What is OrderFlow Trading and how to read it? – Beginners guide

Table of Contents

Do you want to get professional information about Order Flow Trading? – Then you are completely right on this page. With more than 9 years of experience in the financial markets, we will introduce you to the world of Order Flow Trading. For trading successful and constantly profitable in Day Trading it is necessary to know about the Order Flow of the markets. In the following section you will learn exactly why the market is moving and to do an Order Flow Analysis.

Note

Day trading without Order Flow is like driving without wheels.

Why you should use Order Flow Trading:

Order Flow Trading is one of the most hidden knowledge for traders. As professional traders, we can tell you that it will help you and increase your profit. Did you wonder why you got stopped out and do not know why the market is moving? It is because you are trading blind the markets. Especially for day trading, it is very important to use the Order Flow.

For long-term investments, it is not so important to use Order Flow Trading because most trades are made through fundamental analysis. If you use the Order Flow you can directly see why the market is moving and where are important support and resistance areas for the price. It is like an edge for traders compared to normal chart trading.

The advantages of Order Flow Trading:

- See why the market is moving

- See where are important support and resistance areas

- Use it for exact entries and exits for trades

- Be faster than normal chart traders

- See the market liquidity and where is no liquidity

Order Flow basics: Learn the order types

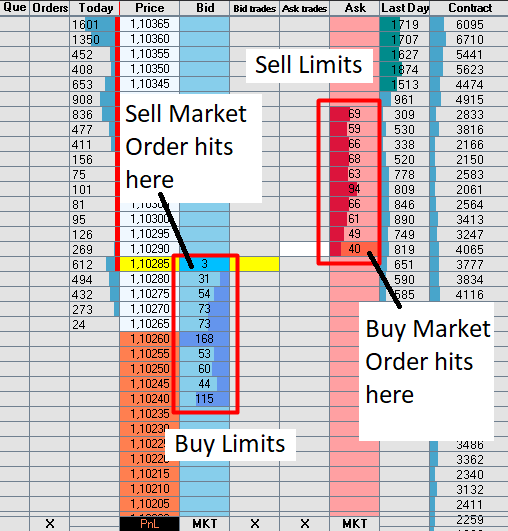

How does the Order Flow work? – First of all, you have to know how the stock exchange is working through different order types. The order types will show you how the market is moving through the order book which we will explain to you in the next section. For regular markets, there has to be always a seller and a buyer otherwise nothing will happen.

1. Market Orders: Market-buy or Market-sell

Market orders are directly made through buying or selling. You will get the next possible offer for your trade. That means for example if you click to buy with one contract someone others have to sell one contract to you. The sale offering is made through a limit order (Ask) which we will discuss in the next point. On the other hand, if you click sell there has to be a buy limit (Bid) in the order book for your sell market order.

Through the order book, there are only limited orders visible. The direct market orders are consuming the limit orders and are moving the price. If a lot of market orders (buy) hit the market (Ask) and there are no more sell limits (Ask) available on this special price the matching engine will move the price one tick higher.

Facts about the market orders:

- Market orders are moving the markets

- They consume buy (Bid) limits or sell (Ask) limits of the order book

2. Limit Orders: Sell-limit (Ask) and Buy-limit (Bid)

Limit Orders are stacked through different prices in the order book as you can see in the picture above. They are waiting to get filled by market orders. There are traders who want to buy or sell at a certain price. These orders do not move the market only market orders can do it but they can act as support or resistance price.

Imagine there are more than 1000 sell limit orders on one price. It takes time to consume all 1000 limit orders through market orders. Sometimes there are not enough buyers so the market will return and drop. The same applies to buy limits. Another important fact to know is that the limit orders can appear or disappear by milliseconds. This can be made by algorithms.

Facts about the limit orders:

- Limit orders are stacked on each price in the order book

- Limit orders are waiting to get filled by market orders

- They can last forever if no one buys or sells them there

- Algorithms are changing the limit orders very fast

3. Stop Orders: Buy-stop or Sell-stop

You do not see the stop orders in the order book otherwise it would be very unfair. Most traders are using buy stops and sell stops to do risk management or get into the market. When the buy stop or sell stop order is triggered it directly changes into a market order. That way the market is moving very fast when a lot of different stop losses are triggered. The trader has to buy back or sell back his asset.

Buy stops or sell stops are hitting the limit orders. What we can do as traders are only to make a forecast where are a lot of stop orders through the chart or other tools. Stop orders are influencing the Order Flow.

Facts about the stop orders:

- Buy stop and sell stops are triggered by the market price

- They convert directly into market orders when they are triggered

- You can not see these orders in the order book

Order Flow liquidity – Slippage explained

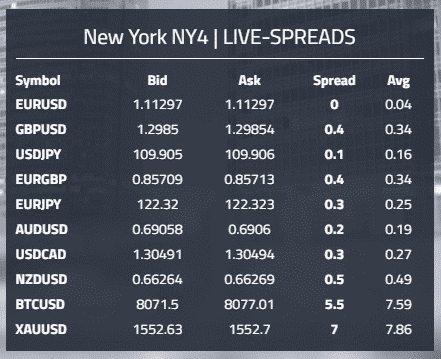

When it comes to Order Flow Trading you will see the liquidity. That means you see how many sell limits (Ask) or buy limits (Bid) are available for trading. Some markets have more liquidity than other markets. If the market got low liquidity you can get a slippage even with one contract. This is possible through market characteristics or conditions.

Notice

Slippage means a lack of limited orders in the order book.

Often it depends on the market movement and your broker. As a retail trader, you do not get the fastest execution. Big banks and hedge funds always get the fastest execution on the stock exchange. By fast movements, it can happen that there are only 10 sell limit orders (Ask) at a certain price. Now 15 market buy orders are placed so only 10 get filled and 5 get another price. Now you got a result of the slippage where you get filled on another price as you want.

Which markets are the best for Order Flow Trading?

You can not trade any market and financial product by the order flow. The most well-known markets for Order Flow Traders are futures and stocks. Furthermore, in our opinion, there are differences between the futures markets. It is always depending on the liquidity. We do not recommend trading markets with very low liquidity because the movements are very difficult to interpret.

Financial products:

- Stocks

- Futures (metals, commodities, shares, indices, and more)

The best markets for futures (high liquidity):

- S&P500

- Euro Stoxx 50

- Bonds

- Oil

- Gold

- Forex

Can you trade forex with Order Flow?

Many traders are interested to trade forex with Order Flow. It is possible to do but you need some knowledge about it. The biggest forex market is the spot forex market (interbank market) where most forex traders are trading. You can not use Order Flow by the spot market because each broker and bank have different liquidity.

You can see the order flow by the forex futures which are traded on the stock exchange. This is the normal future market but not the spot market. Sometimes there are different price movements between these two markets but generally, the spot market is dependent on the future market. For Forex Order Flow Trading you should trade the future or use it for analysis. You can read more about this topic in our article about ➔ Order Flow Forex Trading.

What do you need for Order Flow Trading?

For most traders, it is difficult to create a correct setup to start real Order Flow Trading. In this section, we will discuss the software and setup which you need for successful trading. Order Flow Trading is only possible by trading futures contracts (Wikipedia link), stock, or other products that are traded on the real stock exchange. Assets like forex, commodities, and metals, for example, are traded with future contracts.

To get connection and data from the stock exchange you will need a data feed and broker. The data feed is normally linked to your brokerage account or you get separate login details. The data feed costs a monthly fee and the fee will be debited from your broker account. If you got a brokerage account for futures you also need reputable software for Order Flow Trading (see the section below).

What do you need for Order Flow Trading:

- Broker account for futures (recommendation below)

- Data feed like Rithmic or CQG to get the data from the stock exchange (book it via your broker)

- Order Flow Software

- Connect the broker account with the order flow software

- Account minimum $2,500 for futures

What is important to understand:

- Futures are a different financial product like CFDs or Forex

- CFDs are a “copy” of the futures contract. They are imitating the price.

- There are 2 markets: Forex Spot and Forex Future

- For more markets, you can visit the website of the American Stock Exchange CME

- The position size of futures is higher than Forex and CFDs

Costs for Order Flow Trading:

- Software fee

- Data feed fee

- Trading fees (commission) (by trading futures there are no spreads and direct market liquidity)

Find the best Order Flow Trading Software

For Order Flow Trading you can use different platforms. In the following section, we will present the software ATAS and Sierra Chart. For stock trading, we can recommend TradeStation. The Order Flow Trading Platforms allows you to trade directly on the stock exchange through an order book or chart trader. Besides, there are a lot of tools that can make it easier to understand the Order Flow.

ATAS is one of the best Order Flow Software for retail traders. You can connect any data feed or brokerage account with this platform. The platform comes with a lot of indicators and customizable tools for Order Flow Trading. You can easily use well-known tools like Order Book, Footprint Chart, or Volume Profile. You can test the platform for free. Read through our full review and trading tutorial.

The advantages of ATAS:

- High-performance Order Flow Software

- Connect any data feed or brokerage account

- Customizable indicators and tools

- Test it for free

- Support in different languages

- Order Book, Footprint Chart, Volume Profile, and special indicators

- More than 25 chart types

Sierra Chart: More advanced Order Flow Trading Software

Sierra Chart is a more advanced trading software for trading. Besides, the costs of this software are very low. It supports manual and automated trading which we will introduce more to you on our website. Generally, Sierra Chart is very customizable for professional traders. From our experience this software got the most functions for trading live on the stock exchange.

It supports direct access to most stock exchanges via different data feeds. Also, cryptocurrencies are available to trade. The design looks a little bit old-fashioned but it does not matter for investing and trading. With this software, you can trade like traders in banks or hedge funds.

The advantages of Sierra Chart:

- Professional Software

- Low costs

- Highly customizable features

- Programming and automated trading

- More tools and functions than other trading platforms

- Order Book, Market Depth, Liquidity Chart, and more

Recommend broker for Order Flow Trading

When it comes to choosing an online broker for Order Flow Trading we recommend checking different stats and facts about the broker before you sign up. For stock trading, we recommend TradeStation because of the foot trading platform, and for future trading, we recommend the broker Dorman Trading.

For more than 50 years Dorman Trading is one of the leading brokers for futures. It is a US-regulated company that accepts international traders. The execution is very fast and the fees are cheap.

Criteria for a good Order Flow Broker and advantages of Dorman Trading:

- Based and regulated in the USA

- Fast execution

- Cheap trading fees

- Professional support

- Easy account opening (Account minimum $2,500)

- No inactivity fees, no monthly fees, no hidden fees, no maintenance fees

(Risk warning: Trading Futures and Options on Futures involves a substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. Past performance is not indicative of future results. Stage 5 Trading Corp. is a member of NFA and is subject to NFA’s regulatory oversight and examinations. However, you should be aware that NFA does not have regulatory oversight authority over underlying or spot virtual currency products or transactions or virtual currency exchanges, custodians, or markets. This is an introducing broker link and we share $3 commission with the broker)

Helpful indicators and tools for Order Flow Trading

In the next section, we will show you some tools and indicators which can help you to understand the order flow and chart movements better. All these functions are available on the Order Flow Software ATAS. So for Order Flow Trading, you will need professional trading software.

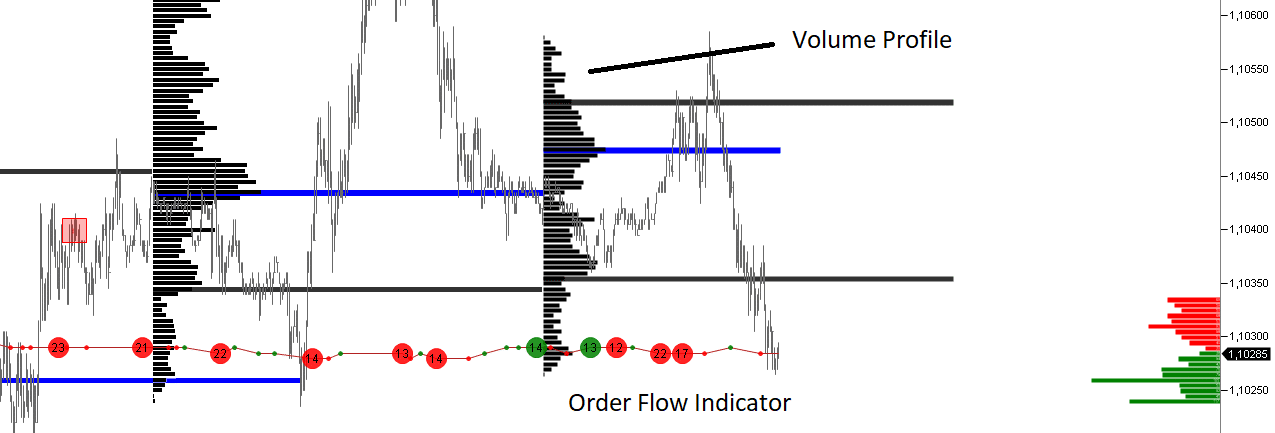

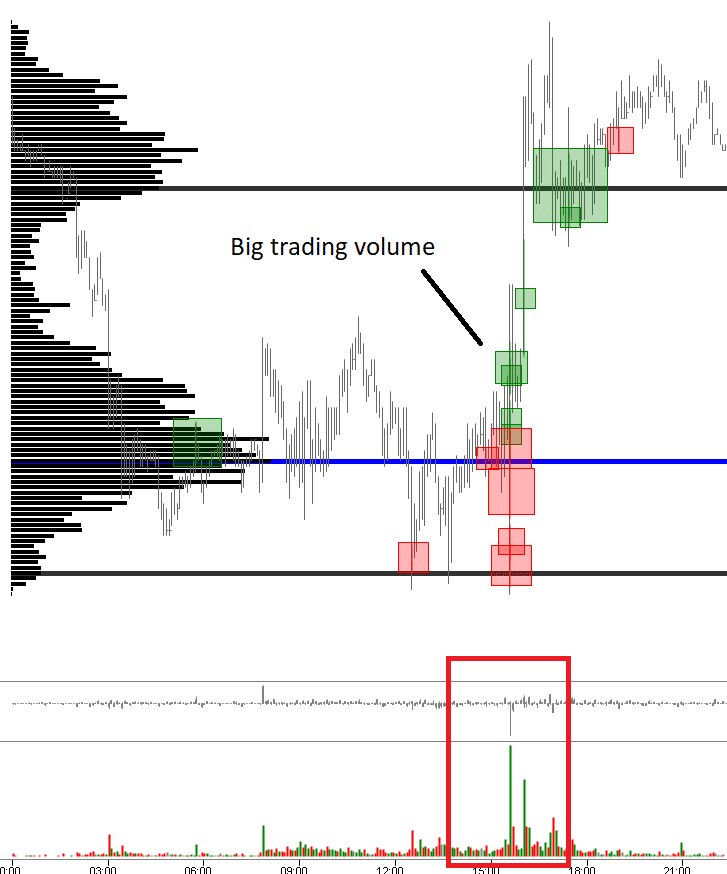

First of all, you can make it easy to understand by implementing some indicators on the chart. It is possible to combine the chart and Order Flow. In the picture below you will see the Order Flow indicator and the Volume Profile.

Volume Profile

The Volume Profile shows you the traded volume on each price level. If one buy or sell limit is filled by a market order it is one volume and shows in the Volume Profile. Through this indicator, you can see which prices are the most traded areas and where are the less traded areas. The blue line shows you the most traded price and the black lines show you the volume area. For the most time, the markets want to stay in the volume area.

Order Flow Indicator

The Order Flow Indicator shows you directly the biggest trades/volumes which are made on the actual price. It is a visualization for the order book. You can change the settings as you want. You can make decisions for your trade entries. For example, if you see a lot of buying pressure on an important price level you can enter a trade.

Advanced analysis

In the picture below you will see an advanced analysis of the Order Flow which is working together with the traded volume. All in all, the chart, the volume, and the order book are working together. You will figure out why the market is moving and why not.

You see in the red box high volume is traded and a big movement in the chart occurs. The green and red boxes show you a big traded volume. The red box means there were big sell trades and the green box means there were big buy trades. As you see the market dropped first and then rises. Many sellers were trapped in this movement because you see the sell volume but the market rises.

You can see this in the delta chart (grey) too. More and more market buy orders came into the market and the market started to rise. The combination of charts, indicators, and order books will give you a huge advantage in day trading.

Algorithmic and automated trading

Nowadays a lot of algorithms are trading in the markets. So the market is very fast and humans are much slower than automated trading systems. Order is made in milliseconds. Big banks are running automated systems for getting their trades placed because they are using high trading volume. There are advantages and disadvantages to this topic.

Automated trading is for most traders hard to do because you need professional strategy and programming skills. But it is not impossible to do. On this website, we also offer automated trading systems that are working with trading volume and Order Flow. Click on the button below to get more information.

Conclusion: Professional traders are using Order Flow Trading

Order Flow Trading is really necessary when it comes to doing day trading or trading large positions on the market. You can directly see why and where the market is moving by watching the order book. Order Flow Trading will help you to make better decisions for your investments.

From our experience, to do day trading without the Order Flow is like trading blind. By only using the normal chart you will never see completely what is happening behind the scenes. Developing trading strategies by using only the order book is difficult and not possible for most retail traders. So we recommend using different indicators and tools to give you a better and deeper view of the market and what is happening.

In conclusion, Order Flow Trading can be learned by every trader and it will increase your profit if you add it to your normal trading strategies.

Order Flow Trading will help you to be better than normal chart traders.

Trusted Broker Reviews

Experienced traders since 2013FAQs- The most asked questions about Order Flow Trading:

Does order flow trading work?

Order flow trading is a proven trading strategy that traders working at trading firms use. Trading with order flow strategies and price ladders will give you a lot of information about the market, helping you make successful trades.

Is there an easy way to use order flow trading?

The easiest approach to order flow trading is reading the momentum. You can avoid positions where the momentum is against you and confirm when positions are going your way. You will also know when to exit trades in profit when you see the momentum fading. Momentum is much easier to read than a turn in the market with order flow. Reading market turns takes practice.

Is order flow trading overrated?

Order flow trading involves studying order executions, volume profiles, and market depth. But the bottom line is that it is just information in the same way price charts are. Many traders, especially new ones, consider order flow trading a technique rather than a set of information. It’s common for traders to look for iceberg orders and fade every iceberg, making it a one-rule system. For such traders that oversimplify order flow trading, it is overrated since they ignore everything else going on in the market.

See other articles about futures:

Last Updated on January 27, 2023 by Arkady Müller