Tickmill trading fees and costs for traders

Table of Contents

What does trading cost with the Forex Broker Tickmill? – Most traders ask this question before they open a new trading account with Tickmill. As experienced traders, we know the broker for more than 5 years. In the following sections, we will give you an exact overview of the trading fees of Tickmill.

Which fees can occur with Tickmill?

By opening an account with a Forex Broker different trading fees or account fees can occur. This is depending on the policy of the company. From our experience, Tickmill is one of the cheapest brokers. There are not any additional fees next to the normal trading fees. In addition, trading fees are very cheap. In the next points, we will show you exactly which fees can occur and which fees do not occur. Later we will go into detail.

Fees that occur by trading with Tickmill:

- Spread (direct spread or higher spread in the classic account)

- Trading commission (only by using the VIP or pro account)

The spread in the classic account by 1.2 pips and you will not pay any commissions. By using the pro account you get 0.0 pips spread and pay a commission of $2 per 100.000 (1 lot) traded. For VIP traders the commission is only $1. On this site, you can read about the best Tickmill account type.

Fees that do not occur by trading with Tickmill:

- No deposit or withdrawal fees

- No account maintenance fees

- No inactivity fees

Get 5% spread rebate with the code: IB60353132

(Risk warning: Your capital can be at risk)

Get 5% spread rebate with the code: IBU13836682

(Risk warning: Your capital can be at risk)

1. Trading fee: Market spread

As mentioned before you can choose between two account types. With the classic account, you pay a higher fee on every trade but no commission. In the following, we will discuss and explain the spread. Even in the pro account the spread is starting with 0.0 pips (variable) and is depending on the market situation. The basic account starts with a spread of 1.2 pips.

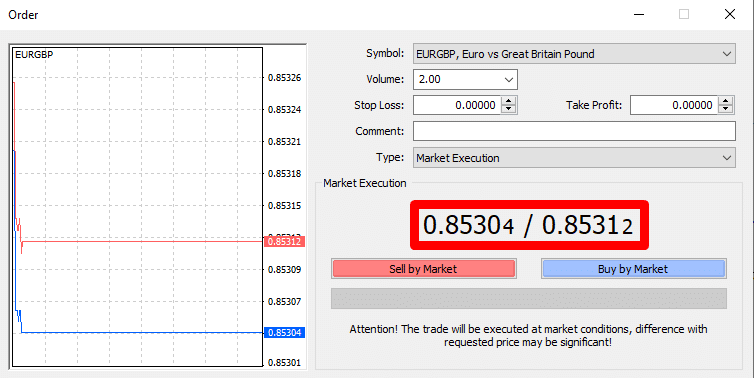

In the picture above you see the order mask with the spread (red box). The spread is the difference between the “Bid” (buy liquidity) and “Ask” (sell liquidity) price. The broker adds an additional spread to the normal market condition to earn money. If you open or close a position you pay the trading fee because of the additional spread.

Example of spread fee calculation:

For example, you want to trade the EUR/USD with one lot (value 100.000). The average spread on the classic account is 1.2 pips on the EUR/USD asset.

To calculate the pip value we use the formula: pip value = one pip / exchange rate * 100,000

At the moment the pip value on the price 1,08962 is $10.00. That means you pay a trading fee 0f $12 by trading 1 lot EUR/USD.

Get 5% spread rebate with the code: IB60353132

(Risk warning: Your capital can be at risk)

Get 5% spread rebate with the code: IBU13836682

(Risk warning: Your capital can be at risk)

2. Trading fee: Commission

By using the pro account you trade the original spreads of the liquidity providers with no markup. The spreads are starting at 0.0 pips but sometimes they can be higher depending on the market situation. Tickmill does not earn money by the spread but with an additional commission for each trade. By trading 1 lot you will pay a $2 commission by opening or closing a trade. Overall it is a $4 fee in this example. If you are using the VIP account you pay fewer fees because the commission is only $1 per 1 lot trade.

3. Trading fee: Swaps

If you trade forex with leverage you are using credit from the broker. The leverage allows you to trade more money than is in your account balance. For example, with leverage of 1:100, you can trade $ 100 with only $ 1 of margin. You will need a lever for most markets because the price is not moving in big percentages.

The Swap fee (interest rate) of the position is depending on the financial product you are trading and the leverage you are using. For more details, you can look on the Tickmills website

How does Tickmill earn money?

Tickmill is a real NDD (no dealing desk broker) that provides high liquidity to its clients. The broker only earns money from the trader’s trading volume. If a trader starts trading he pays the trading spread fee or the trading commission. Tickmill does not hedge or trade against clients like other unpopular brokers.

Tickmill earns only money with:

- Additional spread on the market

- Trading commissions

Payless trading fees with our IB codes

By using our IB codes (below the buttons on this page) you get a 5% rebate on all trading commissions made with the pro account. We negotiated this rebate with Tickmill to give our clients and readers an advantage. Just open a new trading account and type in the code. You will pay fewer trading fees. First of all 5% rebate sounds like nothing but if you do a calculation over a year you can save a lot of money.

Conclusion: The Tickmill trading fees are very small

From our experience, Tickmill is the cheapest online broker. The trading conditions are very good for trading international markets. The broker earns only money by the spread or commissions. There are no hidden fees and the broker does not require deposit, withdrawal, or inactivity fees.

Overall, Tickmill is a highly recommended broker. You will save a lot of money because compared to other companies the trading costs are very low. Moreover, you will get personal support in multi-languages and you can start with a $100 deposit.

We compared more than 50 different brokers and Tickmill is the cheapest one.

Trusted Broker Reviews

Experienced traders since 2013Get 5% spread rebate with the code: IB60353132

(Risk warning: Your capital can be at risk)

Get 5% spread rebate with the code: IBU13836682

(Risk warning: Your capital can be at risk)

FAQ – The most asked questions about Tickmill Fees :

Which charges are possible with Tickmill?

Generally speaking, Tickmill has three different sorts of fees that it might impose, even though certain IB codes available can get you a discount.

1. Trading commission: Market spread

2. Transaction costs: Commission

3. Swaps, a trading charge

Is Tickmill a broker who makes markets?

Tickmill is a market maker, as seen by its Classic account. The Pro account is promoted as the no-desk dealing broker account. The fact that this broker needs to mention which Trading platforms framework is being used suggests that a market maker model is being used for all accounts.

How does Tickmill trading work?

Online Broker for CFD Stock & Commodities with Low Spread and High Leverage. Tickmill: Learn to Trade. Register in just a few easy steps.

– To finish client area registration, fill out the questions asking for your personal information and trade background.

– Verify your profile using a few forms of ID, create your account

– Add funds.

– Download a Platform.

Tickmill is there on TradingView?

TradingView and Tickmill are now connected, enabling their clients to trade commodities on the TradingView platform. Visit TradingView, open the asset’s charting window, and choose “Trading Panel.” Click “Connect” after selecting the Tickmill logo.

See other articles about online brokers:

Last Updated on January 27, 2023 by Arkady Müller