Tickmill withdrawal proof and tutorial

Table of Contents

Many traders are worried about withdrawals with Forex Brokers because on the internet you will find a lot of claims about bad brokers. But with Tickmill you will trade with a serious and trusted Forex Broker. How to do a withdrawal with Tickmill? – On this page, we will show you an exact tutorial on how to do it and our personal withdrawal proof with Tickmill. Inform you about the methods and processes.

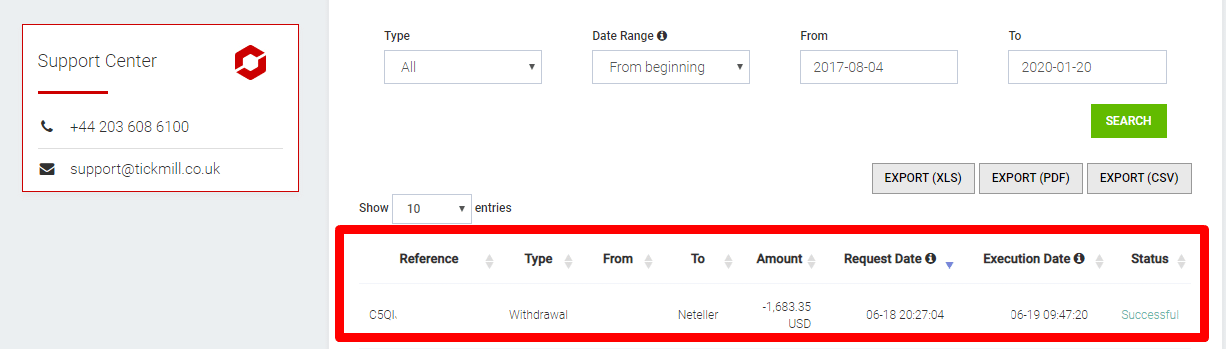

As you see in the picture above the withdrawal with Tickmill is done in less than 3 days (1 day in our example). The following steps will show you exactly how to do a withdrawal and in the next section, we will go into detail.

Get 5% spread rebate with the code: IB60353132

(Risk warning: Your capital can be at risk)

Get 5% spread rebate with the code: IBU13836682

(Risk warning: Your capital can be at risk)

How to do the withdrawal on Tickmill:

- Be sure your trading account is fully verified

- Select your trading account

- Select the payment method

- Choose the amount and submit the withdrawal

- You will get an email when the withdrawal is processed

There are no withdrawal fees.

Step 1: An verified trading account is important

Tickmill is a regulated Forex Broker who is acting under strict laws and rules. The company has to verify your identity and trading account in order to confirm your payments. Also, trading with real money is not possible with a non-verified account under the FCA or CySEC regulation. The broker will always ask you for real documents.

The documents will be verified in a few hours. Just upload a picture or scan of the required identity check. After you did it you can use all the functions of the Tickmill trading account and very fast withdrawal.

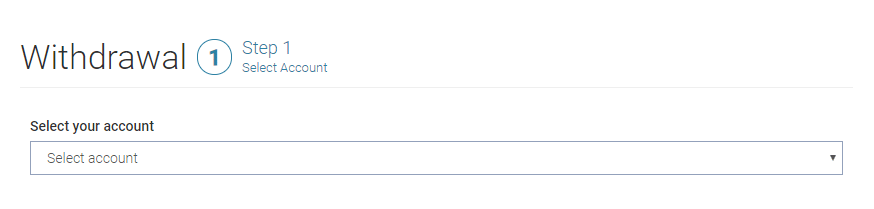

Step 2: Select your Tickmill trading account

To do the withdrawal you have to select your trading account. You directly see the account balance that you can withdraw.

Get 5% spread rebate with the code: IB60353132

(Risk warning: Your capital can be at risk)

Get 5% spread rebate with the code: IBU13836682

(Risk warning: Your capital can be at risk)

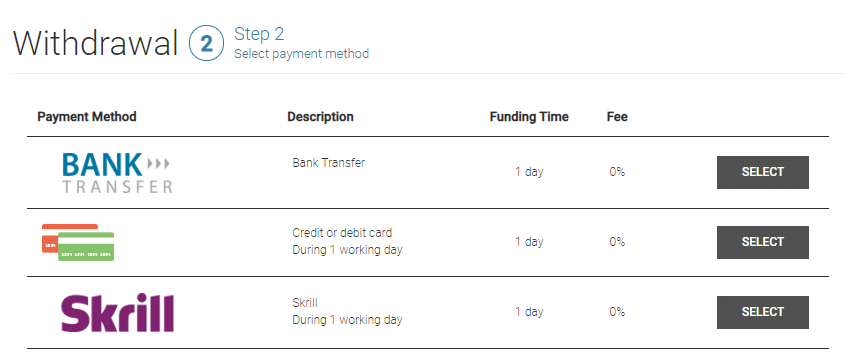

Step 3: Select the payment method

Tickmill offers more than 10 different payment methods for money transactions. You can use the method you want to do the withdrawal or deposit. Electronic methods like Neteller are very fast (in our withdrawal test only 1-day duration). Generally, Tickmill confirms your payment within 1 working day.

The payment methods are depending on your country of residence and the regulation.

Payment methods:

- Bank transfer

- Credit cards

- Skrill

- Neteller

- Sticpay

- Fasapay

- Unionpay

- Nganluong.vn

- Qiwi

- Webmoney

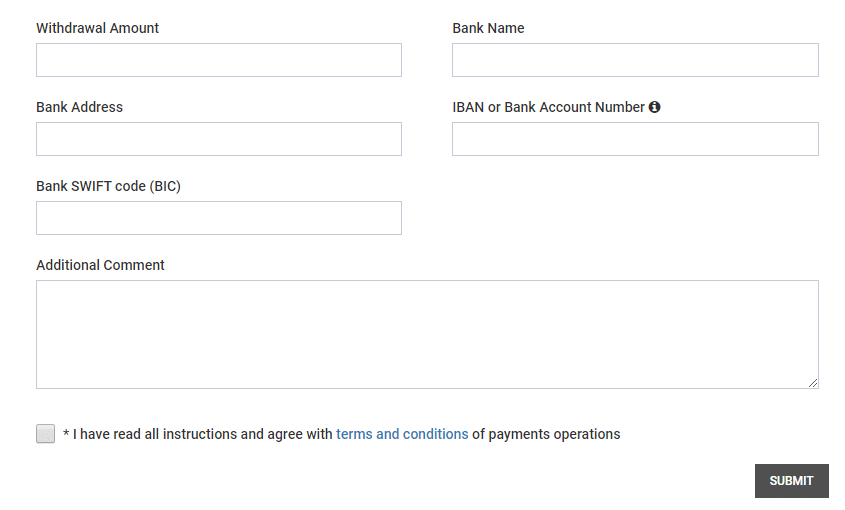

Step 4: Choose the withdrawal amount

Now you have to insert your payment details (see the picture below) and the withdrawal amount. Then you can submit the payment. Make sure that the data is correct. If the data is not correct the broker will inform you.

Get 5% spread rebate with the code: IB60353132

(Risk warning: Your capital can be at risk)

Get 5% spread rebate with the code: IBU13836682

(Risk warning: Your capital can be at risk)

Step 5: Wait till the withdrawal is processed

As mentioned before Tickmill will inform you with an email when the withdrawal is processed. The normal withdrawal duration is 1 working day. The support team is working Monday till Friday. On the weekends the withdrawals are not processed.

Problems with the withdrawal

Sometimes there can be a problem with your withdrawal. That is why we repeat it: You should verify your account correctly in order to trade real money and do correct withdrawals. In addition, Tickmill can require additional documents from you. It is very important to follow the advice.

Moreover, the withdrawal details should match exactly your personal data. You can not withdraw from a foreign bank account or credit card. Tickmill only processes withdrawals to payment accounts which are belonging to your identity. This is a very important safety feature. Even hackers can not steal your money.

To do a successful withdrawal you should:

- Verify your account

- Insert the right personal data and payment details

- Follow the broker’s instructions

Conclusion: Tickmill withdrawals are working without a problem

In conclusion, Tickmill is a trusted Forex Broker who threatens the funds of clients very well. As we showed in our screenshot the payments are processed within one day. There are many payment methods for everyone. And the biggest advantage is you do not pay any fees for withdrawals. All in all, we can recommend trading with Tickmill. It is very easy to do the withdraw profits.

The advantages:

- More than 10 different payment methods

- Payments are processed within one working day

- No fees for your payments.

- Minimum withdrawal amount is only $10

As we showed on this website the withdrawals with Tickmill are working very fast and without any fees.

Trusted Broker Reviews

Experienced traders since 2013Get 5% spread rebate with the code: IB60353132

(Risk warning: Your capital can be at risk)

Get 5% spread rebate with the code: IBU13836682

(Risk warning: Your capital can be at risk)

FAQ – The most asked questions about Tickmill Withdrawal :

Is Tickmill a legitimate website?

Indeed, Tickmill is a safe website to use. Tickmill has a trust rating of 82 out of 99, which indicates moderate risk. Tickmill is not a publicly traded firm and does not handle a bank. Three-tier regulators have authorized Tickmill.

How long does it take to withdraw money from Tickmill?

At Tickmill, it took one business day to withdraw the funds. Depending on the nature of your funding, the withdrawal may take some more time. It may take a day to withdraw, and sometimes it takes more than that to receive the money.

Does Tickmill charge commissions?

Yes, Tickmill charges commission; an explanation of Tickmill’s charges, Tickmill on average, spread cost is $.20 pips, and $2.00 fee per lot, per transaction, and spread costs for pro accounts during the peak trading time. When trading is at its peak, the spread costs about 0.5 pip.

What is a Tickmill Pro account?

Pro account is designed for traders with some advanced features. For the Tickmill pro account, the minimum deposit amount required is $100, and the spreads start at zero pip. The commission, which is only $2 per side on every traded lot, is also quite minimal.

See other articles about online brokers:

Last Updated on January 27, 2023 by Arkady Müller