How much does it cost to trade with Plus500? – Fees explained

Table of Contents

Online brokerages like Plus500 generally charge much lower fees than traditional brokerages. This is mainly because online brokerages can be scaled much easier. There are fewer overhead costs like building leases and employee payroll. Since they don’t have as high operating costs, they can still thrive by offering much more cost-effective trading solutions.

However, it’s important to note that there are still fees that will occur since they’re still offering a service. So what type of fees can you expect with Plus500? In this article, we reviewed all of Plus500’s various fees to determine just how much they charge their users, so you can decide if their platform is right for you.

Which fees can occur with Plus500?

Overall, Plus500 has generally low trading fees. As we looked over their fee structures, it was easy to see that they either don’t charge a brokerage fee for some services that other brokerages would charge for, or they just charge a lower amount. This makes them a suitable option for most traders whether you trade a little or trade often (even multiple times every week). Now, we’ll break down the various Plus500 trading charges and non-trading charges to see just how expensive their platform costs.

Summary of Plus500 costs and fees:

- Spreads

- Overnight fees for open positions

- Inactivity fee

- Overnight funding

- Currency conversion

Costs and fees which do not occur:

- No deposit fees

- No withdrawal fees

- No deposit fees/commissions

Risk warning: 82% of retail CFD accounts lose money. You should consider whether you can afford to take the high risk of losing your money.”

Plus500 spreads comparison:

Similar to the majority of CFD Brokers, Plus500 charges a fee from the spread. The spread is simply the difference between an instrument’s buy (bid) and sell (ask) price. To properly explain the spreads, we’ve compared Plus500’s spread costs to eToro and AvaTrade. The spreads and commissions displayed are based on Plus500’s website’s minimum spreads.

We compared the spreads between more than 50 different brokers. In the table below you will 2 big competitors of Plus500. In addition, you should note that the spreads are variable and depend on the market situation. Plus500 only earns money by adding an additional spread on the asset. The spread is a direct trading fee that is paid to the broker.

Spreads are constantly adjusted according to the market spread:

| Plus500 Average From 07.07.2021, 10 A.M: | EToro: | Avatrade: | |

|---|---|---|---|

| EUR/USD: | 0.7 pips | 3.0 pips | 0.9 pips |

| GBP/USD: | 1.1 pips | 4.0 pips | 1.6 pips |

| USD/JPY: | 0.8 pips | 2.0 pips | 1.1 pips |

| NZD/USD: | 3.6 pips | 5.0 pips | 1.8 pips |

| EUR/GBP: | 2.4 pips | 4.0 pips | 1.6 pips |

| OIL: | 0.05 | 0.05 | 0.06 |

| GOLD: | 0.23 | 0.50 | 0.37 |

It’s important to note that the spreads are only intended for informational purposes as they are dynamic. As you can tell by viewing the above Plus500 spread comparison table, their minimum spread for trading EUR/USD is only 0.01%. This is comparably low when analyzing the average EUR/USD spreads of 0.7 pips.

If you want to guarantee your position closes at a specific price, you may pay bigger Plus500 spread fees to execute these kinds of trades. Plus500 is offering a guaranteed stop loss in that case. Your positions will be definitely close at a certain price. This can be very helpful if you are running overnight positions.

Risk warning: 82% of retail CFD accounts lose money.

Plus500 overnight fees explained

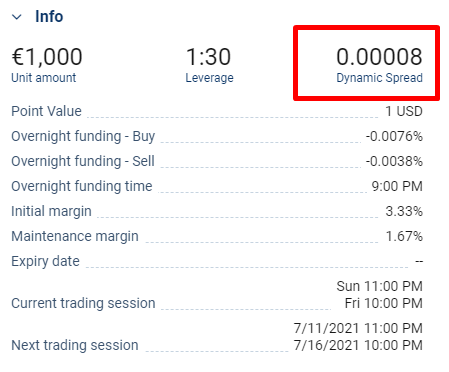

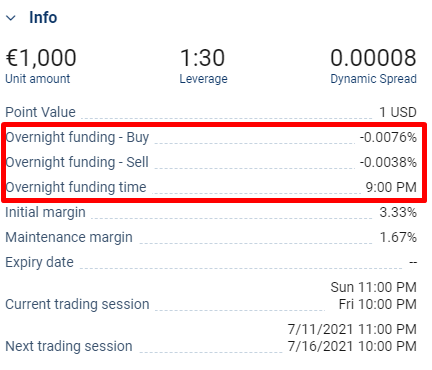

Whenever your funds are left in an open position overnight, a premium, or fee, is added (or deducted) from your Plus500 account. “Overnight” essentially just refers to a specific cut-off time. The specific cut-off time, or overnight funding time, can be seen in the “Details” link beside the instrument’s name on the platform.

The overnight fee is calculated by looking at this formula:

Size of Trade x Opening Rate x Daily Overnight Funding % = Overnight Fee

If you hold a position for more than an hour, this overnight fee, or premium fee, is applied. This premium charge is three times higher if you hold it over the weekend. For example, a position you open on Friday that isn’t closed until Monday will receive is 3x bigger. It’s important you understand the time your Forex position is closed when you choose to hold a position.

The overnight fee is occurring because you are trading leveraged positions. That means you are trading bigger positions with a small margin. The broker lends money for the positions and the interest rates influence the overnight fees.

Plus500 commission fees

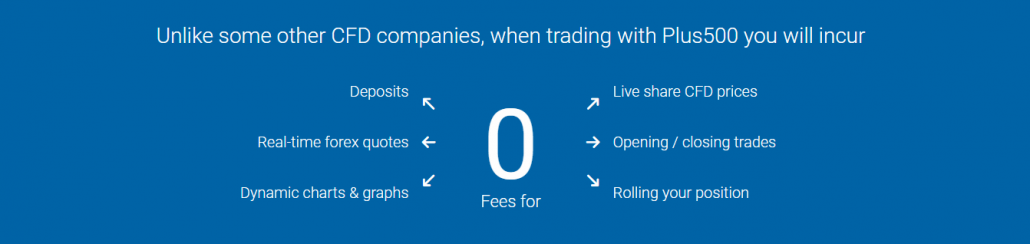

Plus500 does not charge commissions for deposits and withdrawals.

No deposit fees

With some brokers, a deposit fee is generally applied to your trading account whenever you deposit money from your bank into your trading account. Thankfully, Plus500 does not charge a deposit fee. Whatever you deposit will be the real number of funds you see available to use in your account.

It’s important to note that even though Plus500 doesn’t charge deposit fees, your bank or credit card company may charge you a fee for any international credit transactions, including incoming or outgoing bank transfers or if you’re using a currency that isn’t supported on the platform.

Risk warning: 82% of retail CFD accounts lose money.

No withdrawal fees

Similar to the zero deposit fee policy, Plus500 also doesn’t charge a withdrawal fee for up to five withdrawals per month, which means they cover most of the payment processing fees. However, just like deposits, your issuing bank or credit card company may charge you fees for international transfers or transactions, especially if your currency isn’t compatible with Plus500.

While Plus500 offers five free withdrawals every month, you will be charged if you exceed the limit. If you exceed five withdrawals in a month, you will be charged $10 per withdrawal. Plus500 also has a minimum withdrawal amount of $100 and will add a fee if you choose to withdraw less. If you withdraw under $100, you will be charged an additional $10. For most traders, frequent withdrawals, especially under $100, won’t be a major issue, however.

Deposit and withdrawal methods:

- Debit and Credit cards

- PayPal

- Skrill

- Bank transfer

Plus500 inactivity fee

If you aren’t active on the Plus500 for a period of time, you may incur an inactivity fee. Traders will incur a $10 inactivity fee from Plus500 if they don’t use their platform for three months.

It’s important to note that this fee only applies to accounts with real money in them, and only if the trader has the necessary funds in the account. You should be strategic with your trading to ensure you aren’t charged from inactivity on the Plus500 platform. If you are a buy-and-hold type of investor, then Plus500’s charges are less ideal for you.

However, to avoid an inactivity fee, all traders have to do is simply log in to their accounts every month or two, which isn’t a hassle for most people.

Conclusion: Low trading fees & average non-trading fees

Overall, Plus500 isn’t an expensive platform. They have low trading fees and average non-trading fees. Plus500 trading costs are quite low, making them one of the best platforms for frequent traders.

Looking at their non-trading fees, Plus500 offers average fees. Some of their non-trading fees are a bit high, but others are either low or free, making them average, overall. Even their inactivity fee is only charged after three months of inactivity. But even then, the $10 inactivity fee can be avoided by simply logging in.

Advantages of Plus500 costs:

- Competitive spreads

- No deposit fees/commissions

- No withdrawal fees

- Small overnight fees

Plus500 is a very competitive trading platform. You can trade more than 2,000 markets with low fees.

Trusted Broker Reviews

Experienced traders since 2013Risk warning: 82% of retail CFD accounts lose money.

FAQ – The most asked questions about Plus500 :

Are there any overnight costs with Plus500?

Fees from Plus500 do apply to deposits, withdrawals, and commission charges. Currency exchange, guaranteed stop orders, and overnight financing costs are the three primary charged expenses that traders must be informed of. For dormant accounts that are idle for three months or more, Plus500 also charges an inactivity fee.

Can I use Plus500 to withdraw all of my funds?

Almost all brokers provide it, and Plus500 is one of them. You may withdraw money from Plus500 to a debit or credit card in addition to bank transfers. The minimum deposit required is $100, and the withdrawal can be made in 1 to 3 business days. Therefore, Plus500 has an advantage here.

Is Plus500 a secure place for my money?

Being listed on a stock market, subject to the oversight of several reputable financial regulators, and publishing its financial information are all positive indicators of Plus500’s dependability. Additionally, due to the complication and volatility of CFD trading, Plus500 may not be the most newcomer-friendly trading platform.

Can I trust Plus500 with my money?

Positive signs of Plus500’s reliability include being listed on a stock exchange, being overseen by some respected financial regulators, and publicizing its financial information.

Last Updated on March 31, 2024 by Andre Witzel