account, the withdrawals are also usually charged no fee and are processed within 15-20 minutes. Some fees may be charged depending on the method.

Bonuses and Promotional Offers

FBS offers a wide range of bonuses, special events, and contests that rival many top forex brokers. Unfortunately, due to regulation and ESMA in particular, European users cannot avail themselves of any FBS bonus offers. As an international account holder, however, there are many available. Anyone looking for the FBS 123 bonus and FBS 50 bonus will find these have expired but there are still many great offers to select from.

These include a 100% deposit bonus. A no deposit bonus of $100 may also be available though. This can only be withdrawn once you have met certain trading requirements. The partner IB account program also allows for money to be earned through referring new users and there is a generous FBS loyalty program.

When it comes to other offers and contests, FBS Pro allows for a demo account contest where you receive a $10,000 demo account and 1:100 leverage. After 2 weeks of trading with this account, the top earners receive a prize of up to $450. There are also cashback offers of up to $15 per lot traded, and regular chances to win cars and holiday trips.

Conclusion on the FBS account types

FBS offers a wide range of accounts to customers and FBS account types are a topic that should be addressed. This piece properly examines that. Overall, the ECN account is the best trading account for FBS. Fixed or Zero spread accounts should be used for news trading.

(Risk warning: Your capital can be at risk)

FAQ – The most asked questions about FBS Broker account types :

What are the different FBS account types allowed?

FBS is undoubtedly one of the most popular brokerage platforms that allow traders and investors to maximize their gains, make their portfolios versatile, and even deal with trading instruments. There are five account types one can access on FBS. These are the cent, micro, standard, zero spread, and ECN accounts.

Is there any commission on the FBS account?

The cent, micro, and standard FBS trade accounts don’t have commissions. But if we talk about the ECN account, traders and investors need to pay a commission of $6. As for the zero spread account, the commission charged will be $20 per lot.

Is there any trading limit on the FBS accounts?

Yes, for cent, micro, standard, and zero spread accounts, the maximum number of open trade positions and pending orders will be 200. To save yourself from this limitation, you need an ECN account with no trading limit.

What are the documents needed to verify the FBS account?

To verify the FBS account, there are certain documents that you need to submit. Before taking further steps, you must submit proof of identity and residence documents.

See other articles about online brokers:

Last Updated on January 27, 2023 by Arkady Müller