XM broker review and test – Is it a scam or not?

Table of Contents

REVIEW: | REGULATION: | SPREADS: | MIN. DEPOSIT: | ASSETS: |

|---|---|---|---|---|

(5 / 5) (5 / 5) | FCA. BaFin, CNMV,MNB, CONSOB, ACPR, FIN-FSA, KNF, AFN, FSC | Starting 0.0 Pips | 5$ | 1,000+ |

Should you avoid the online broker XM or is it a recommendable company? – On this page, we share our own experiences in the form of a test report on this Forex and CFD broker. Learn about the terms and offers for traders in the following texts. Also, we will show you a step-by-step tutorial on how to trade successfully. Is it worth it to invest his money or not? – Inform now transparently.

(Risk warning: 75.59% of retail CFD accounts lose)

What is XM.com? – The forex broker presented

XM Group (XM) is a group of regulated online brokers. Trading Point of Financial Instruments Ltd was established in 2009, and the Cyprus Securities and Exchange Commission regulates it (CySEC 120/10); Trading Point of Financial Instruments Pty Ltd was established in 2015, and it is regulated by the Australian Securities and Investments Commission (ASIC 443670), and XM Global Limited was established in 2017 with headquarters in Belize, and it is regulated by the International Financial Services Commission (IFSC/60/354/TS/19). The company was founded in 2009 and has since enriched more than 1.500.000 customers in over 196 countries. Even the broker is one of the biggest in his industry.

The goal is to give the customer a fair and reliable offer for investing in international financial markets. Customer support is also a top priority for this company and is available in more than 30 languages. We will check this in the following experience report exactly. In addition, the broker is very active in distributing advertising and sponsorship. Especially for customers, the broker is even to be found at seminars or financial fairs worldwide.

XM offers trading in currencies (Forex) and CFDs on commodities, precious metals, energies, stocks, and indices. Currently, over 1000 different markets are provided to traders. In addition, the broker works as an intermediary for tradable contracts for difference. In summary, the offer is huge at first glance, and also the company data prove to be trustworthy.

Facts about the FX Broker XM.com:

⭐ Rating: | 5 / 5 |

🏛 Founded: | 2009 |

💻 Trading platforms: | MetaTrader4, MetaTrader5 |

💰 Minimum deposit: | $5 |

💱 Account currencies: | USD |

💸 Withdrawal limit: | No limit |

📉 Minimum trade amount: | $1,000 trading volume / 0.01 lot |

⌨️ Demo account: | Yes, up to $10,000 |

🕌 Islamic account: | Yes |

🎁 Bonus: | $30 bonus for each new live account |

📊 Assets: | Stock, commodities, equity indices, precious metals, energies |

💳 Payment methods: | Bank transfer, debit/credit card (Visa and Mastercard), Skrill |

🧮 Fees: | Starting at 0.0 pip spread, variable overnight fees |

📞 Support: | 25/7 support via phone, mail, and chat |

🌎 Languages: | 25 languages |

(Risk warning: 75.59% of retail CFD accounts lose)

What are the pros and cons of XM?

We know with the large selection of brokers, choosing the perfect broker can be challenging. So here are our most important pros and cons of the broker to help you decide whether XM is a good fit. What we really like about XM is their focus on the success of the customer. According to their website, the broker has more than 10,000,000 customers from 190 countries

Pros of XM | Cons of XM |

✔ Dedicated personal account manager | ✘ Only USD as standard account currency is available |

✔ Low minimum deposit | ✘ Rating on Trustpilot isn’t great |

✔ Website and customer support available in 25 languages | ✘ Some users complain about a difficult withdrawal process, although that’s not our personal experience |

✔ Website is extremely well optimized for mobile users | |

✔ International traders from most countries accepted | |

✔ Professional and fast customer support | |

✔ Cheap fees and commissions |

Regulation of XM and safety of customer funds

An official regulation or license radiates trustworthiness and security. Every trader should find out about opening an account with a broker. The regulation is intended to push frivolous fraudsters out of the market. Licenses require certain criteria and regulations that guarantee a clean and secure trade.

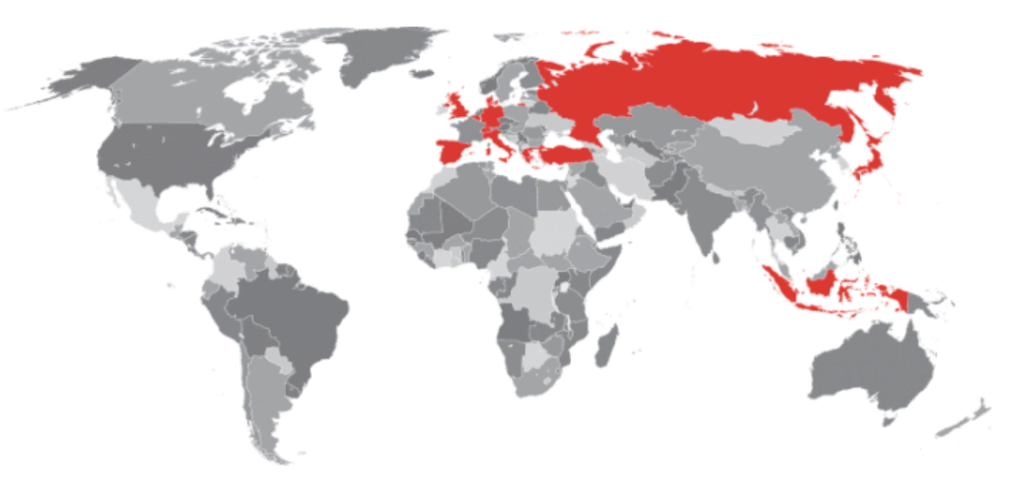

Another good impression for us is that XM has several licenses. In more than four countries, the broker is regulated by an official financial regulator. In addition, the company is registered in many European countries with appropriate supervision and has EEA freedom to provide services.

In addition, customer funds are managed in different investment-grade banks. XM is only doing business with regulated payment providers. Also, the broker is a member of the Investor Compensation Fund. XM does not trade with its clients, which is forbidden through the regulation, and for more safety, there is negative balance protection.

Which authorities are XM regulated by?

XM is a highly trusted broker and has certificates from a large number of official authorities. This makes XM one of the safest and most trusted companies in this industry. Below you will find a list of authorities XM is regulated by:

- Cyprus Securities and Exchange Commission (CyCec)

- Financial Conduct Authority (FCA)

- Federal Financial Supervisory Authority (BaFin)

- The National Securities Market Commission (CNMV)

- The Italian Companies and Exchange Commission (CONSOB)

- The French Prudential Supervision and Resolution Authority (ANCP)

- The Finnish Financial Supervisory Authority (FIN-FSA)

- Polish Financial Supervision Authority (KNF)

- Netherlands Authority for the Financial Markets (AFM)

- Financial Supervisory Authority (FI)

- Financial Service Commission (FSC)

Why XM is a very safe online broker:

- Member of the Investor Compensation Fund (only for Trading Point of Financial Instruments Ltd.)

- XM does not trade versus clients

- The client’s funds are kept in segregated client bank accounts

- Negative Balance Protection

ESMA Regulation

In 2018, the leverage for traded derivatives (Forex and CFDs) was massively restricted to 1:30 by the European Financial Services Authority (ESMA). Brokers, which have a license in Europe, are only allowed to offer this small lever to customers. This is a significant problem for some traders because certain strategies (such as hedging) can no longer be performed.

However, the leverage of 1:30 applies to clients registered under the EU-regulated entity of the Group. Leverage depends on the financial instrument traded.

(Risk warning: 75.59% of retail CFD accounts lose)

Review of the XM trading conditions for traders

XM is very broad, with over 1000+ tradable instruments. There should be no lack of choice here for a trader. As mentioned above, various stocks, commodities, currencies (Forex), precious metals, and energies are offered for trading. Especially stock trading is a massive advantage with XM, assets from more than 14 different countries are available.

Available markets:

- Currencies

- Stock CFDs

- Commodities CFDs

- Indices CFDs

- Precious Metals CFDs

- Energies CFDs

In terms of trading platforms, XM relies on the world-famous platforms MetaTrader 4 and 5. This is one of the best software for private traders. We will give you a more detailed explanation in the section Trading Platforms.

The terms of trading in leveraged financial products are very excellent and competitive in my experience and tests. XM relies on several different account types, which give a trader excellent conditions, depending on the capital strength. Spreads can start at 0.0 pips on the most traded markets. In addition, the execution is very reliable, and there are 100% no requotes.

As a trader, you can start trading for as little as a $ 5 minimum deposit or use a free demo account. In addition, there are different account types for every type of capital (more on that later). All in all, the conditions make a very positive impression on us, and XM can be one of the cheap and most reliable brokers.

Conditions for traders:

- Spreads starting at 0.0 Pips

- Different account types

- Maximum leverage is 1:30 for clients who registered under EU regulated entity

- Maximum leverage is 1:500 for clients who are registered under Belize or ASIC-regulated entity

- Minimum Deposit of 5$

- Free and unlimited Demo Account

- More than 1,000 different markets

REGULATION: | SUPPORT: | ASSETS: | SPECIAL: |

|---|---|---|---|

CySEC, ASIC, IFSC | 24/5 in different languages, webinars, and training tutorials | 1000+ (Forex Trading, Stocks CFDs, Commodities CFDs, Equity Indices CFDs, Precious Metals CFDs, and Energies CFDs) | Different account types |

(Risk warning: 75.59% of retail CFD accounts lose)

Review and test of the XM trading platform

As mentioned before in this review, the well-known trading platform Metatrader in versions 4 and 5 is offered. In our opinion, there is no better trading platform for private traders worldwide because it offers many universal options. The trading platform is characterized by its flexibility and user-friendliness.

With the MetaTrader, you can adapt your trading to any trading style. The platform can be customized and even programmed. Whether long-term or short-term hands, the Metatrader always delivers the right settings. Robots or automatic programs are also allowed with this program.

The following trading platforms are available:

- MetaTrader 4 (web, mobile app, desktop)

- MetaTrader 5 (web, mobile app, desktop)

The advantages of the XM MetaTrader:

- One login and access to the web trader, app, and desktop version

- Automatic programs may be used

- No requotes

- Rental of a VPS server is possible

- Complete video tutorial is available from XM

(Risk warning: 75.59% of retail CFD accounts lose)

Charting and analysis for forex trading

Of course, charting and analytics are very important to successful traders. It is not uncommon that traders to even need to access external software. This will not be necessary with XM because the MetaTrader offers all-important charting and analysis options. Choose between more than four different chart types in the software.

Any timeframe (time unit) of the chart can be set for the analysis. The software also offers the right tools. Free indicators can be added at any time. There are also several drawing tools available. If that is not enough, you can program the indicators yourself or insert them externally.

- Individually customizable tools

- Free indicators

- Big range of technical drawing tools

Mobile trading for any device possible

Another benefit of the software is that it is available for every device. Use the MetaTrader also on Apple (iOS) and Android devices. Mobile trading today is a standard requirement for trading software, as it is essential to be able to respond to news from within. Positions can be opened, managed, or closed by your smartphone. Furthermore, you only need access to each device. With your account data, you can log in everywhere.

(Risk warning: 75.59% of retail CFD accounts lose)

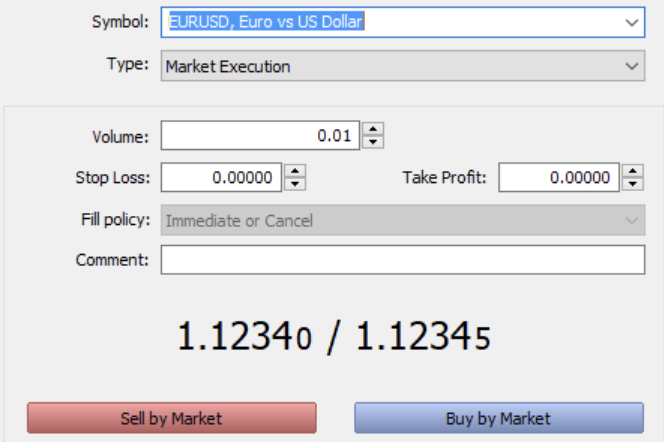

Trading tutorial: Learn how to trade with XM step by step

In the following section, we would like to give you a guide to trading with Forex Broker XM. In the picture below, you can see the order mask of the MetaTrader. There are many different settings options for trade execution. The following points will tell you how the typical trading process works.

- First, analyze one out of 1000 different markets/assets at XM and decide to invest or open a trading position. For this purpose, fundamental analysis or technical analysis can be used. MetaTrader offers enough tools and settings.

- As you can see in the order mask, you can always bet on rising or falling prices. This is easily possible with forex trading and happens during CFD trading via short sales.

- Now you have to choose the position size (volume) and the stop loss or take profit. All sizes are dependent on your planned risk. Choose specific price tags when opening and closing a trade. The position sizes are given in lots (1 lot = 100,000 units of the base currency). Beginners should definitely use the XM Forex Calculator, which is available on the website.

- The stop-loss stops you in a loss at a certain price (risk), and the take profit automatically closes your position at a certain price in profit. Learn to divide the profit-risk ratio.

- Pending orders are another way to open positions. Place orders at specific prices in the market. If the market touches this price, your position will be opened (whether sell or buy).

Open your free account with XM

Next, we would like to look at the account opening in this review. On the website, it is clear that you can open a demo or live account directly. In a few minutes, the depot opening works according to the support. Use a valid email and other personal information. The email address must be confirmed after opening the account.

Free and unlimited demo account

A demo account is a virtual balance account. You can use it to try out all the features of Broker XM and trade without risk. It simulates the real money trade with “play money”. It is also a great way for beginners and advanced traders to develop their own strategies or test new markets.

XM offers a free demo account of over $ 10,000 in virtual credit. If desired, a currency other than the USD may be taken. This account can be used indefinitely, and it is the perfect way to get practice with the broker.

How to open your real account

Once you have chosen XM, you can open a real money account. This requires more data. The broker also asks a few questions about your knowledge of trading before opening an account. You also need to confirm your phone number to ensure additional security for the account. Before the capitalization, the account should and should be verified. This is very easy with the upload of a passport and proof of residence.

XM guides you through the account opening process. There is a detailed and accurate step-by-step guide so everything can go smoothly. If you have questions, you can contact support. In summary, opening an account is very easy and works quickly.

(Risk warning: 75.59% of retail CFD accounts lose)

Choose the best account type for you

XM offers the advantage of 3 different account types. It can be decided between the “Micro”, “Standard” and “XM zero account”. The account types are adjusted to the capital strength of the customer. For example, in a micro account, you can trade with very small position sizes (risk of a few cents). There is a separate cent contract size.

In the “Standard” and “XM zero accounts”, there are average lot sizes. The difference between these two accounts lies in the fees and the possible currency of the account. For example, you can choose seven currencies for the standard account and only 2 for the “XM zero account”. Spreads are much lower in the “XM zero account” and start at 0.0 pip. But you have to pay a commission of $ 3.5 per $ 100,000 traded. The “XM zero account” is much cheaper than the standard account.

| XM Ultra Low MICRO Account | XM Ultra Low STANDARD Account | XM ZERO Account | |

|---|---|---|---|

| MIN. DEPOSIT: | 5$ | 5$ | 5$ |

| CURRENCY: | USD, EUR, GBP, CHF, AUD, HUF, PLN | USD, EUR, GBP, CHF, AUD, HUF, PLN | USD, EUR |

| SPREADS: | 1.0 Pips | 1.0 Pips | 0.0 Pips |

| COMMISSION: | No | No | 3,5$ commission per 1 Lot traded |

| ISLAMIC ACCOUNT | Yes | Yes | Yes |

(XM also offers the XM ULTRA LOW account, which allows you to trade with either micro or standard lots, lower spreads from 0.6 pips, and it has a minimum initial deposit of $5. The XM ULTRA LOW account is not applicable to all entities of the group)

Should you choose fixed or variable spreads?

Some brokers offer fixed spreads. This means that the spread (the difference between buying and selling prices) is always the same. He is also independent of the market situation. The problem here is that high fees or insurance premiums usually have to be paid. In addition, it isn’t easy to guarantee fixed spreads because the stock market does not work on the principle. Fixed spreads are generally unnatural.

XM offers direct interbank spreads for your clients. This also has the advantage that there is no conflict of interest. The spreads are reduced to the lowest, and you always get directly the current market prices. It is not better. XM is very transparent here and reaps a clear plus point for us.

XM always offers the best and tightest spreads.

(Risk warning: 75.59% of retail CFD accounts lose)

Do your first deposit (minimum deposit)

Now it is your turn to capitalize on the trading account. From our experience, this also works pretty fast. We will give you an overview of this section about the payment methods. You can use electronic methods or a classic transfer for the deposit. Using electronic methods (credit card, e-wallets, Skrill), the money is credited directly to the account. Bank transfer can take 1 to 3 days. There are no fees for the deposit. The minimum deposit is only $ 5 with this online broker.

Review of the withdrawal at XM

Another important point of a good broker is the quick and easy payment of client funds. It is not uncommon for a broker to experience difficulty in paying large sums and delays.

This is not the case with XM. The company is always liquid and makes payments in less than a day. Therefore, the fees are to look for in vain. The only fee that can be incurred is if you pay less than $ 200 by bank transfer. From our experience with XM, you are with a very secure broker who treats client funds with the highest confidence.

The conditions for payments:

- Credit Card (Visa, MasterCard)

- Electronic Wallets (Skrill)

- Bankwire

- Minimum deposit 5$

- Withdrawal within 24 hours

- No withdrawal fees (except bank wire under $ 200)

Is there a Negative Balance Protection?

Cruel stories about account balances, thanks to the extra payroll haunting the internet. Many traders fear additional funding and would like to act without them. These concerns are entirely correct.

With XM.COM, there is no additional payment obligation. The balance can not end up in a negative balance. The broker will automatically stop all postings before. Should the account balance become negative anyway, XM will compensate him (very unlikely).

(Risk warning: 75.59% of retail CFD accounts lose)

How does the broker make money from you?

XM generates revenue through a variety of channels that cater to the needs of its diverse clientele. The primary source of income for XM Broker comes from the spread, which is the difference between the bid and ask prices of financial instruments. This spread is slightly marked up, allowing the broker to earn a profit with each trade executed on their platform.

Additionally, XM Broker may charge commissions on certain account types or services. The company also benefits from overnight fees, known as swap fees, charged to traders who hold positions overnight. These swap fees are applied based on the difference in interest rates between the two currencies in a currency pair. By leveraging a combination of spreads, commissions, and swap fees, XM Broker can sustain its operations, continually improve its platform, and provide traders with a seamless and efficient trading experience.

XM support and service for traders tested

With XM you get more than one trading account because many employees of the company provide customer service. Over 30 different languages are available in customer support. International employees also work for the company and help you around the clock. Use telephone, email, or chat support.

For example, you can also access professional training and webinars. The webinars are held almost daily and are accessible to every customer. There are also daily market analyzes and even signals to trade. Another plus is the personal account manager from XM. Each customer is assigned an employee who is available for questions and suggestions. It tries to find the best deal for you as a trader.

In summary, we can say from my experience that the analyzes offered, etc., are very well applicable for their own trade. Beginners and advanced traders can expand and improve their knowledge for free. In addition, the service makes a good impression on me.

Facts about the service:

- Personal account manager

- 24/5 support in different languages

- Daily webinars and analysis

- Service for beginners and advanced traders

(Risk warning: 75.59% of retail CFD accounts lose)

What are the best XM broker alternatives?

If you are still looking for an alternative, we would like to introduce you to the best options available on the market.

Captial.com

Capital.com is one of the most reputable brokers with outstanding client satisfaction, thanks to their dedicated support team and e-learning hub for new traders, and easy-to-use trading platform. We have a full review on capital.com available on our site. Read here, why capital.com is among the most reputable brokers in the world.

RoboForex

RoboForex has an impressive selection of more than 12,000 assets to trade from and is an exciting broker if this is an essential criterion for you. Additionally, the execution of orders is laser-fast, and clients benefit from the integrated negative balance protection. Learn more about the pros and cons of the broker in our detailed review.

XTB

The company was founded back in 2002 in Poland and quickly developed into one of the biggest brokers in the world. XTB is an excellent option for professional traders, thanks to it’s high leverage of up to 1:500 for professional traders.

Conclusion of the XM broker review – Scam or reliable company?

XM can hold its own in comparison to other brokers and gets a very good rating from me on this page. With several licenses and regulations, the company exudes a high level of security and trustworthiness. In addition, client funds at XM are managed separately from corporate funds, which eliminates a conflict of interest.

Overall, the broker, with its over 1000+ markets, offers a very large offer for private traders. Take, for example, markets from distant countries. The portfolio will also be supplemented by the new markets. The MetaTrader trading platform is also perfect for analyzing needs and opening trades. Diversity for customers is 100% guaranteed by this broker.

Another advantage is the terms of trade and the deposit and withdrawal. The fees are so low that XM can count as one of the cheapest brokers. The positive features of the company are rounded off by customer support. At XM, you get technical help, and a great way to educate yourself in the trade.

The advantages of XM:

- More than 1,000 different assets

- A regulated and safe company

- Cheap trading fees

- No hidden fees

- 3 different account types

- Metatrader Software

- Professional support and service

- Accept international customers (Europe, Africa, Indonesia, Asia, India, China, and more)

In summary, XM is a recommended and trusted Forex Broker. We highly recommend this company after our test. Happy Trading

Trusted Broker Reviews

Experienced and professional traders since 2013(Risk warning: 75.59% of retail CFD accounts lose)

FAQs – The most asked questions about XM Forex Broker:

Is XM.com regulated?

Yes – XM.com is regulated several times. The company holds the following licenses: CySEC (Cyprus), ASIC (Australia), IFSC (Belize). There is a license according to the EEA freedom of services in Europe and, therefore, also registration in several regulation registers.

Can I test XM.com for free?

Yes – XM.com offers every client a free demo account to test the platform and markets. The account is filled with virtual funds, and you trade without risk. The demo account is ideal to gain new experience or developing strategies for trading.

Which markets does XM.com offer?

Yes – XM.com offers every client a free demo account to test the platform and markets. The account is filled with virtual funds, and you trade without risk. The demo account is ideal to gain new experience or developing strategies for trading.

What is the XM broker’s minimum deposit amount?

The minimum deposit amount at XM is $5 for both Standard Accounts and Micro Accounts. In addition, the low spread “Ultra Low Account” from XM is also available to traders for $50.

There is no deposit cost with XM. This is great since the broker won’t get anything from the deposits, so you won’t have to worry about how much the bank or even a third-party service supplier charging you to send the money will charge you.

Is XM a trustworthy Forex dealer?

Yes, ASIS in Australia and CySEC, two of the world’s leading regulators, oversee XM. Moreover, they have been in operation for more than ten years. They become a reliable CFD and FX broker as a result.

What withdrawal options are there at XM?

Withdrawals from XM can be made using MPesa, wire transfers, as well as eWallets such as Skrill and Neteller. With the exception of wire transfers, withdrawals often take place within a few hours.

The most popular withdrawal method is, by far, bank transfer. Most brokers, including XM, provide it, thus, it is available everywhere.

Additionally, XM lets you withdraw money utilizing a debit or credit card. This is an advantage for XM because few brokers provide this choice.

See other articles about online brokers:

Last Updated on June 7, 2023 by Res Marty