IC Markets minimum deposit and payment methods

Table of Contents

The minimum deposit amount with trading broker IC Markets is $ 200. New traders in the IC market will be able to use the AUD, USD, EUR, GBP, SGD, NZD, JPY, HKD, CHF, CAD as the base currency. When using a standard or raw spread account, you can apply several messages in the IC Market to make a minimum deposit.

The low minimum deposit attracts customers and increases interest in trading. IC Markets is a popular forex and CFD broker. So any new customer creates an account for trust and assurance. IC Market expresses a minimum deposit only as a condition, the minimum deposit facility is provided to increase the interest of the customers in the trader and to create opportunities. For deposits, you can make transactions through any credit/debit card, Neteller, Skrill, Clarna, or a cable transfer to fund your account. IC Markets is a market that is very popular as a forest blogger as it offers the best offers to customers or traders.

Facts about the IC Markets minimum deposit:

- The minimum deposit is only $ 200

- You can use more than 5 different base currencies for your trading account

- Multiple payment methods are available

- No fees and costs for deposits

- Start trading with small amounts of money and micro-lots

(Risk warning: Your capital can be at risk)

What is the IC Markets minimum deposit?

IC Markets minimum deposit is a condition that allows the user to deposit money into his account and start trading with a real money account. In new cases, users verify the broker’s assurance with a minimum deposit. With IC Markets, the minimum deposit is a condition only, in which case no injustice is imposed on the customers. The broker allows you to start trading and get access to more than 200 markets with a small minimum deposit of $ 200. The minimum deposit helps activate the account in the first instance, but the minimum deposit is not acceptable on older accounts.

The popularity of IC Markets is much higher than you think. A lot of investors start with this broker because they can trade micro-lots and small positions in forex. The conditions are the same for every user. Because the financial instruments can be even more profitable with much less deposit. You will not get more benefits by depositing $ 500 instead of the minimum deposit of $ 200 in your account. IC Markets is the best place for you if you are serious about broker trading.

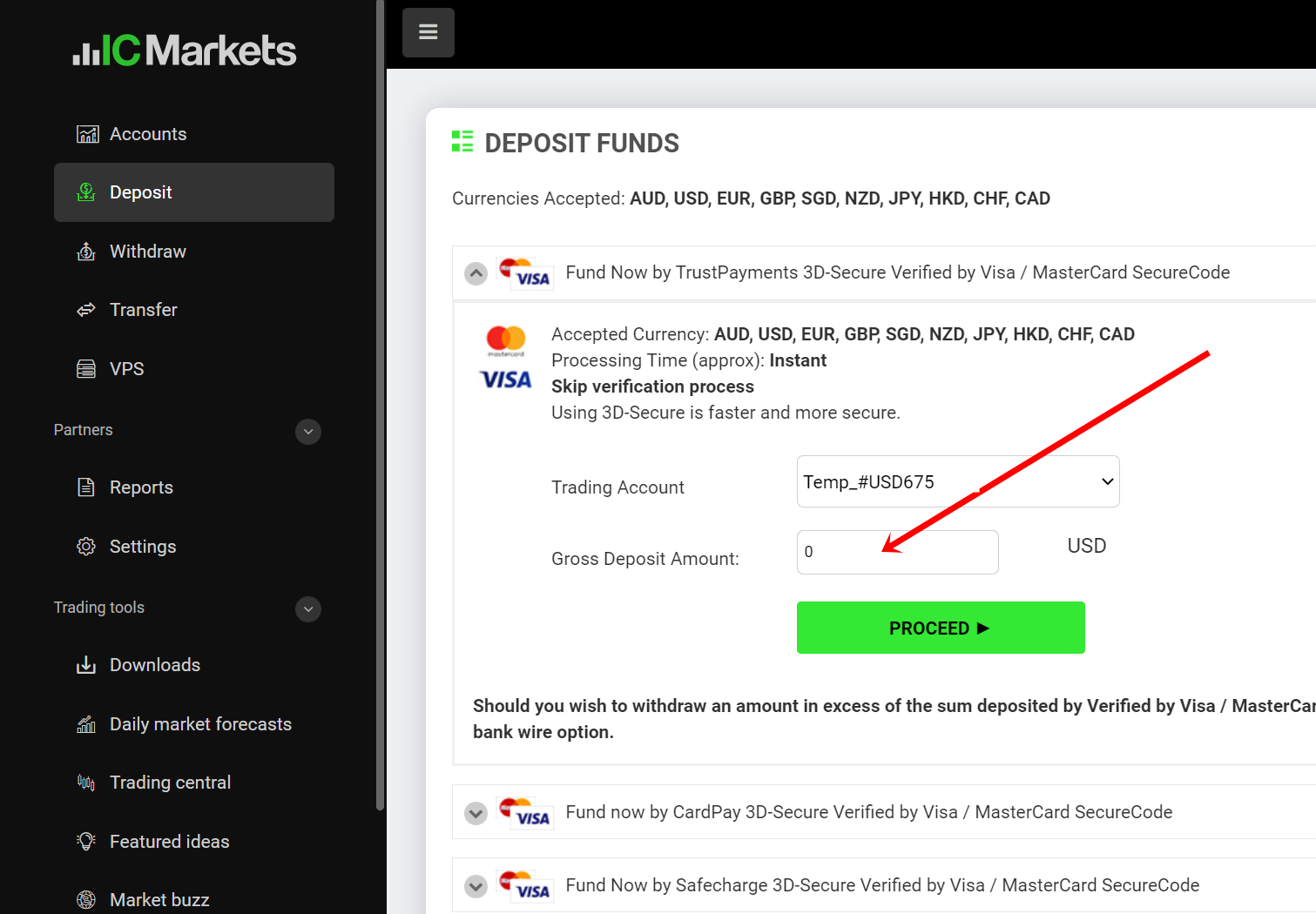

What are the IC Markets deposit methods? (How to Deposit)

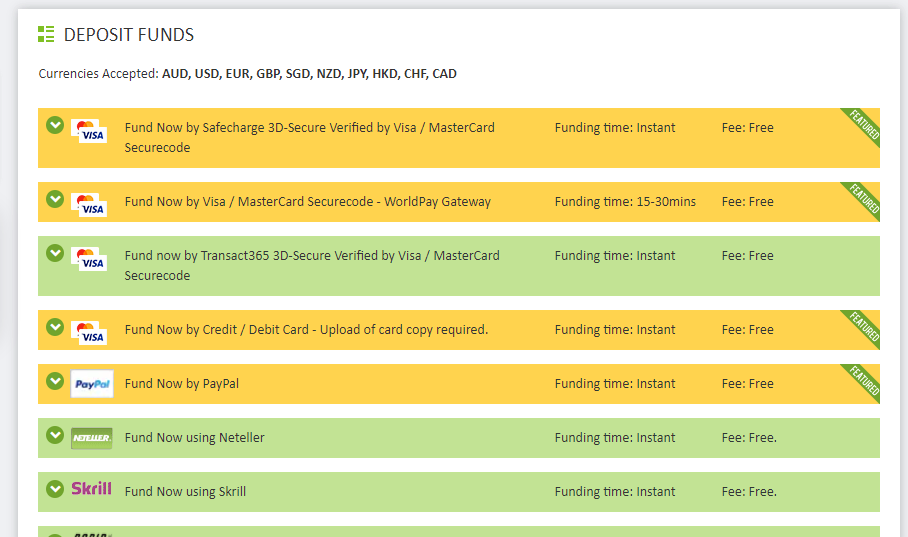

You can use many methods to deposit on IC Markets. Each method of trading depends on the customer’s choice. Deposits can be made instantly through Paypal/Neteller/Skrill. You can also make deposits using bank transfer and debit card/credit card. In this trade, you can transfer Domestic Wire in just 1 working day. It can also take up to 3 to 5 days if you transfer via debit card or credit card deposit.

IC Markets accepts payments from all countries and will be able to collect deposits by choosing any method following the prevailing laws of their country. Since the broker has implemented many methods to transfer deposits, customers are more attracted to this trading.

The transaction methods that most traders use in this trading are:

- PayPal

- Neteller

- Skrill

- Debit card and credit card

- Domestic Wire transfer

- Klarna

- Rapid Transfer

- Thai Internet Banking

- Vietnamese Internet Banking

With so many options available, brokers from any country can be involved in this trading. IC Markets is a trusted and popular online broker in the world. So you can make your deposit using any one method.

(Risk warning: Your capital can be at risk)

Are there IC Markets deposit fees?

The forex broker IC Markets does not require a deposit fee. IC Markets determines the fee by comparing the average spread published by the raw spread account section of the broker. This trade even offers withdrawal fees and lower commission fees. So there is no need to submit the minimum fee.

Traders set fees according to their choice of the three top forex trading platforms. Since Forex trading has many types of accounts, the accounts are charged a commission fee based on the amount of the trading transaction. So not all trading traders’ fees will be the same. IC Markets MT4, MT5, and cTrader set separate fees. Due to the low fees, the IC Markets offers currency pairs, crypto, and CFD trading opportunities.

Are there IC Markets account Types?

IC Markets encourages three leading forex trading platforms for traders. You can get MT4, MT5, and cTrader, you can create an account according to your choice. The broker gives you the opportunity of CFD (indices, commodities, metals, stocks), currency pairs, and cryptocurrencies. So there is no problem with new traders choosing the type of account.

Learn about the accounts below:

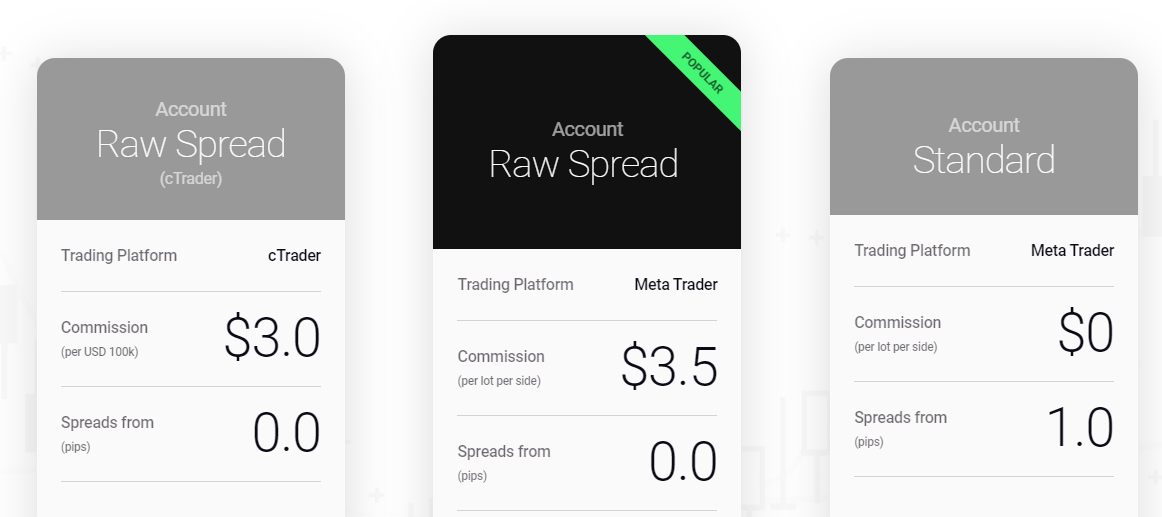

In IC Market you can open three types of accounts as a CFD trader. Such as Standard Account, Spread Account, and Ctrader Raw Account.

(Risk warning: Your capital can be at risk)

Standard account

There are no commissions on these trades in the IC market, but you will pay a spread fee here. This account uses the MetaTrader 4/5 forex trading platform. This account is specially designed for beginner forex traders. The spreads are starting from 1.0 pips and there are no commission fees. It is an STP account.

Raw Spread Account

In this account, you will have the opportunity to spread a minimum ECN Broker commission of + $ 3.50 per 1 lot traded. Also used here is MetaTrader 4/5 forex trading platform. This account allows you to create scalping strategies because of the nonexisting spread. This account of IC Market will be ideal for you because the fees are lower than with the “Standard account” in comparison.

cTrader Raw Account

In this account you will pay the lowest commission with IC Markets spreads to + $ 3.00 per 1 lot traded which is great for you. This account is primarily used in the cTrader platform. IC Market C # programming languages are included in this account. It is depending on the choice of which platform you will use. The cTrader has another interface than the MetaTrader. You should try both platforms in the demo account and find out which is the best for you.

IC Markets offers different accounts on different platforms for the level of trading experience in the market. This broker allows forex traders to perform automated trading strategies. The trading takes a lower fee for the raw account which the customers prefer. The above accounts are considered IC Markets Standard Accounts. Forex trading accounts will set a much easier price for you. The commission structures in the IC Market are not complicated. So you do not need to calculate the brokerage fee.

What does the broker offer to its clients?

IC Markets is a multi-regulated brand that offers trading with derivates and leverage up to 1:500. The broker is very popular because of the low spreads and commissions. Clients get offered high liquidity in the forex market. Also, the execution of traders is very fast and without slippage. For trading, the newest platforms MetaTrader 4/5 and cTrader are offered.

There are no additional fees for customers. Deposits and withdrawals are free. Customers can use multiple payment methods. From our experiences, IC Markets is a very safe broker to trade with. See the conditions below:

- Regulated in Australia and Seychelles

- Free demo account

- A minimum deposit of $ 200

- Multiple deposit methods

- No hidden fees

- More than 200 markets to trade

- Leverage up to 1:500

- Spreads from 0.0 pips

- Fast execution and high liquidity

- Support 24/7

Conclusion on the IC Markets minimum deposit

If you are looking for a good broker of the international standard then IC Markets is right for you. The broker is a popular trading provider among international traders. Also if you are looking for the lowest deposit broker then IC Market is helpful for you. There are three types of appropriate accounts for traders in the market, so you can add this broker with comfort. You can accept different types of leverage offers due to the differences in the trading accounts. IC Market trading is still at the top in terms of offers.

If you are new to the broker business, IC will be very helpful for you. In the first instance, you can create a free practice trading account here, gaining great experience in the financial markets. So if you want to get involved in Forex trading, then create an account in IC Markets right now to implement your decision.

(Risk warning: Your capital can be at risk)

FAQ – The most asked questions about IC Markets minimum deposit :

Is it compulsory to follow the minimum deposit for IC Markets?

Yes, it is customary for every trader or investor to follow the minimum deposit amount for the IC Markets. You can only trade if the deposit is made above or equal to the minimum amount. However, you would only be able to open an account on IC Markets once you make a minimum deposit of 200 USD.

Which deposit methods can be used in IC Markets?

There are plenty of options you can use to deposit money on the IC market. For instant money deposition, you can use PayPal, Skrill, or Neteller. Bank transfers and debit or credit cards are also acceptable in IC markets.

What is the minimum deposit fee at IC Markets?

There are no minimum deposit fees charged in IC Markets.

Which base currencies can be used for minimum deposit at IC Markets?

You can deposit a minimum amount in a variety of base currencies, including SGD, HKD, JPY, NZD, CAD, EUR, AUD, CHF, and others. If you have a raw spread account, you may also use several more currencies in the IC Markets to make the minimum deposit.

Read more information about online brokers:

Last Updated on January 27, 2023 by Arkady Müller

Leave a Reply

Want to join the discussion?Feel free to contribute!