List of the 10 best online brokers in comparison

Table of Contents

An Online Broker is a bridge between an investor and the financial markets. Brokers are able to sell, buy and provide financial assets to retail traders.

Online trading has given rise to many scams, making it hard to trust an online broker. However, these 10 online brokers are perfect for trading online. A trader can trust these ten brokers and have great trading experience.

See the best 10 online brokers in comparison:

1. RoboForex

This trading platform is a very well-known name among online brokers. RoboForex excels in offering traders the best trading services. The trading platform supports a perfect technical analysis for traders. Besides, RoboForex has many underlying assets that a trader can trade.

| Facts | Description |

|---|---|

| Company Name | RoboForex Ltd |

| Year Founded | 2009 |

| Regulation | CySEC, IFSC, and Belize IBC |

| Tradable Assets | Forex, Stocks, Indices, Cryptocurrencies, Commodities |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader, R Trader |

| Account Types | Pro-Standard, Pro-Cent, ECN-Pro, Prime |

| Minimum Deposit | $10 for Pro-Standard and Pro-Cent accounts, $100 for ECN-Pro and Prime accounts |

| Maximum Leverage | Up to 1:2000 |

| Spreads | From 0 pips |

| Commission | From $2 per lot |

| Deposit/Withdrawal Methods | Credit/debit cards, bank wire transfer, e-wallets (Skrill, Neteller, WebMoney, Perfect Money, FasaPay, and more) |

| Customer Support | 24/7 live chat, email, phone, and callback service |

| Demo account | Yes |

Features of RoboForex:

- First, RoboForex excels in offering traders many account types. Thus, a trader can choose an account type depending on his trading requirements

- The demo account for learning to trade on RoboForex is easily accessible to traders. The demo account on RoboForex is free to use for any trader

- Traders can start their trading account on RoboForex with a low minimum deposit. A trader would need only $10 to trade on RoboForex

- In addition, RoboForex also offers traders great spreads

- RoboForex offers traders several investment tools, as well as educational magazines, journals, etc., to learn to trade

Good to know!

2. Vantage Markets

Vantage Markets is the best choice for traders looking for an average-risk online trading platform. This online broker offers traders a MetaTrader suite. Thus, Vantage Markets allows traders to have an enhanced trading experience with automated trading.

| Facts | Description |

|---|---|

| Company Name | Vantage Global Prime Pty Ltd (trading as Vantage FX) |

| Year Founded | 2009 |

| Regulation | ASIC (Australia) |

| Tradable Assets | Forex, Stocks, Indices, Cryptocurrencies, Commodities |

| Trading Platforms | MetaTrader 4, MetaTrader 5, WebTrader, mobile trading apps |

| Account Types | Standard STP, Raw ECN, Pro ECN, Islamic |

| Minimum Deposit | $200 for Standard STP and Raw ECN accounts, $20,000 for Pro ECN accounts |

| Maximum Leverage | Up to 1:500 |

| Spreads | From 0 pips |

| Commission | From $3 per lot |

| Deposit/Withdrawal Methods | Credit/debit cards, bank wire transfer, electronic wallets (Skrill, Neteller, FasaPay, etc.) |

| Customer Support | 24/5 live chat, email, phone, and callback service |

| Demo account | Yes |

This trading platform excels on the online brokers’ list because of its features.

Features of Vantage Markets:

- The platform offers traders the best trading account with a low minimum deposit

- Traders can access the MetaTrader suite on Vantage Markets

- The broker offers traders a safe trading platform. Because Vantage Markets is regulated, traders generally consider it a safe online broker

- Vantage Markets has great educational tools and research materials for beginners

- Traders can access first-class features like copy trading with this online broker

- Vantage Markets permits traders to begin trading on its platform for only $50

- The online broker also has more than 900 tradable symbols

Good to know!

In addition to these features, traders can enjoy Vantage Markets trading with low fees and commissions. Vantage Markets allows traders the best market spreads of all online brokers.

3. ActivTrades

Not many online brokers offer traders a platform with low fees. However, ActivTrades excel in offering world-class services to traders at a low cost. This online broker excels in offering traders the best trading services.

| Facts | Description |

|---|---|

| Company Name | ActivTrades PLC |

| Year Founded | 2001 |

| Regulation | FCA (UK), DFSA (Dubai) |

| Tradable Assets | Forex, Indices, Commodities, Stocks, ETFs |

| Trading Platforms | MetaTrader 4, MetaTrader 5 |

| Account Types | Standard, Professional, Islamic, and a free demo account |

| Minimum Deposit | $/€/£ 100 for Standard accounts, $/€/£ 1,000 for Professional accounts |

| Maximum Leverage | Up to 1:30 for retail clients, up to 1:400 for professional clients |

| Spreads | From 0.5 pips |

| Commission | No commission on forex, a commission on shares starting from $0.01 per share |

| Deposit/Withdrawal Methods | Credit/debit cards, bank wire transfer, electronic wallets (Skrill, Neteller, etc.) |

| Customer Support | 24/5 live chat, email, phone, and callback service |

| Demo account | Yes |

Good to know!

Additionally, other benefits accrue when a trader uses ActivTrades.

Features of ActivTrades:

- Traders can use ActivTrades once they sign up for a trading account. The trading platform has a seamless signup process

- ActivTrades has a very simple user interface, making it the best online broker in terms of user-friendliness. Even beginners find it easy to use this trading platform without much trouble

- Traders can have first-hand learning experiences by accessing online brokers such as ActivTrades. The broker is widely known for offering traders first-class educational resources

- Features that help in automated trading are easily available on ActivTrades

- Traders can enjoy funding and withdrawing funds from their ActivTrades trading account without paying any fee. The deposits and withdrawals on ActivTrades are free

- The minimum deposit is very low

- Besides, the online broker offers traders many trading tools. You can use all trading indicators on several charts to conduct your trading analysis

4. OctaFX

Another broker on the list of top online brokers is OctaFX. This broker is popular for the faster trade execution that it offers.

| Facts | Description |

|---|---|

| Company Name | Octa Markets Incorporated |

| Year Founded | 2011 |

| Regulation | FSA (St. Vincent and the Grenadines), CySEC (Cyprus) |

| Tradable Assets | Forex, Indices, Commodities, Cryptocurrencies |

| Trading Platforms | MetaTrader 4, MetaTrader 5 |

| Account Types | Micro, Pro, ECN |

| Minimum Deposit | $/€/£ 5 for Micro accounts, $/€/£ 50 for Pro and ECN accounts |

| Maximum Leverage | Up to 1:500 |

| Spreads | From 0.0 pips |

| Commission | No commission on Micro and Pro accounts, a commission on ECN accounts starting from $6 per lot |

| Deposit/Withdrawal Methods | Credit/debit cards, bank wire transfer, electronic wallets (Skrill, Neteller, etc.), cryptocurrencies |

| Customer Support | 24/5 live chat, email, phone, and callback service |

| Demo account | Yes |

OctaFX allows traders to signup for a trading account without much hassle.

Good to know!

Here are some more OctaFX features that any trader would enjoy trading on this platform.

Features of OctaFX:

- The online broker is a reliable trading platform because it is regulated

- OctaFX is available in most countries. So, traders can trade on this trading platform globally

- OctaFX offers traders several underlying assets they can trade on the trading platform

- Technical indicators such as MACD, RSI, EMA, etc., are easily available on OctaFX

- Besides, traders can also access several trading charts they can use for conducting a trading analysis

- It offers traders a low-cost MetaTrader suite

- There are plenty of research tools available on OctaFX

- Tradable symbols are available in plenty for traders using OctaFX

- Also, OctaFX offers traders a variety of deposit and withdrawal methods

- This online broker also offers traders a mobile trading application, making trading even more convenient

5. FBS

FBS offers great trading services to traders. It is another well-regulated broker that leads the list of top online brokers. FBS ranks top in stability and trustworthiness.

| Facts | Description |

|---|---|

| Company Name | FBS Markets Inc. |

| Year Founded | 2009 |

| Regulation | IFSC (Belize), CySEC (Cyprus) |

| Tradable Assets | Forex, Metals, Indices, Energies, Cryptocurrencies |

| Trading Platforms | MetaTrader 4, MetaTrader 5 |

| Account Types | Cent, Micro, Standard, Zero Spread, ECN |

| Minimum Deposit | $1 for Cent and Micro accounts, $100 for Standard and Zero Spread accounts, $500 for ECN accounts |

| Maximum Leverage | Up to 1:3000 |

| Spreads | From 0.0 pips |

| Commission | No commission on Standard, Zero Spread, and ECN accounts, a commission on Cent and Micro accounts starting from $0.01 per lot |

| Deposit/Withdrawal Methods | Credit/debit cards, bank wire transfer, electronic wallets (Skrill, Neteller, etc.), cryptocurrencies |

| Customer Support | 24/5 live chat, email, phone, and callback service |

| Demo account | Yes |

The fees that FBS charges from traders are comparatively low. So, this online broker can be a top choice for a trader.

Good to know!

Features of FBS:

- FPS offers traders a quick deposit and withdrawal process

- The trading platform has great research facilities that traders can use to trade

- Traders look forward to trading on FBS because of its competitive spreads

- This online broker allows traders to trade in their preferred currency

- The fees that FBS charges from traders are very fair

- Traders can use the MetaTrader suite on FBS

- The trading platform is available for use on the web and mobile

- This trading platform supports one-click trading. Trading from charts is also possible on FBS

So, FBS can be a top choice for traders searching for the best online brokers. This broker puts forth a wide range of order types for traders that helps them plan their trade well.

6. XM

XM is an ideal trading platform for traders looking for average-risk brokers. Among online brokers who offer high-quality educational resources to traders, XM stands out.

| Facts | Description |

|---|---|

| Company Name | Trading Point Holdings Ltd. |

| Year Founded | 2009 |

| Regulation | Forex, Stocks, Indices, Commodities, Metals, Energies, Cryptocurrencies |

| Tradable Assets | Forex, Metals, Indices, Energies, Cryptocurrencies |

| Trading Platforms | MetaTrader 4, MetaTrader 5 |

| Account Types | Micro, Standard, XM Zero |

| Minimum Deposit | $/€/£ 5 for Micro and Standard accounts, $/€/£ 100 for XM Zero accounts |

| Maximum Leverage | Up to 1:888 |

| Spreads | From 0.0 pips |

| Commission | No commission on Micro and Standard accounts, a commission on XM Zero accounts starting from $3.5 per lot |

| Deposit/Withdrawal Methods | Credit/debit cards, bank wire transfer, electronic wallets (Skrill, Neteller, etc.), cryptocurrencies |

| Customer Support | 24/5 live chat, email, phone, and callback service |

| Demo account | Yes |

However, XM needs to improve in offering traders a great range of markets. Even though the platform offers all leading tools to traders, the choice of assets is limited compared to other online brokers. Let’s explore XM features to understand the worthiness of this trading platform.

Features of XM:

- The trading platform offers more than 1000 CFDs for trading

- Traders can access several forex pairs to trade on XM

- Various live recorded lectures are available on XM for traders

- MetaTrader is available for traders trading on XM

- Features such as copy trading, and social trading

,are available with this online broker - Signing up process on XM finishes within a few minutes

- Traders can enjoy mobile trading with the mobile application of XM

- There is a great offering of investments on this trading platform

- Above all, XM leads the race because of its safety

Good to know!

7. Pepperstone

Pepperstone is a broker that excels in offering great forex and CFD trading services to traders. The broker offers several pros that make this trading platform lucrative for traders.

| Facts | Description |

|---|---|

| Company Name | Pepperstone Group Ltd. |

| Year Founded | 2010 |

| Regulation | ASIC (Australia), FCA (UK), DFSA (Dubai), SCB (Bahamas), CIMA (Cayman Islands) |

| Tradable Assets | Forex, Stocks, Indices, Commodities, Cryptocurrencies |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader |

| Account Types | Standard, Razor, Swap-Free |

| Minimum Deposit | $/€/£ 200 for Standard and Razor accounts, $500 for Swap-Free accounts |

| Maximum Leverage | Up to 1:500 |

| Spreads | From 0.0 pips |

| Commission | A commission on Razor accounts starting from $3.50 per lot |

| Deposit/Withdrawal Methods | Credit/debit cards, bank wire transfer, electronic wallets (Skrill, Neteller, PayPal, etc.), cryptocurrencies |

| Customer Support | 24/5 live chat, email, phone, and callback service |

| Demo account | Yes |

The online broker supports a fast account opening process and promotes fully digital trading. Besides, Pepperstone’s customer support is relevant for any trader.

Features of Pepperstone:

- Pepperstone is a regulated broker overseen by regulating authorities from Germany, Bahamas, Kenya, and several other nations

- The commissions that the online broker charges on trading are very reasonable. A trader has to pay only $3.5 commission on every lot

- Compared to other brokers, this trading platform has no inactivity fee

- The minimum deposit that a trader requires on Pepperstone is only $50

- Various trading tools, such as trading charts, technical indicators, and copy trading are available on this platform

- Funding your trading account with the online broker is seamless

- Traders can also use the demo account on Pepperstone for free for 30 days

- In addition, the online broker also offers a mobile trading platform to traders

Good to know!

8. Exness

This online trading platform Exness has a considerable number of active clients, proving its legitimacy. The online broker provides his clients with an opportunity to trade underlying assets, including crypto, currency, metals, commodities, and forex.

| Facts | Description |

|---|---|

| Company Name | Exness Group |

| Year Founded | 2008 |

| Regulation | FCA (UK), CySEC (Cyprus), FSA (Seychelles) |

| Tradable Assets | Forex, Metals, Energies, Indices, Cryptocurrencies |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader |

| Account Types | Standard, Raw Spread, Zero |

| Minimum Deposit | $1 for Standard and Raw Spread accounts, $200 for Zero accounts |

| Maximum Leverage | Up to 1:2000 |

| Spreads | From 0.0 pips |

| Commission | No commission on Standard and Zero accounts, a commission on Raw Spread accounts starting from $3.5 per lot |

| Deposit/Withdrawal Methods | Credit/debit cards, bank wire transfer, electronic wallets (Skrill, Neteller, WebMoney, etc.), cryptocurrencies |

| Customer Support | 24/7 live chat, email, phone, and callback service |

| Demo account | Yes |

Exness has something to meet every trader’s needs. Like most online brokers, this trading platform has competitive spreads. The MetaTrader suite is also available on Exness.

Features of Exness:

- The broker is well-regulated

- Exness offers traders a great dealing desk that supports quick order placement

- Traders get a free demo account when they sign up on Exness

- Most traders prefer this online broker because of its instant withdrawals. Traders can enjoy withdrawing their funds instantly from their Exness trading accounts

- The broker also offers features that allow traders to track the price data. High-volume trading is also possible with this online broker.

- A great feature of Exness is that its operation is highly transparent. Traders can find online broker’s reports publicly available. So a trader can easily look into the broker’s performance

- Of all online brokers, this trading platform is the least suitable for traders with little knowledge about the industry. Because educational resources are scarce on this trading platform, traders might need external help to support their trading knowledge

9. Moneta Markets

Traders can easily use the web version or MetaTrader trading platform on Moneta Markets. The broker makes it to the list of the best online brokers because of its competitive research offerings.

| Facts | Description |

|---|---|

| Company Name | Vantage International Group Limited |

| Year Founded | 2019 |

| Regulation | VFSC (Vanuatu) |

| Tradable Assets | Forex, Stocks, Indices, Commodities |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader |

| Account Types | Standard, Raw Spread |

| Minimum Deposit | $200 for Standard and Raw Spread account |

| Maximum Leverage | Up to 1:500 |

| Spreads | From 0.0 pips |

| Commission | A commission on Raw Spread accounts starting from $3 per lot |

| Deposit/Withdrawal Methods | Credit/debit cards, bank wire transfer, electronic wallets (Skrill, Neteller, FasaPay, etc.), cryptocurrencies |

| Customer Support | 24/5 live chat, email, phone, and callback service |

| Demo account | Yes |

Also, the broker’s pricing is very fair, making it affordable for traders.

Good to know!

Features of Moneta Markets:

- Most traders prefer this online broker because of its high trust score. Also, its ratings are very high

- The fees and commissions on Moneta Markets are easily affordable. So, even beginners can use this trading platform in a budget-friendly manner

- The platform offers tools that assist traders in their technical analysis

- Mobile trading is fast on its mobile application because of its seamless interface

- More than 900 tradable symbols are available with this online broker

- Traders can trade as many as 54 for experience with this online platform

- All leading payment methods are accessible on Moneta Markets. Besides, traders can start trading on this platform for only $50

- Several trading indicators and charting tools are available with this broker. Traders can draw trend lines when using the feature of mobile charting

- A forex calendar is also available to assist traders’ trading analysis

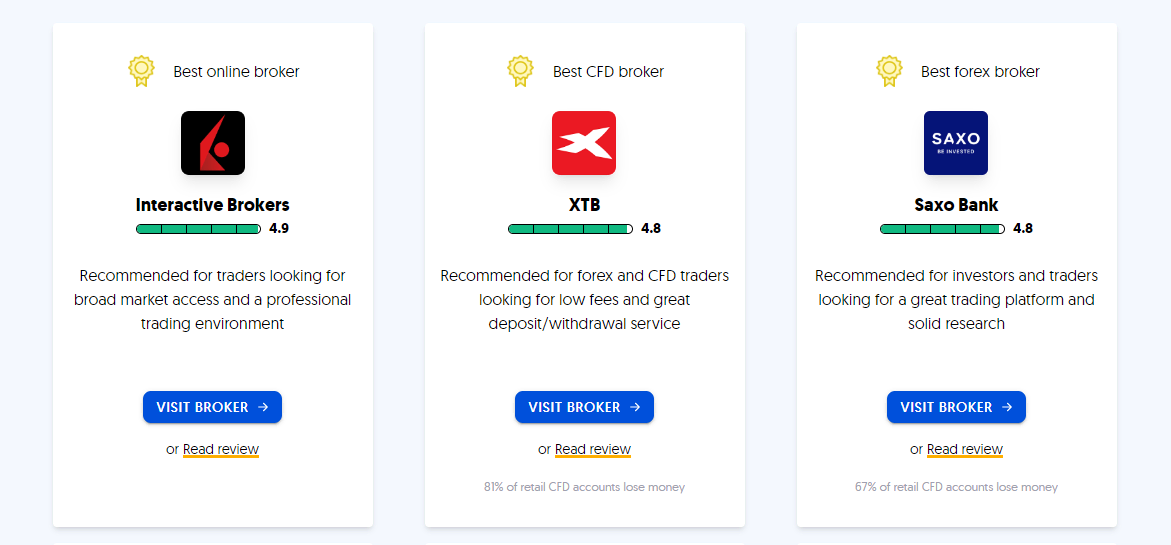

10. XTB

For beginners looking out for the best online brokers, XTB is a great choice. Mostly, traders use this trading platform to trade CFDs.

| Facts | Description |

|---|---|

| Company Name | XTB International Limited |

| Year Founded | 2002 |

| Regulation | FCA (UK), KNF (Poland), CySEC (Cyprus) |

| Tradable Assets | Forex, Stocks, Indices, Commodities, ETFs |

| Trading Platforms | xStation 5, MetaTrader 4 |

| Account Types | Standard, Pro |

| Minimum Deposit | $/€/£ 1 for Standard accounts, $/€/£ 250 for Pro accounts |

| Maximum Leverage | Up to 1:200 |

| Spreads | From 0.0 pips |

| Commission | No commission on Standard accounts, a commission on Pro accounts starting from $3.5 per lot |

| Deposit/Withdrawal Methods | Credit/debit cards, bank wire transfer, electronic wallets (Skrill, Neteller, PayPal, etc.) |

| Customer Support | 24/5 live chat, email, phone, and callback service |

| Demo account | Yes |

This trading platform is highly intuitive and also offers traders a demo account. So, traders who wish to test XTB before placing live trades can use it.

Good to know!

Features of XTB:

- The online broker has low commissions. However, traders might find stock trading a little expensive on XTB

- The broker does not charge traders for account maintenance

- All debit card deposits and withdrawals that traders make into their XTB live account are free. However, the minimum withdrawal amount on XTB is $200

- If a trader leaves his XTB trading account inactive, an inactivity fee of €10 gets imposed

- Customer care of XTB is highly useful for traders. Traders can avail themselves of live chat, phone, email, and customer support in times of trouble

- There is no minimum deposit that XTB stipulates for traders. Also, traders can use several deposit methods to put funds into their trading accounts

What is the most popular online broker?

Naming only one popular online broker might be challenging. The brokerage market is full of the best brokers. Almost all brokers excel in delivering quality services to traders. However, not all trading platforms or online brokers are genuine. But these 10 trading platforms discussed here offer the ultimate trading experience to traders.

Good to know!

A trader can assess which broker meets his trading expectations and start trading immediately.

What you will learn in this article:

- Broker definition

- How does a broker work?

- How does a broker make money?

- Why do you need a broker?

- Types and differences

- Choosing the best broker

- What do you need to start with an online broker?

- List of the 10 best online brokers in comparison

Definition of a Broker:

A broker is an intermediary of financial products and investments between the client and the financial market. The broker gives direct access to the markets. Brokers can trade on behalf of a client or let the client trade themselves. This is done through an online platform or instruction by telephone. Likewise, brokers are used to arranging large transactions between different customers.

Below you can find answers to important questions about online brokers:

- How to become a Broker?

- How does a broker work?

- How does a broker make money?

- Why do I need a broker?

How to become a Broker?

The term “broker” comes from American usage. There, employees of a financial company are also called brokers. You can call the company a broker or you can call the employee a broker.

In order to become a broker, you can apply for a job at a company that sells financial products, but also real estate salesmen are often called brokers. In this article, we will limit ourselves only to the financial sector. The main task of a broker, who is an employee, is limited to direct sales of products. For this, you need knowledge and skills in “sales”. Depending on the company, most of the time a high degree is not required if you want to join as a broker/salesperson.

If you want to open an online broker or brokerage company you need a lot of capital first. Without starting capital it is impossible to start a broker.

The following costs will be incurred:

- Costs for licenses

- Costs for software

- Costs for employees

- Costs for lawyers

- Costs for advertising and marketing

Regulations of most countries prescribe a certain share capital. This is usually an amount of more than $500.000. Behind a broker usually hangs a large infrastructure, which must be planned in detail. The bureaucratic work and verification of licenses will consume the largest amount of money. Brokers are strictly regulated (depending on the country) to prevent fraud and better protect clients. To start a broker, you don’t need extra studies or training. You only need capital and trustworthy partners.

The best brokers for traders in our comparisons – get professional trading conditions with a regulated broker:

| Broker: | Review: | Advantages: | Free account: |

|---|---|---|---|

1. Capital.com |  (5 / 5) (5 / 5)➔ Read the review | # Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 3,000+ markets | Live account from $ 20: (Risk warning: 78.1% of retail CFD accounts lose money) Types and differences between BrokersIn general, it is necessary to distinguish between financial products and brokers. For example, there are a few pure stockbrokers or pure Forex brokers. However, many providers do not limit themselves only to financial products but offer a wide range of investment opportunities. We have already written articles about the following brokers: Multi-Asset Broker Multi-asset brokers are very popular with the average investor and trader. There is usually an offering of over 10,000 different markets. The largest multi-asset broker is Interactive Brokers. With this provider, you can actually trade all financial products that are available to retail investors worldwide. A multi-asset broker is not always the best choice for traders who know exactly what they want to trade. Brokers that specialize in a particular product can usually offer better conditions than a multi-asset broker. Stock BrokersWith stock brokers, you can buy and sell securities. An important criterion for this broker is also the choice. There are countless stock exchanges worldwide. For example, if you want to buy stocks from Russia, not every stockbroker offers that. Therefore, you should know which offer is available at the provider before signing up. Cryptocurrencies BrokerCryptocurrencies are usually offered on unregulated platforms. However, the broker industry is not idle and is now increasingly trying to offer regulated trading in cryptocurrencies. This is done either via derivative or direct coin. There is still a lot of growth and undiscovered opportunities in this market segment. Forex and CFD BrokersForex and CFDs are usually offered together by one broker. They are also derivatives that are traded with leverage. You can actually trade CFDs (contracts for difference) on all markets. The advantage lies in the leverage and the possibility of short selling as well. It is an easy and fast way to enter the markets. Forex and CFD brokers secure themselves in the background with external market makers who have the appropriate licenses for this. Futures BrokerFutures (forward contracts) are traded transparently on the stock exchange. For futures, there are also many specialized brokers that offer an easy way to this financial product. The fees are very low and the leverage is high. For futures contracts, you need larger amounts of money. It is not recommended for beginners, because you are forced to trade with large positions, because there are no smaller ones. The financial product was developed for hedging the economy. However, many traders speculate about these contracts because they are transparent and liquid. Futures are also available for very many markets. Speculations on rising and falling prices are possible. How to choose the best broker Choosing an online broker is the first and foremost task any trader should do. Picking the best broker is essential for having a perfect trading experience. The ultimate quality of the trader’s trading journey depends upon his online broker. Unfortunately, there are always brokers that are not good or even dubious. Watch out for scam websites on the Internet disguised as brokers. You can even find copies of brokers’ websites trying to get customer funds over and over again. So always be careful from the start which website and platform you want to use. Generally, it is recommended to use a broker that has been in business for several years and has good ratings. The fee structure and service should also be scrutinized. Broker selection is one of the most important tasks of an investor. The broker is instrumental to a large extent in the profits of the trader. Therefore, the trader must consider a few factors before he chooses his online broker:

Regulatory statusIt is essential to check the online broker’s regulatory status. A trader must choose only that broker who is regulated or overseen by regulating authority. These brokers are answerable for their trading practices. Signing up with unregulated brokers might cause a loss of money. So choosing a regulated broker is the trader’s way to pick the best online broker out of the herd. Features Traders must compare and evaluate the features offered by online brokers. Nowadays, most online brokers support several features that help traders conduct automated trading. In addition, there are several other features that a trader must consider. These include the following:

Broker’s reputationA trader can use several ways to check the broker’s reputation. For instance, several trading forums discuss brokers. So, a trader should get acquainted with these reviews to ascertain whether trading with any broker is worthwhile. Our checklist for a good provider:

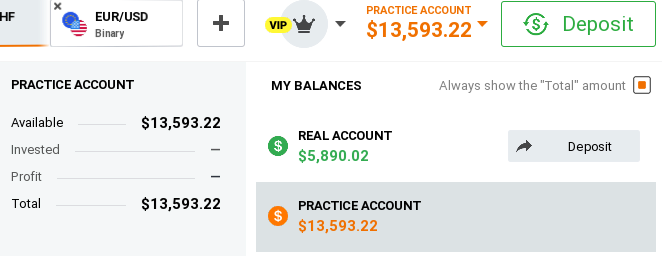

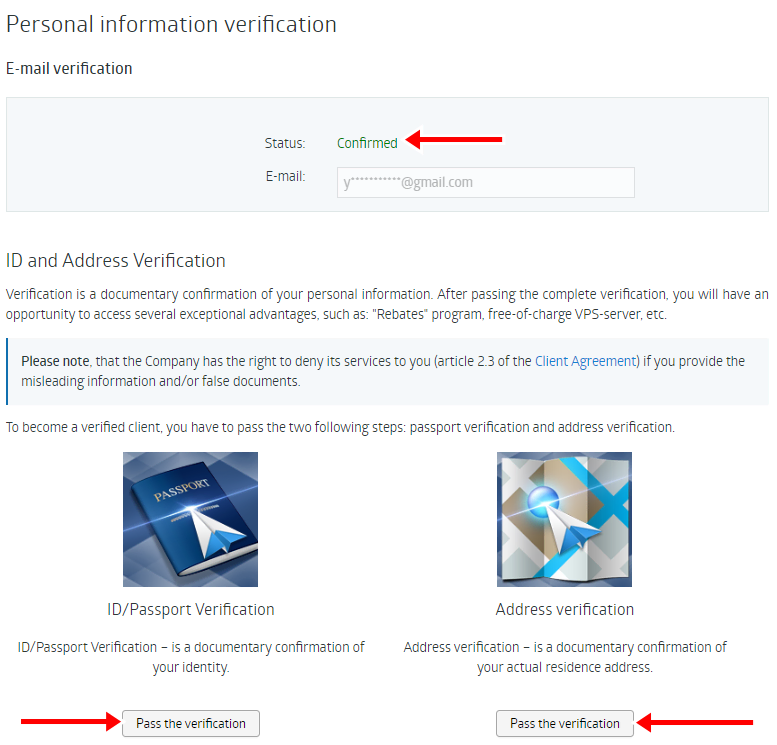

Check the above points whenever you choose a broker. Use a demo account Another important point in finding the best broker is a demo account. Most brokers offer a free demo account to test their services. This is a virtual account with credit. So you trade with play money and imitate real money trading. Every new trader is advised to use the demo account first before investing real money. For a recommendation, you can visit our Forex, or CFD broker comparison. How to start trading in easy steps?A brokerage account is an account you open with a reliable trading platform to enter the market. The ability to quickly open a broker account has made it easy for people to make trades in the financial market. Starting with an online broker is simple and easy. You can do it in just a few steps:

Select a broker or firmThe first step of opening a trading account is to select a reliable broker. For this, you need to identify your trading objectives; then choose a suitable broker using the checklist provided above. Compare broker rates and services If you have selected more than one broker account and are confused, the best thing to do is compare their rates and services. Each broker charges a certain amount of deposit money, withdrawal fees, deposit fees, and other charges. In addition, compare the services offered by different online brokers to find out which one is worth it. A broker offering more features and services can be trusted because it shows the platform thinks about its registered clients. Get in touch with the selected brokerCertain brokers charge fewer fees, while some charge high fees. But you must not get lured by less fees because such brokers are not necessarily the best. You can also read reviews to understand whether the trading platform is worth it. Get in touch with a selected broker to open your trading account. Fill account opening and KYC formYou must fill out an online account opening form with your selected broker. The easy form-filling process can be completed in no time. Submit your identity and residential proof along with the account opening form. Application verification process Once you have submitted all the necessary documents, the verification process begins. At this stage, check the provided data. After your application form is accepted, your trading account becomes active. Use the provided credentials to start trading assets in the financial market. Fund the accountYou cannot start trading in the real market without funding your account. So, deposit the minimum amount through one of the accepted payment methods. Different trading accounts have different minimum deposit requirements. Make sure you know about it before starting the registration process. Place buy or sell ordersOnce you have funded your account, start trading. Analyze the trading market, use the best strategies and tools to place orders, and buy or sell securities. Our conclusion about how to start trading Brokers make money by charging trading fees. In return, they provide infrastructure and services to their clients. It is a legitimate and lucrative business. However, competitive pressure is also very strong in the industry. A bad broker will only be able to survive on the market for a few months. As a broker, you can earn a lot of money, but the cost is also very high. Opening a trading account with a reliable broker can offer you a safe way to enter the trading market. Follow the steps mentioned in this post to start easily with an online broker. It has never been easier to open a broker account, especially because everything can be done online. Once your account opening form and documents are under process, you will get access to trading accounts in a few hours. Conclusion about the 10 best online brokers Brokers make money by charging trading fees. In return, they provide infrastructure and services to their clients. It is a legitimate and lucrative business. However, competitive pressure is also very strong in the industry. A bad broker will only be able to survive on the market for a few months. As a broker, you can earn a lot of money, but the cost is also very high. Opening a trading account with a reliable broker can offer you a safe way to enter the trading market. Follow the steps mentioned in this post to start easily with an online broker. It has never been easier to open a broker account, especially because everything can be done online. Once your account opening form and documents are under process, you will get access to trading accounts in a few hours. Though many brokers exist in the trading industry, wisely choosing a broker should be any trader’s priority. Settling with an unregulated broker is the worst mistake any trader could make. A trader must choose the best online broker to have a perfect trading experience. Out of all online brokers, these 10 offer traders the best trading services. Traders can explore various underlying assets on these online trading platforms. In addition, these brokers offer all leading tools to traders, which helps them conduct technical analysis. So, choosing one of these 10 brokers can be any trader’s best choice. FAQ – frequently asked questions about best online brokers:What does an online broker do?An online broker simplifies the task of trading for the trader. A broker provides traders with all tools needed to place trades. In addition, brokers also widen the trader’s reach to access several underlying assets. A trader can execute his trades with the help of an online broker. What are the types of brokers?There are many types of brokers which you will have to choose according to your needs. It is very crucial to understand the differences between the types of brokers as it will help us to choose the best one for us. Some of the common types of brokers in financial markets are multi-asset brokers, cryptocurrency brokers, Futures brokers, CFD and Forex brokers, and stock brokers. How can I become a broker?There are many jobs available in companies that sell financial products where you can apply. If you want to become a financial broker, your day-to-day responsibilities would include direct product sales. For this, a good knowledge of sales is a prerequisite in most companies. But, if you want to open your own brokerage company, you must be ready with a lot of capital. How to choose a broker?If you are an investor, all your trading and business depends upon the type of broker you have chosen. Choosing a good broker is very important to understand financial markets and start trading. You should always choose a broker who has several years of experience in trading and investment. Make sure to stay away from fraud and learn how to spot a fraud broker online. You should also check the fees they are charging per trade and make sure to compare it with other brokers. Are online brokers safe?Not all online brokers are safe. Some brokers run a highly questionable trading platform. Traders must avoid signing up with such brokers. A trader can trust these 10 online brokers if he wants a reliable online broker. What are the best online brokers for non-US residents?The following 10 online brokers are the best for non-US traders: – RoboForex Last Updated on June 17, 2023 by Andre Witzel https://www.trusted-broker-reviews.com/wp-content/uploads/Trusted-Broker-Reviews-logo.png 0 0 Andre Witzel https://www.trusted-broker-reviews.com/wp-content/uploads/Trusted-Broker-Reviews-logo.png Andre Witzel2020-12-11 14:12:362023-06-17 15:45:33List of the 10 best online brokers in comparison |