The best 5 forex trading accounts in comparison

Table of Contents

People have been talking about forex trading for years now. For some, trading forex is a full-time job, and they have earned so much by investing in this particular asset class. For others, they trade this product from time to time just to earn a few extra bucks using their existing capital.

It is no surprise that there are so many brokers that offer forex available on the market. If you’re thinking of trading this asset, then you’ve come to the right place. Below is a list of the 5 best forex trading accounts.

See the comparison list of the 5 best forex trading accounts below:

Forex Broker: | Review | Regulation: | Spreads | ASsets: | Advantages: | Free account: |

|---|---|---|---|---|---|---|

1. RoboForex  | IFSC | Starting 0.0 pips + $ 4.0 commission per 1 lot traded | 9,000+ (40+ currency pairs) | + Huge variety + Micro accounts + Bonus program + Leverage 1:2000 + ECN accounts | Live-account from $ 10(Risk Warning: Your capital can be at risk) | |

2. Vantage Markets  | ASIC, CIMA | Starting 0.0 pips + $ 2.0 commission per 1 lot | 120+ (40+ currency pairs) | + Leverage 1:500 + ECN Broker + Personal service + MT4/MT5 + Crypto payments | Live-account from $ 200(Risk warning: Your capital can be at risk) | |

3. Capital.com  | CySEC, FCA, ASIC, FSA | Starting 0.0 pips + no commission per 1 lot traded | 6,000+ (70+ currency pairs) | + Best platform + TradingView charts + MT4 + Leverage up to 1:500 + Best education + Personal support | Live-account from $ 20 (Risk warning: 78.1% of retail CFD accounts lose money) | |

4. Tickmill  | FCA, CySEC, FSA | Starting 0.0 pips + $ 2.0 commission per 1 lot | 100+ (60+ currency pairs) | + VIP conditions + Fast execution + Personal service + Highly regulated | Live-account from $ 100(Risk warning: 70% of retail CFD accounts lose) | |

5. XTB  | More than 10 | Starting 0.0 pips + 3.5$ commission per 1 lot | 3,000+ (50+ currency pairs) | + Huge variety + Good platform + Best service + Personal service | Live-account from $ 0(Risk warning: 72% of retail CFD accounts lose money) |

List of the 5 best forex trading accounts

The list of the 5 best forex trading accounts includes:

- RoboForex – Great for forex trading

- Vantage Markets – Solid allrounder

- Capital.com – Numerous assets to choose from

- Tickmilll – Highly regulated

- XTB – Popular choice for traders

1. RoboForex – Great for forex trading

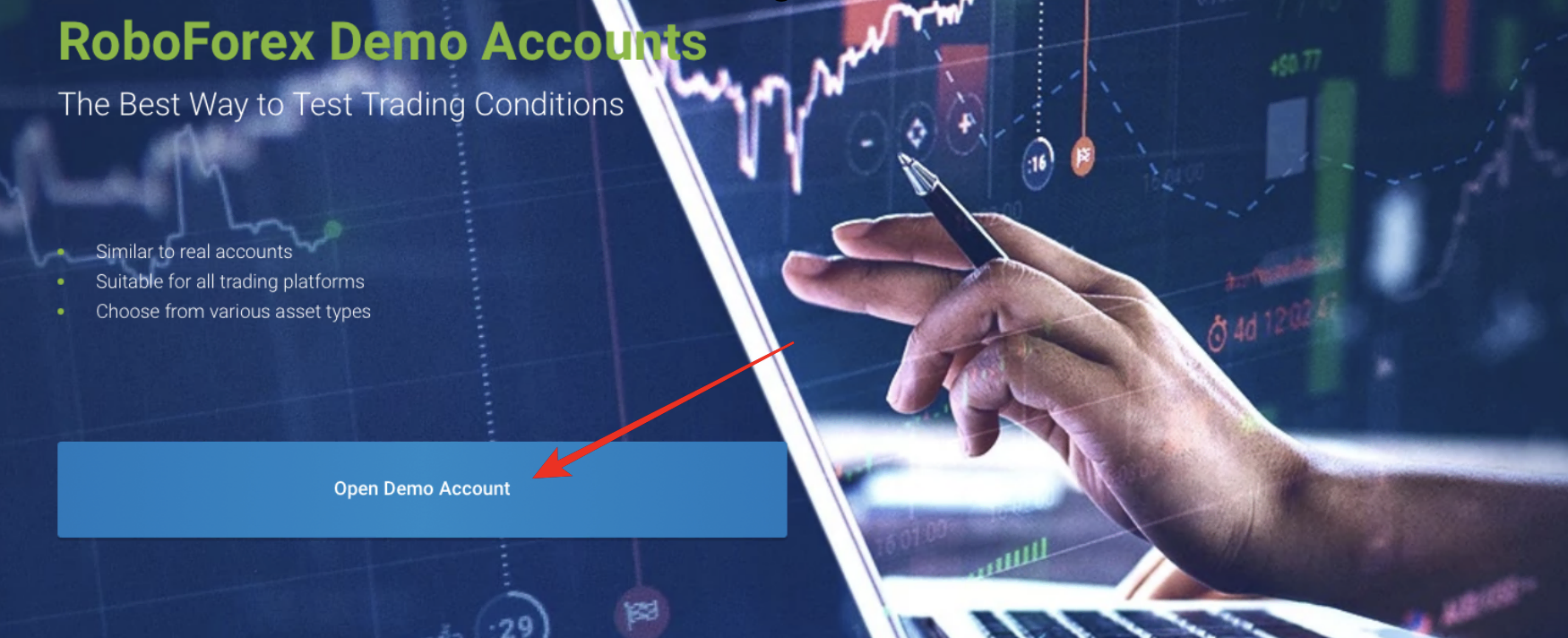

RoboForex, as the name suggests, specializes in forex or currency trading. Created in 2009, this broker’s main office is located in Belize and is regulated by the IFSC or the International Financial Services Commission with a license number 000138/210. To date, it has gained over 3 million clients with its award-winning app and trading platform.

In total, there are 36 currency pairs available on this broker’s platform. RoboForex’s top forex instruments are EUR/GBP, EUR/USD, GBP/USD, and USD/JPY. There are five platforms that clients can use when trading with this broker. These are MT4, MT5, cTrader, R Trader, and RoboForex’s own trading terminal.

All of these can be launched using any web browser. They can also be downloaded for Windows desktops and Android and Apple devices. These platforms are free to download and have their own unique sets of features and tools.

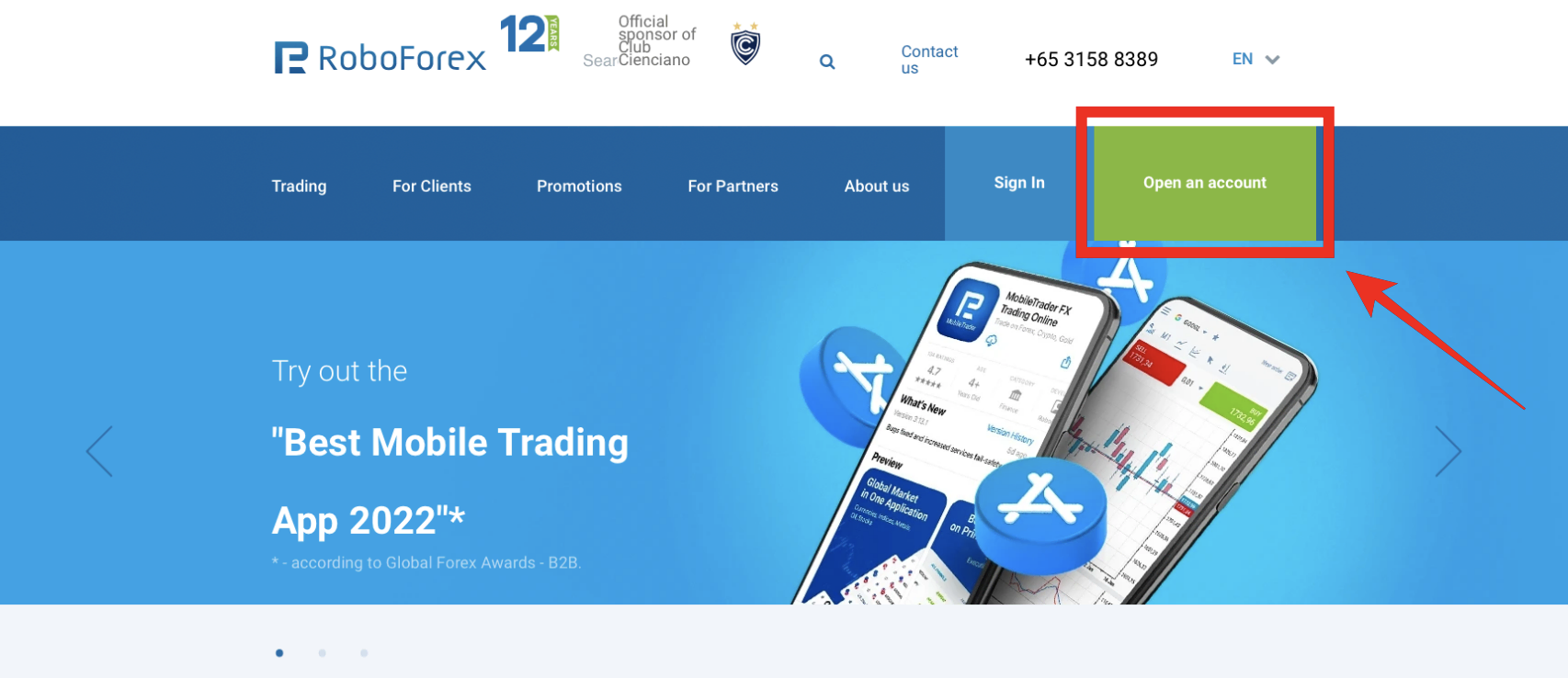

When creating an account with RoboForex, you will also be opening a demo account that can be used on any of the available platforms. You can practice on any of the platforms for free using virtual funds provided by the broker. Keep in mind, however, that this is only available for 90 days. Additionally, they offer tutorials for opening an account, how to trade videos, and access to forex charts to help you with your next trades.

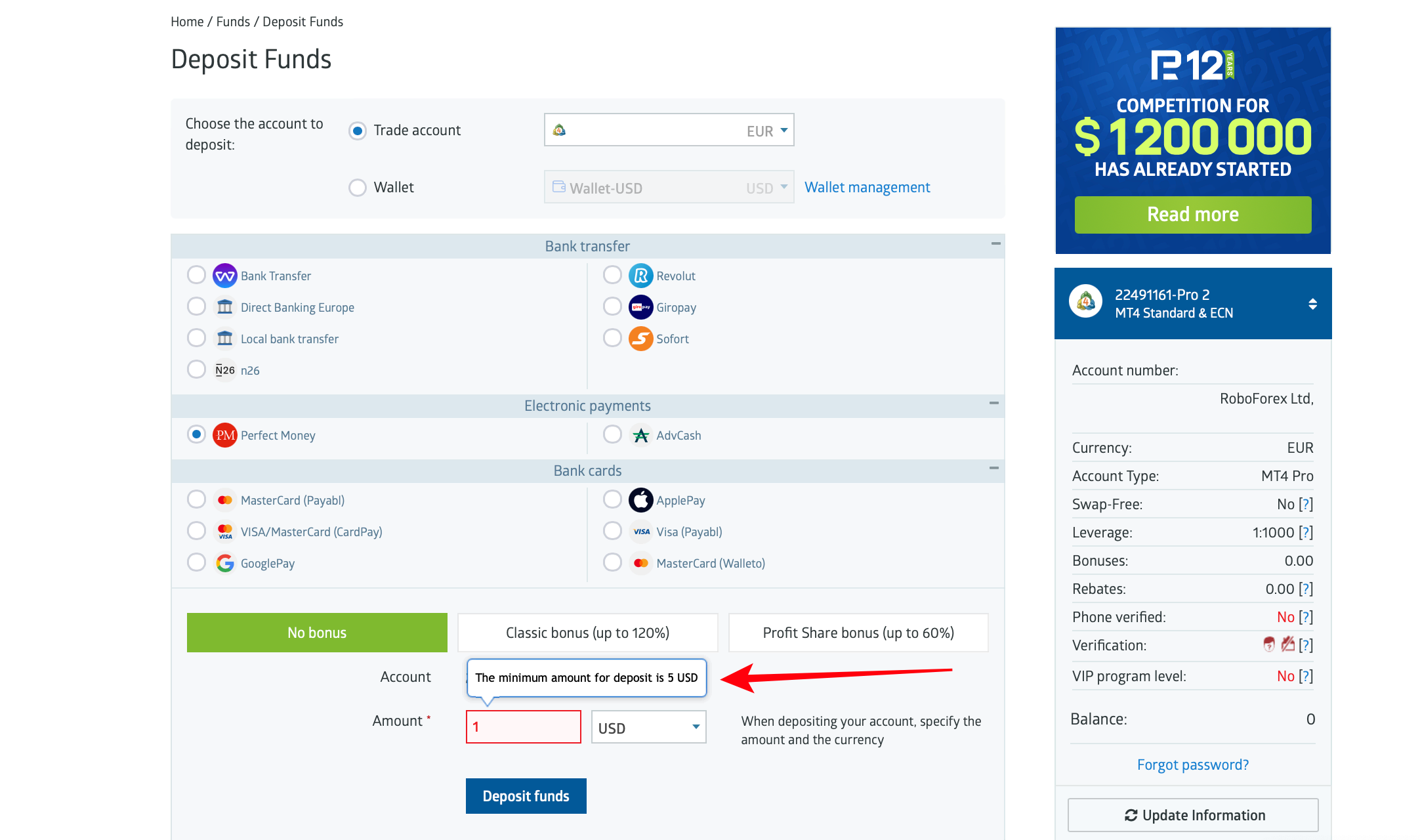

RoboForex’s minimum deposit is only $10, which makes it a broker that is ideal for beginners or traders who are not planning to invest too much right off the bat. Multiple payment methods are available, so you can easily add funds to your account. Some of these payment methods are Webmoney, QIWI, MoneyGram, Neteller, FasaPay, Cashu, and wire transfer. Upon registering, you will also be entitled to a welcome bonus of $30.

RoboForex’s customer support representatives are available 24/7 and support languages including Malaysian, Arabic, Spanish, Indonesian, and many more. You can send them an email or chat with them via Facebook Messenger, Skype, Viber, Whatsapp, and Telegram.

Although RoboForex is available in India, France, Italy, Denmark, Saudi Arabia, United Arab Emirates, the United Kingdom, and most other countries, traders from the United States, Japan, Canada, the Russian Federation, and Australia can not partner with this broker.

Benefits of RoboForex:

- Regulated by IFSC

- Demo account is free for 90 days

- $10 minimum deposit with a $30 sign up bonus

- 36 forex pairs

- Has multiple trading platforms to choose from

- Spreads as low as 0 pips depending on the forex pair being traded

- No commission for forex trades

- 24/7 multilingual email and chat support

- Multiple analytics, educational materials, and trading tools

(Risk warning: Your capital can be at risk)

2. Vantage Markets – Solid allrounder

Vantage Markets has been offering reliable and affordable trading since it was founded in 2009. This broker is a part of Vantage Global Prime Pty Ltd and was known as MTX Global before it was rebranded to Vantage Markets in 2015.

This specific broker is registered in Australia and the United Kindom by the ASIC or Australian Securities and Investments Commission and FCA or Financial Conduct Authority. It is also allowed to operate in the Cayman Islands and is regulated by CIMA or Cayman Islands Monetary Authority.

With Vantage Markets, you can trade any of the 40+ forex pairs available on this broker’s platform. While they have a proprietary trading platform, the MT4 and MT5 platforms can also be used when trading assets offered by Vantage Markets.

These platforms can be accessed through your web browser on any device. They also come in the form of mobile apps that you can download so you can trade wherever you are. These apps and platforms are free to use and are easy to navigate.

You can also test any of the platforms using the free demo account feature. Signing up for a live account automatically opens a demo account for you. You can create an account within 30 seconds by filling out the registration form or linking your Facebook or Google Plus account.

A minimum deposit of $200 is required before you can access Vantage Market’s live trading feature. You can deposit funds to your account using Visa, MasterCard, wire transfer, Skrill, Neteller, JCB, China Union Pay, AstroPay, and FasaPay. For clients from Australia, you can use POLi , BPAY, and Domestic Fast Transfer.

Vantage Markets gives clients a 50% credit bonus on their first deposit. You can get up to $500 of credit. Furthermore, you can get a 10% credit bonus for all your future deposits.

To contact Vantage Markets’s customer support representatives, you can simply send them an email or start a live chat session. You may also give them a call for more urgent concerns or queries. They are available 24/7 and support multiple languages.

The website supports 16 languages, including French, Italian, Spanish, Korean, Chinese, Japanese, German, and many more. Unfortunately, Vantage Markets is not available for traders from Canada and the United States.

Benefits of Vantage Markets:

- Regulated by ASIC, FCA, and CIMA

- Free demo account

- A Vantage Markets minimum deposit of $200 is required

- 40+ forex pairs

- Multiple trading platforms to choose from

- Spreads and fees on Vantage Markets start at 0.1 pips

- 24/7 multilingual email, phone, and live chat support

- Offers deposit bonuses and multiple free forex trading tools

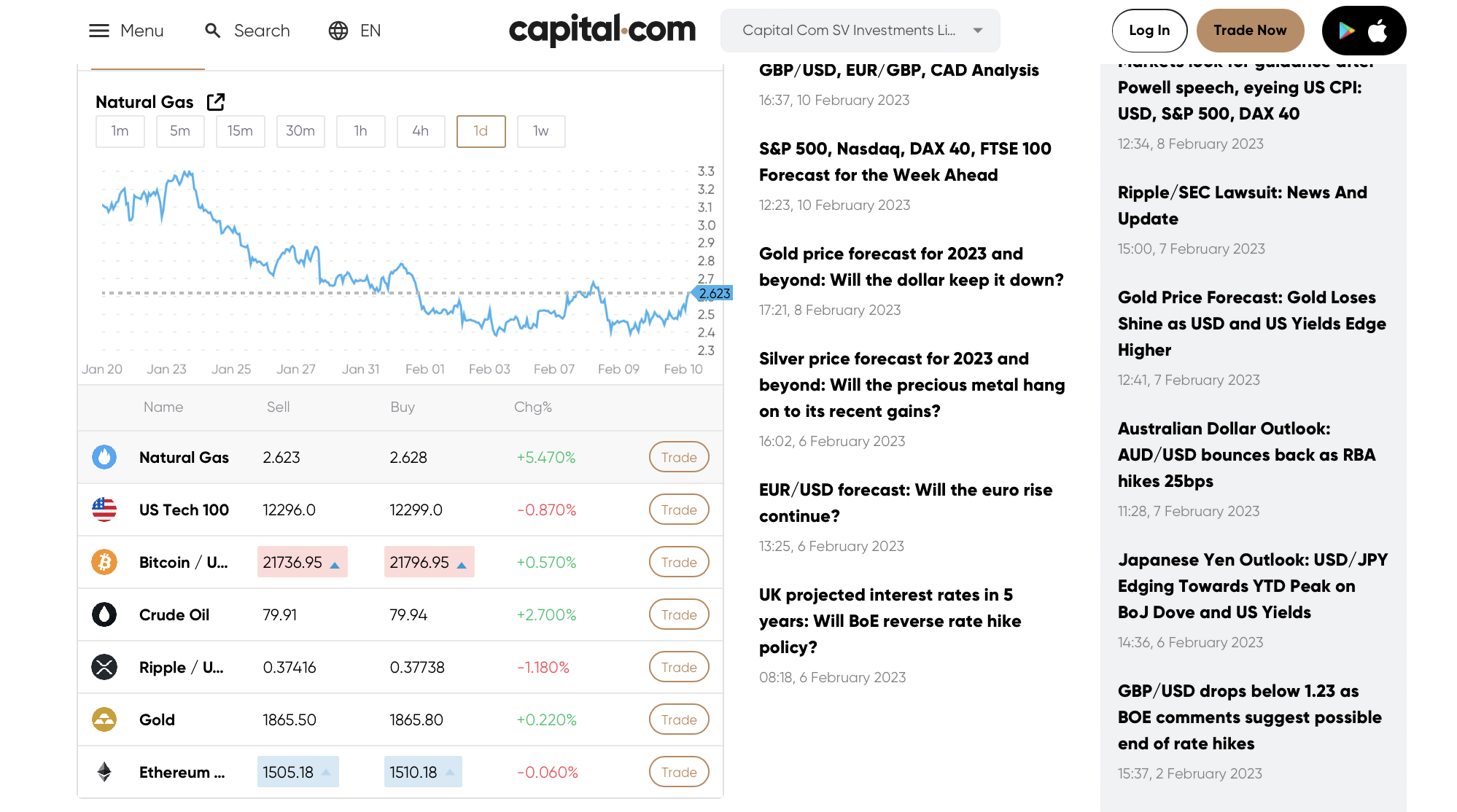

3. Capital.com – Numerous assets to choose from

Capital.com is a prominent Forex and CFD trading website. It offers you many assets to trade, such as cryptocurrencies, foreign exchange, stocks, and stock CFDs.

Since 2016, CySEC, FCA, ASIC, and FSA have regulated the platform. The platform has over 285,000 active user because of its user-friendly interface and great trading tools, making it a popular choice for traders around the world. It offers you 24 languages and over 6,000 financial instruments to trade with.

Capital.com’s education-focused app, Investmate, gives you the chance to learn with video lecture series. The four-level program helps traders improve their technical analysis abilities with quizzes.

Furthermore, the account creation setup only takes 30-seconds and requires only putting in your email address and personal information. The firm offers a $10,000 demo account for practice that may be renewed. Overall, it is one of the best choices when it comes to forex trading.

Platform benefits:

- CFD trading on 6,000+ marketplaces

- Free demo account on Capital.com

- Low minimum deposit of 20 EUR, 20 USD, 20 GBP, or 100 PLN

- Lots of educational content

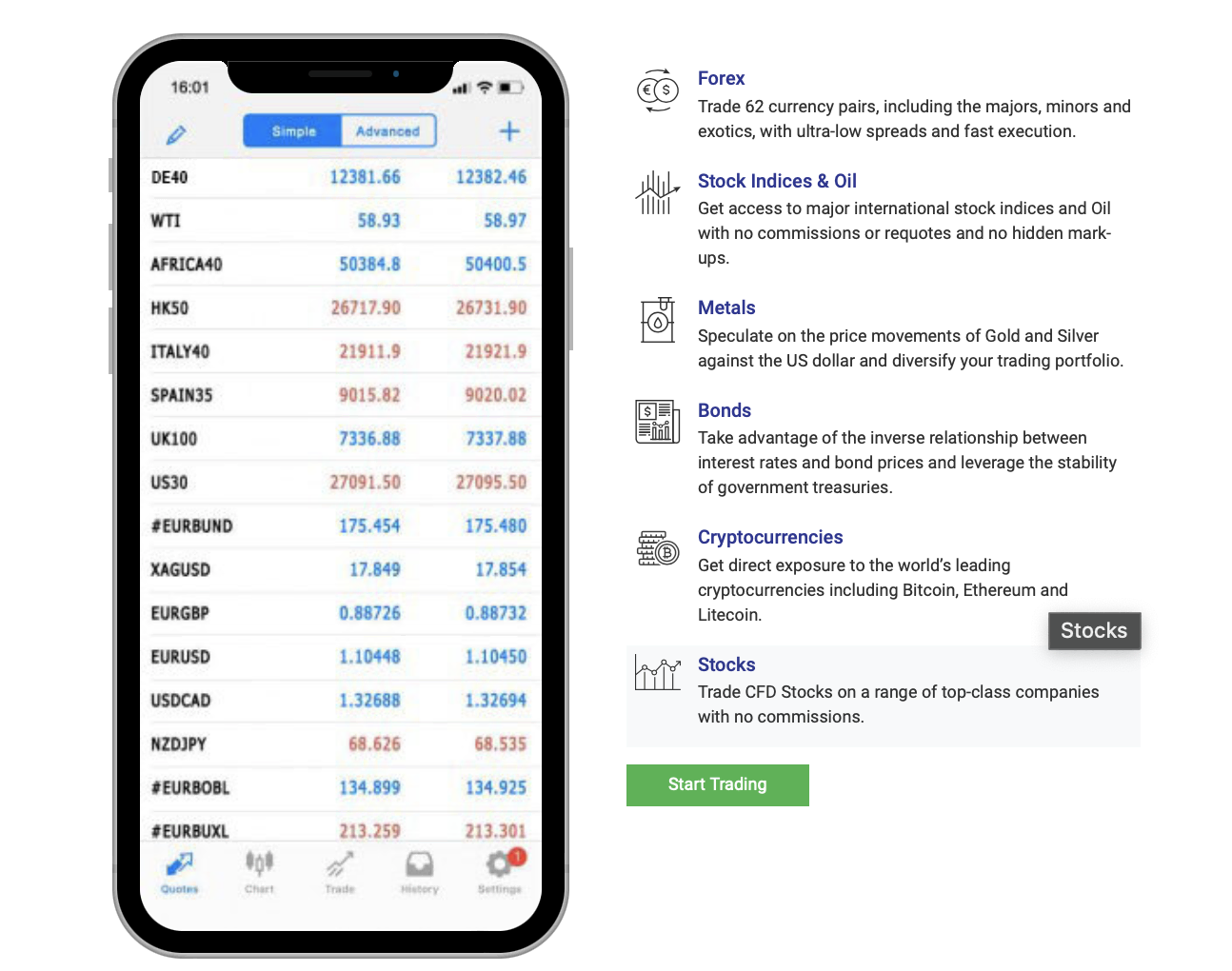

4. Tickmill – Highly regulated

Tickmill operates as the trading arm of Tickmill Ltd, which is a part of Tickmill Group. Tickmill Group has been around since the 1980s and now has multiple trading companies. It caters to clients from more than 200 countries and has an average monthly trading volume of over 120 billion. To date, there are more than 350,000 registered accounts.

It has a global reach and has various offices from around the globe, and is registered by the FCA, FSA, LFSA, and CySEC. For added safety, Tickmill implements a negative balance protection feature. This means there is no way that your account will incur a balance of less than zero.

Clients can trade any of the 62 forex pairs offered by Tickmill. Examples of the tradeable forex pairs are ZAR/USD, GBP/USD, and EUR/GBP. This broker offers the most currency pairs on this list, which makes it ideal if you want to diversify your forex trading portfolio.

All these can be traded with a minimum spread of zero, but the typical spreads vary depending on the asset you are trading. The amount may also depend on your account type.

Compared to the other brokers on this list, Tickmill leans towards the traditional side when it comes to its trading platform. It utilizes the well-known MetaTrader 4 platform that requires no download to use. It can be accessed from any browser on both desktop and mobile devices.

With Tickmill’s demo account, you can familiarize yourself or explore the trading platform for free. You can also use it as training grounds to practice trading risk-free before you start trading live. To start trading live, a minimum deposit of $100 is required by this broker.

The accepted payment methods are wire transfer, Webmoney, Visa, Swift, Sticpay, Skrill, Rapid Transfer, QIWI, Perfect Money, Paysafecard, Neteller, and FasaPay. Clients are also given a 30% deposit bonus on their first deposit.

If you’re having trouble navigating the platform, making a deposit, or claiming your deposit bonus, Tickmill’s customer service representatives are readily available from Monday to Friday, starting at 7:00 to 16:00 GMT. You can easily contact them through email or live chat found on the website. You can even give them if you prefer to speak with someone.

Tickmill’s website supports English, German, Indonesian, Chinese, Russian, Spanish, Arabic, Polish, Italian, Korean, Thai, Malay, Vietnamese, and Portuguese. This broker accepts clients from countries like Australia, Thailand, United Arab Emirates, and many more. But keep in mind that traders from the United States, Kenya, Nigeria, Pakistan, Bangladesh, Japan, and Canada can not trade forex using this broker.

Get 5% spread rebate with the code: IB60353132

(Risk warning: Your capital can be at risk)

Get 5% spread rebate with the code: IBU13836682

(Risk warning: Your capital can be at risk)

5. XTB – Popular choice for traders

XTB is well known because it is one of the largest forex brokers. This broker has been serving over 300,000 clients since its inception in 2004. With more than 15 years of experience on the market and main offices in over 13 countries, XTB surely deserves a spot on this list.

Four of the world’s largest and well-known supervision authorities regulate this broker. These are Komisja Nadzoru Finansowego (KNF), Financial Conduct Authority (FCA), International Financial Services Commission (IFSC), and Cyprus Securities and Exchange Commission (CySEC). As an added layer of security, XTB grants its clients free insurance from Lloyd’s of London.

There are 48 tradeable currency pairs on XTB’s proprietary platform, xStation 5. Included in the list of forex pairs are USD/TRY, NZD/USD, AUD/USD, EUR/GBP, and EUR/JPY. The available assets can be traded as micro-lots. This means the minimum amount per trade is smaller than the average broker’s cost per lot.

As previously mentioned, XTB utilizes its own trading platform, xStation 5. XTB’s innovative platform can be accessed via Chrome, Safari, Opera, or Firefox. However, you may also download the xStation 5 from XTB’s website. If you prefer trading on mobile devices, this platform is available for download on the Apple App Store and Google Play Store. The platform is also very user-friendly and even has a trader calculator to further assist you.

Creating an XTB account only takes a couple of minutes. XTB will ask for your annual net income, your main source of income, and how much you plan to invest. Your address will also be required, and a couple of other basic information.

Creating an account automatically entitles you to a free demo account as well. The XTB demo account comes with virtual funds and can be used for 30 days. You won’t need to deposit actual cash to practice trading with the demo account. You may also access XTB’s “Learn to trade” tab to review articles and educate yourself using the trading academy.

The great thing about this platform is that there is no minimum deposit required. This makes this broker ideal for forex traders who are just starting out and aren’t confident enough to trade with real money. You can use PayPal or QIWI to add funds to your account, and these methods also double as withdrawal methods.

XTB’s dedicated support system is available 5 days a week, 24 hours a day. You can contact them via email or live chat. This broker also has a multilingual phone support system. The numbers can be found on the website.

Customer support is available in Arabic, Thai, Vietnamese, Turkish, Slovak, Russian, Spanish, Romanian, Polish, Portuguese, Italian, Hungarian, German, French, Czech, and English. Traders from the United States, Romania, Iran, Iraq, Kenya, Cuba, Syria, Uganda, Ethiopia, Bosnia and Herzegovina, Pakistan, India, Israel, Turkey, Mauritius, Slovakia, Japan, Australia, and Canada can not use XTB’s platform.

Benefits of XTB:

- Regulated by FCA, CySEC, IFSC, and KNF.

- Demo account is free for 30 days

- No minimum deposit required

- 57 forex pairs

- Has its own trading platform known as xStation 5

- Competitive spreads that start from 0.01 pips

- No commission for forex trades

- 24/5 multilingual chat and phone support

- Has a trading academy, articles, price tables, market analysis, and market calendar

What is a forex trading account?

A forex trading account, as the name suggests, allows clients to trade forex. Being involved in forex trading has a lot of differences as compared to simply investing in stocks, bonds, or indices.

With this kind of account, you gain the ability to access the world of currency trading that is considered to be the biggest market in the world. Liquidity providers and market makers for forex ensure that spreads and slippage are minimal to benefit clients around the globe. Although users do not receive dividends or other forms of passive income such as interest, they do gain the benefit of being able to profit as long as there is volatility in the market.

Forex traders pride themselves on being able to trade bull markets and bear markets of their currency of choice. They are able to objectively analyze market-moving news and take advantage of impulsive market movements before common investors and traders realize what’s going on.

With these, forex traders require high-speed software and an interface that can handle the fast-paced world of forex. Lucky for them, forex brokers nowadays have streamlined the process of processing forex orders so that clients can get the best price for their chosen currency with minimal slippage.

Applications for computers and mobile devices have become so advanced that forex traders do not need the help of traditional brokers when executing any of their trades. In addition to this, additional features such as charting, performance analysis, and portfolio tracking have been made accessible even for non-professional users.

Since currency pairs only move in small percentages when compared to stocks or binary options, brokers encourage the use of both margin and leverage with proper risk management to realize adequate gains. These brokers would surely provide easy access to these tools for the benefit of the client.

Additionally, to set up a competitive edge against other brokers in the market, most forex brokers now offer other asset classes to trade as well. This gives users additional exposure and opportunity when forex pairs don’t have much volatility.

How to sign up for a forex trading account

Opening a forex trading account is a fairly straightforward and easy process. It varies depending on the broker, but forms usually only ask for basic information. Some brokers give you the option to link your social media accounts for a more speedy process.

(Risk warning: Your capital can be at risk)

Demo online forex trading account

Demo accounts are extremely important to some, if not all, traders. It is used to test the broker’s platform to see if it has everything you need. It also helps beginners and professionals train and come up with new trading strategies. This type of account is free and comes with virtual funds that you can use to trade the offered assets.

Deposit and withdrawal

Payment and withdrawal methods also vary depending on the broker. When depositing funds, the amount will instantly reflect on your account so you can start trading as soon as possible. Withdrawals may take longer, depending on your method of choice.

Fees for a forex trading account

Fees for forex trading accounts are known as spreads. These are usually very minimal, but it’s best to inquire or take a look at the trading conditions before you start investing. Creating a trading account, however, is 100% free.

Conclusion – There are many great forex trading accounts out there

When choosing which broker to partner with, consider one of the brokers listed above. They are all reputable and offer everything you need to start your forex trading career. But make sure to visit their websites for more details.

Last Updated on February 17, 2023 by Arkady Müller

(5 / 5)

(5 / 5) (4.9 / 5)

(4.9 / 5)