Vantage FX minimum deposit tutorial – Payment methods

Table of Contents

Do you want to trade forex or any other similar financial asset? Are you based in Australia or anywhere else in the world? Do not worry. VantageFX opens widely the gates to the foremost financial markets in the world. The forex market, most notably, is the world’s largest financial market. If you would like to get into it, here is all you need to know about the Vantage FX minimum deposit so that you can do just that.

In this article, we will show you the important information about how to deposit on Vantage FX. Learn about the methods, fees, and conditions for online trading.

Facts about the Vantage FX minimum deposit:

- The minimum deposit is $ 200

- There are different account types

- The deposit currencies are: $ AUD, $ USD, £ GBP, € EUR, $ SGD, $ CAD, $ NZD, ¥ JPY, $ HKD

- No fees for depositing money

- Different payment methods

(Risk warning: Your capital can be at risk)

How high is the Vantage FX minimum deposit amount?

The minimum deposit at Vantage FX is $200. The minimum deposit means that you will first need to transfer this amount to your brokerage account from your bank account in order to start trading. It is sometimes called an initial deposit or funding. Beyond the required minimum deposit, there are a couple of other factors to consider when you are about to open an account at Vantage FX.

So, why does Vantage FX require a minimum deposit? Online brokers sometimes require a minimum deposit in order to cover the initial costs associated with creating a new account and to ensure their profitability. The higher the amount you deposited, the higher the chance for you to trade more and generate bigger profits for the broker.

Also, different account types are offered. See the table below for the different minimum deposits and the conditions:

| Account: | Standard STP | RAW ECN | PRO ECN |

|---|---|---|---|

| Minimum deposit: | $ 200 | $ 500 | $ 20,000 |

| Execution: | STP | ECN | ECN |

| Spreads: | From 1.4 pips | From 0.0 pips | From 0.0 pips |

| Commissions: | No | From $ 3 per one traded lot | From $ 2 per one traded lot |

| Platform: | MetaTrader 4/5 | MetaTrader 4/5 | MetaTrader 4/5 |

| Leverage: | Max. 1:500 | Max. 1:500 | Max. 1:500 |

How to deposit on Vantage FX? – Deposit methods explained

Vantage FX does not charge a deposit fee. This is great because the online broker won’t deduct anything from your deposits and you only have to calculate the costs charged by the bank / third party you send the money with. While there is no deposit fee at Vantage FX, the available deposit methods are also important for you.

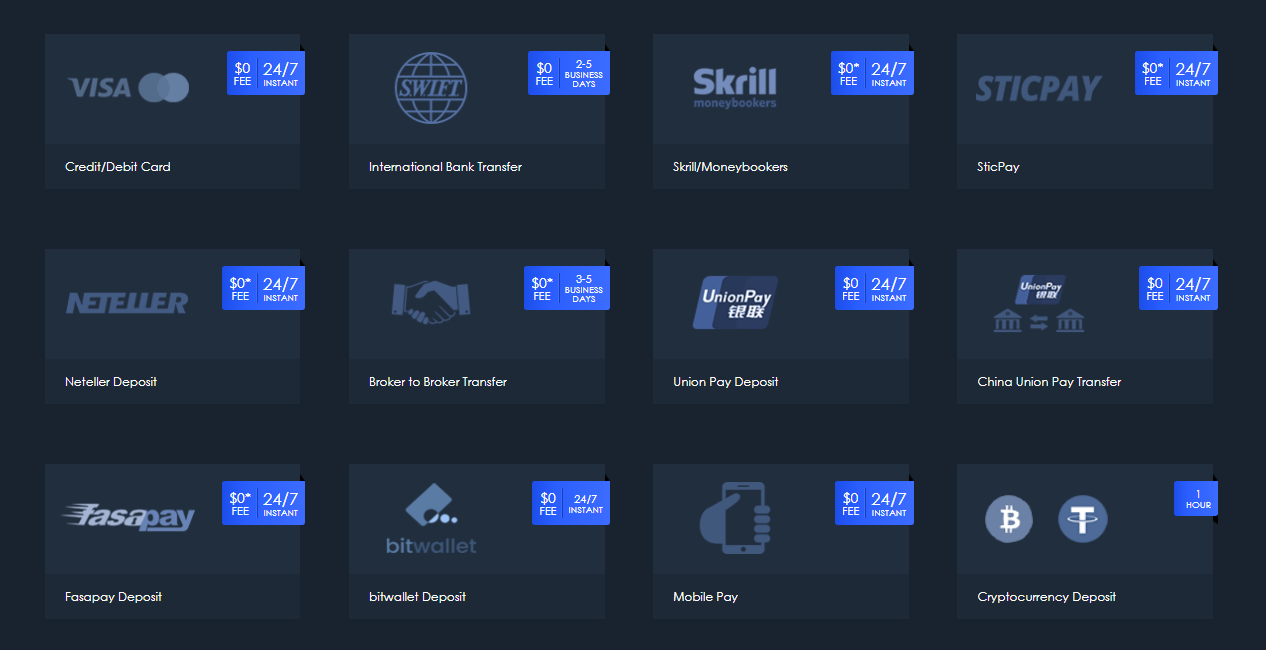

First of all, you have to create your free Vantage FX trading account and fill out the requested questions. Verify your account with the required documents. Upload an identity verification document and verification of your address. This broker is regulated, which means they have to do a KYC. But from our experiences, the process can be finished in a few minutes. Then navigate in the client portal to the option “deposit funds” and you will see the picture below:

There are zero fees for the deposits. Only if you are using the Bitcoin network you can be charged fees. As you see in the picture above most deposits are instant.

The offered payment methods and durations are:

- Credit-/ Debit card – Instant

- International bank transfer – 2 – 5 business days (your bank may charges fees)

- Skrill – instant

- Stickpay – instant

- Neteller – instant

- Broker to Broker transfer – 3 – 5 business days

- UnionPay – instant

- fasapay – instant

- Bitwallet – instant

- Mobile Pay – instant

- Cryptocurrencies – up to 1 hour

Traders can deposit funds using a variety of channels. They can make use of bank cards like Mastercard and Visa; They can use electronic wallets such as Swift; BPay; Skrill; Poli; Neteller. Funds deposited via a credit or debit card will normally be visible in the account and ready for use within sixty seconds. Bank wire transfer deposits will normally take some days after they are deposited to reflect.

Withdrawals are processed daily. In most cases, the request for withdrawal will take place on the same working day. For Australian clients, the funds should normally be in their bank accounts by the next working day. Overseas clients may have to wait several days for the money to reach their accounts.

(Risk warning: Your capital can be at risk)

Introduction to Vantage FX – What will you get for your minimum deposit?

One of the leading forex brokers based in Australia, Vantage FX offers a range of trading services, enabling clients to access the international Forex as well as other CFDs markets. Benefiting from excellent customer care and with a commitment to delivering fast transactions, VantageFX has risen to become a significant player in the online brokerage space. The broker is a part of Vantage Global Prime Pty Ltd which was set up in 2009 under the name of MXT Global but then rebranded in 2015.

Registered in Australia, Vantage FX originally aimed for an Australian audience. However, the brand has since grown and now boasts a global user base. It now accepts traders from Australia, Thailand, United Kingdom, South Africa, Singapore, Hong Kong, India, France, Germany, Norway, Sweden, Italy, Denmark, United Arab Emirates, Saudi Arabia, Kuwait, Luxembourg, Qatar, and most other countries.

You may not however be able to use it in places like the USA.

Regulation

VantageFX is a reliable broker that is regulated in multiple locations and multiple jurisdictions. For one, it is regulated in Australia by the Australian Securities and Investments Commission (ASIC), but also by the Financial Conduct Authority (FCA) of the United Kingdom, as well as by the Cayman Islands Monetary Authority (CIMA) in the Cayman Islands.

Available trading platforms

VantageFX boasts one of the most diverse trading platforms. It offers so many channels through which traders can access its services. The broker uses mainly Metatrader software, giving users access to MT4 and MT5. However, it also offers other platforms such as MetaTrader, Webtrader (which doesn’t require a download), Apps for mobile trading, Multi-Account Manager) and PAMM (Percentage Allocation Management Module (MAM/PAMM), Zulu Trading, and MyFXBook Autotrade.

This level of variety gives traders access to diversity. So, traders can easily choose any they have access to or any they choose to go for. The mobile app is available across platforms. That is, you can download it on the Google Play Store for Android devices as well as Apple App Store for iOS-powered devices. VantageFX also places an emphasis on robot trading, where trades are made automatically within predetermined parameters.

The new MT5 platform in particular enables many of the popular automated trading tools and add-ons made possible by the MetaTrader community. Overall, all the platforms are user-friendly and intuitive for a trader. And one more good thing about all these trading platforms is that they are all synced. That is, they work hand-in-hand. In short, when you take any action on one trading platform, it automatically reflects on all the other trading platforms.

(Risk warning: Your capital can be at risk)

Available markets

Traders on VantageFX are able to access a variety of markets. These include the Forex market (38 currency pairs are available); 24 different types of CFDs; cryptocurrency trading (as part of CFD); indices trading; and commodities trading, amongst others.

- Forex

- Commodities

- Metals

- Stocks

- Indices

- Cryptocurrencies

Spreads and Fees

Generally, VantageFX is in line with most of the other key players in the online trading industry when it comes to spreads and commission rates. The Standard STP account does not attract a commission, but spreads are significantly larger than those found in the Raw ECN account (commission-based).

For the Standard STP account, an indicative spread of 1.4 (EUR/USD) is quoted. For the Raw account, the average spread is quoted as just 0.1 pips, but the commission is payable and very cheap. Demo and Islamic accounts are also available.

Leverage

For VantageFX.com, leverage ratios start at 100:1, rising to a maximum of 500:1. Access to the higher levels of leverage is limited, with only some clients and accounts being eligible for this. Clients who wish to access higher levels of leverage need to apply directly to the broker. The leverage is mainly in line with what others are offering in the industry, but many traders who wish to take more risk may find the 100:1 leverage restricting them.

That means if you doing the minimum deposit of $ 200. You can trade the maximum of $ 100.000. (200*500 = 100.000). This is quite a high amount for the low minimum deposit. It only means it is possible, you do not have to do it. You can adjust the position size by using different lots or micro-lots.

Free demo account

The importance of a demo account in the life of a trader can never be overemphasized, both for newbie traders and the more experienced ones. The new trader will find it useful in learning trading skills. The experienced trader will find it useful in testing out new trading strategies. Both of them, however, will have the demo account useful in helping them test out a new broker before committing to it. Before you do the minimum deposit you should definitely try out the offers with a free demo account.

(Risk warning: Your capital can be at risk)

Promotions and bonuses

VantageFX.com offers free education that covers several topics that traders need to learn on their journey to becoming successful. There is beginner training on learning the basics of Forex; MT4 and MT5 manuals; as well as a host of pre-recorded webinars. In addition, traders can benefit from the broker’s Forex signals feature. These signals are delivered via email.

VantageFX also provides its traders with free expert advisors and free Forex VPS as well as a free economic calendar, the latest MT4 indicators, and forex sentiment indicators. Above all, VantageFX offers traders a 50% bonus on deposits. We have to note that this is very huge.

Benefits

This broker does have an award-winning customer care, as well as an attractive set of promotions. It is particularly appealing to new traders or those wishing to keep their levels of risk and investment at the lower end of the spectrum.

Drawbacks

VantageFX.com doesn’t offer much-added value for experienced traders or those wishing to adopt a higher risk strategy: experienced traders may find the upper limit of 1:100 leverage for most customers a burden.

Contact Details

The support team can be contacted: by phone (1300 945 517); by email: [email protected]; or by live chat.

Safety and Security

The company operates a trader compensation scheme and has indemnity insurance. Clients’ funds are held in the National Australia Bank, in segregated accounts.

Overall conclusion on the Vantage FX minimum deposit: It is a professional broker

Vantage FX is one of the best online brokers for trading forex and CFDs. With a small minimum deposit of $ 200, you get a large variety of offers for investing. We recommend depositing at least $ 500 to use the ECN RAW account. You will pay much fewer fees by using it. Overall, Vantage FX is the right type of online broker for you if you want to start investing with a secure and cheap platform.

(Risk warning: Your capital can be at risk)

FAQ – The most asked questions about Vantage FX minimum deposit :

What are the currencies allowed for Vantage FX minimum deposit?

Vantage FX allows a plethora of different currencies, thereby ensuring traders can easily invest or make initial deposits according to their convenience. Some currencies allowed are AUD, USD, GBP, SGD, EUR, CD, HKD, NZD, and JPY.

What is the minimum deposit requirement for different account types on Vantage FX?

The accounts offered are the standard STP account, raw ECN account, and pro ECN account. The minimum deposits for each account will also vary because, for the standard STP account, the minimum deposit is $200. The lowest possible deposit for the raw ECN account is 500 USD, while the lowest deposit for the pro ECN account is 20,000 USD.

What minimum deposit methods are available at Vantage FX?

Vantage FX is a flexible trading system that accepts a mode of payment, allowing market participants to conduct transactions with ease. Vantage FX accepts all forms of credit cards and debit cards. Traders can also use money transfers to deposit funds. E-wallets such as Skrill, Perfect Money, and Neteller are also available.

Does Vantage FX impose charges for minimum deposits?

There are no organizational costs for depositing funds at Vantage FX. Transnational money transfers, on the other hand, are subject to an additional bank service fee of 20 units of your account’s main currency.

See other articles about online brokers:

Last Updated on January 27, 2023 by Arkady Müller